A Chink In The Stock Market Rally?

Stock-Markets / Stock Markets 2016 Mar 28, 2016 - 11:18 AM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

SPX: Long-term trend - Severe correction underway.

SPX Intermediate trend: Potential rally top.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discuss longer market trends.

A CHINK IN THE RALLY?

Market Overview

"If, however, as it is the case today, we are tracking an exceptionally strong counter-trend rally, we can assign a more liberal count to the trend and, in that case, we come up with 2058, 2070, and perhaps even 2080 before we reach a reversal point."

Last week, SPX reached a high of 2056.60 and had its best (minor, so far) pull-back since the 2009 high of 3/04. The high is close enough to the 2058 projection mentioned in last week's letter to take notice, especially if the initial decline of 34 points continues down to its potential short-term target of about 2002. Incidentally, the 34-point retraction was equivalent to a .382 retracement of the phase which started at 1970 on 3/10. Do we now extend the rally from 1810, or do we continue to decline to the full projection of 2002 -- which would amount to a .618 retracement? The 2002 projection was based on the amount of distribution which occurred above the 2041 level.

If the index did continue to sell-off to that level, it would increase the probability (above 50%) that the rally phase from 1810 did end at last week's high, but we should not expect much more downside at this time. As we did after the 2116 top of 11/03/15, a period of volatility between 2000 and 2056 could take place which would create the amount of distribution needed to extend the primary bearish trend. This is speculation about what could take place over the next few weeks if 2056 turns out to be the rally top; it is not a forecast. First, next week's market action needs to confirm that a top has been made. Let's see what happens!

SPX Chart Analysis

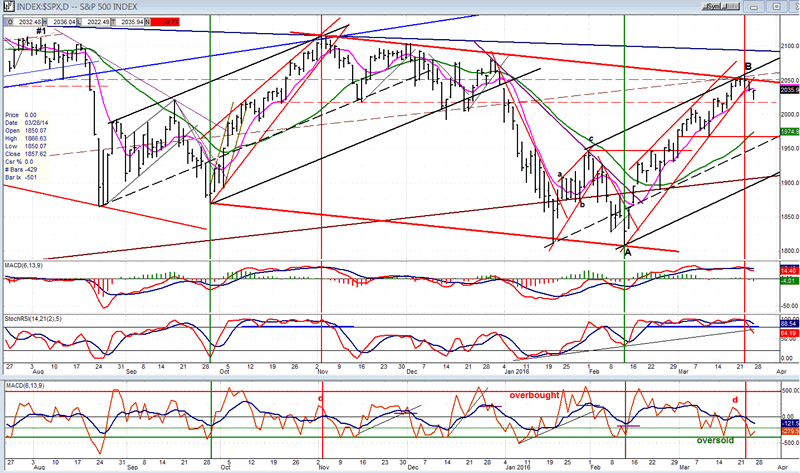

Daily chart (This chart, and others below, are courtesy of QCharts.com.)

As I stated above, there is a good chance that last week we witnessed the high point of the rally from 1810. Why is that? Let's start with the chart. I have already mentioned the similarity between the rally from the September low and the one from the February low. They are both wedges, a bearish pattern which is well suited for a countertrend rally. They are also about the same length in time, with the current one being a few days longer than the last one. But there is more than similarity between them in the length of each uptrend: within a few pennies, they span exactly 244 points! Because of that, we can draw a channel (heavy red lines) which contains the present correction and runs at a slightly lesser angle than the top trend line. This is important 1) because it indicates deceleration within the longer-term trend, and 2) because if, after a brief consolidation, the rally should extend outside of that channel, it would be the first indication that the large pattern between August '15 and February '16 might only have been a consolidation in the long-term uptrend. For this reason, what the index does over the next few weeks will be very important.

Let's now compare the pattern which was made by the indicators from the beginning to the end of each wedge. I have drawn a green vertical line at the start and a red vertical line at the end for each wedge. The MACD and SRSI have exactly the same formation in each one, with both indicators rolling over and initiating a bearish cross in their MAs after the lower line of the wedge was breached. The similarity of the A/D oscillator is also evident. An initial high was made at the start of the rally, a slow decline down to the oversold line while the index progressed upward, and a secondary peak which showed negative divergence at the final high, followed by another decline as the price trend line was penetrated.

