FT Misinterprets Sterling Market Action on BrExit Fears, EU Referendum Propaganda?

ElectionOracle / EU_Referendum Mar 24, 2016 - 04:13 PM GMTBy: Nadeem_Walayat

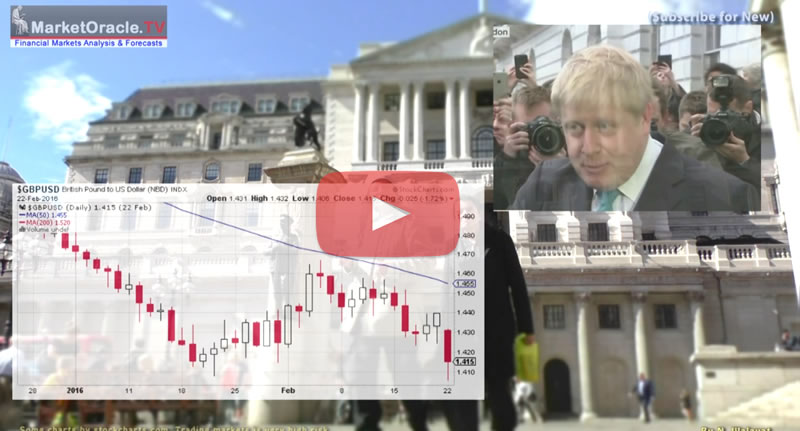

A recent article in the FT's EU Referendum fear campaign is concerned with the rise in the cost of insuring against a fall in sterling as a consequences of the increasing risks of BrExit that it attributes to the Brussels terror attacks. The story is a continuation of operation Fear that began with Boris Johnson's declaring to join the LEAVE / BrExit campaign.

A recent article in the FT's EU Referendum fear campaign is concerned with the rise in the cost of insuring against a fall in sterling as a consequences of the increasing risks of BrExit that it attributes to the Brussels terror attacks. The story is a continuation of operation Fear that began with Boris Johnson's declaring to join the LEAVE / BrExit campaign.

FT - Brexit fears add to pressure on pound

Cost of insuring against falling sterling climbs sharply

However, there are two flaws in the FT's article which is indicative of its output at least that which surrounds the EU Referendum being more propaganda than that which is based on probability.

Firstly, that the rise in the cost of insuring against a fall in sterling i.e. option prices could just as well be as a consequence of the risks of Britain voting to REMAIN within the European Union, as the Brussels Terror Attacks further illustrate to market participants that the European Union is on an unsustainable trend trajectory which impacts on both the Euro and Sterling.

Secondly, as I pointed out at the time of Boris Johnson's decision to join the LEAVE camp that a fall in sterling is actually what governments and their central bankers are attempting to engineer by means of the currency wars of competitive devaluations as I explained in the following video -

Therefore, a weakening currency is a signature of a central bank that is winning the currency war, all without adopting the extreme measures of negative interest rates that the likes of the ECB and Bank of Japan have recently announced. Of course in our EU referendum topsy turvy world that's not how the establishment press is currently presenting the story, instead everything is being given an anti-Brexit spin despite the exact opposite being more probable.

And where sterling is concerned, well the graphs illustrates that sterling against the dollar and Euro is little changed since the day the EU referendum was announced, so all of the news stories since of a plunging currency on the risks of Brexit are in reality pure propaganda that do not reflect reality.

The bottom line is that probability actually favours sterling being substantially higher a year from now then lower (at least 10%), regardless of the outcome of the EU Referendum.

Ensure you are subscribed to my always free newsletter (only requirement is an email address) for the following forthcoming in-depth analysis :

- US Interest Rates and Economy

- US Dollar Trend Forecast

- UK Housing Market Trend Forecast

- Stock Market Trend Forecast

- US House Prices Detailed Trend Forecast

- Gold and Silver Price Forecast

By Nadeem Walayat

Copyright © 2005-2016 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.