With so much similarity of price and indicator action, we have good reasons to expect that it will continue as we go forward; that is, a continuation of the initial decline, followed by a period of distribution before we are ready for a new low in the primary trend. If something substantially different should happen, we will need to revise our expectations.

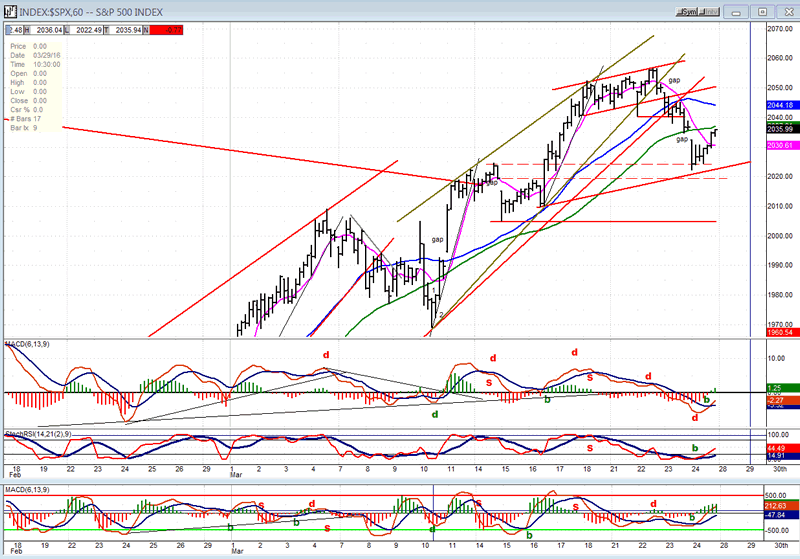

Hourly chart

The hourly pattern reveals a small wedge pattern at the end of a larger one with a short period of distribution before the initial decline started. That distribution formation has a count which has the potential of taking SPX lower, but the index found support at a previous minor high, formed a small consolidation pattern, and closed on its high on Friday, in an attempt at filling the day's downside gap opening. It did not quite make it, failing to close it by less than a point. It will get another chance on Monday since the indicators have given a buy signal which may be limited in price movement because the daily indicators are in the process of giving a sell signal. We'll have to see if the index holds a little longer in this area, or drops lower to fill its top congestion target. If it attempts to move higher, it will meet with resistance at the 2041 level. How it handles it will give us some clues about what to expect next. We need to be sure that the higher potential counts will not be reached.

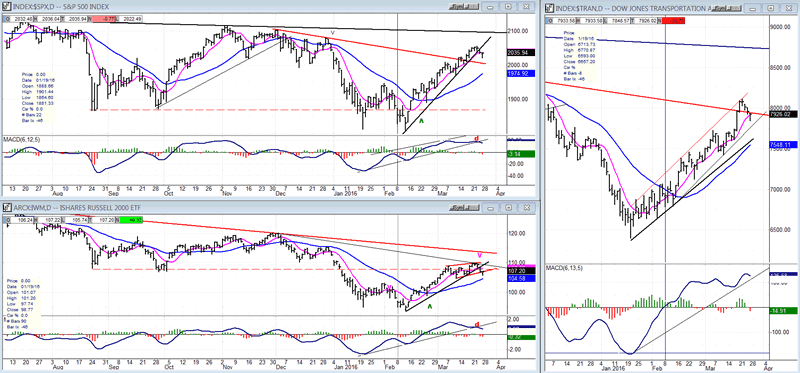

SPX vs. TRAN (Dow Jones Transportation average) and IWM (Russell 2000 ETF)

The TRAN is trading about even with the SPX and is not showing relative weakness over the short-term. It may now trade in sync with SPX and, for this reason, I have relegated it to the side chart. IWM, on the other hand, noticeably weakened vis-à-vis SPX during the decline into February and continues to do so. During the current rally, it essentially stopped going up a couple of weeks before SPX and TRAN, and its momentum indicator rolled over sooner. Perhaps leadership has changed! Most indexes followed are still giving a mixed picture.

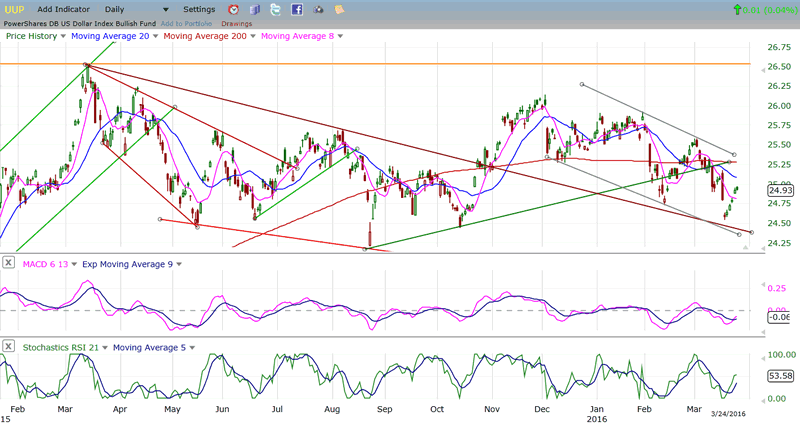

UUP (dollar ETF)

Last week, UUP had a nice rebound which could mark the end of its consolidation. That will depend on its ability to follow through with a rise above its 200-DMA and out of its corrective channel. Should it do so, this strength should have an effect on both gold and oil. This is the third low of the correction and it stands a chance of being the last.

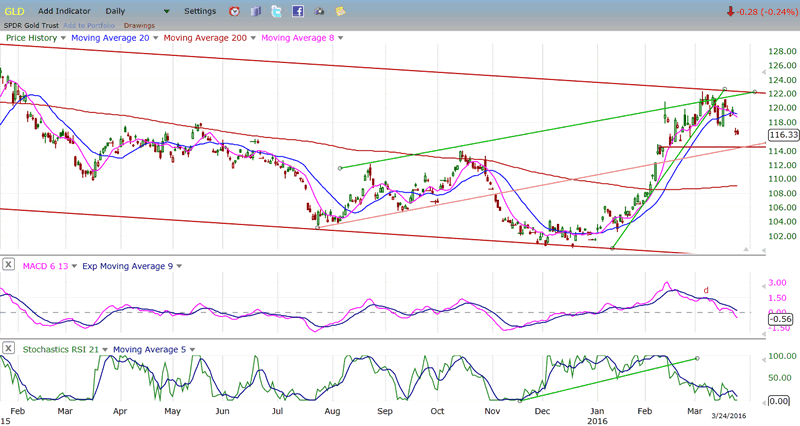

GLD (gold ETF)

GLD is looking increasingly vulnerable to a correction. After breaking its uptrend line, it rallied back up to the top of the green channel and started to pull back. Last week, the strength in the dollar caused it to gap down to a new correction low. The next support level could coincide with closing the gap at 114.50. This would also be a .382 retracement (113.79) of its initial rally making it unlikely to be the entirety of the correction. With a cycle low near the middle of next month, a 50% retracement to its 200-DMA (111) is nearly certain. There is even a P&F target down to its .618 retracement level of 108. And... but that's enough for now.

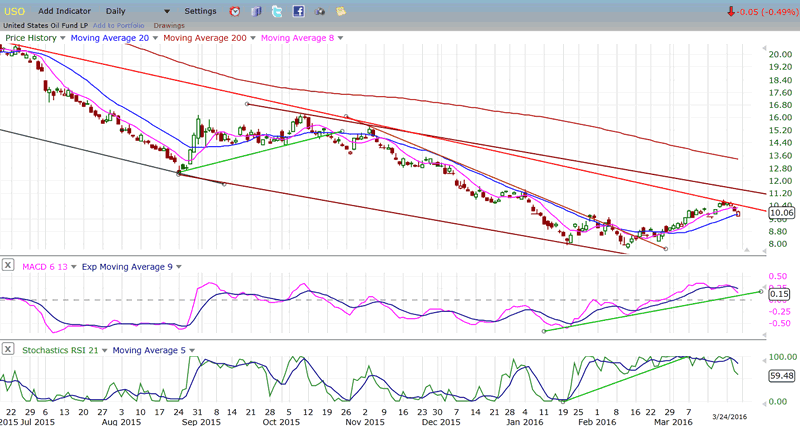

USO (US Oil Trust)

USO met its base projection of 10.50 and has started to pull back. By the looks of the indicators, it may not be finished, especially if UUP continues its upward move.

Summary

"After Friday's action, SPX looks poised for a minor pull-back. That may be all we get unless we can retrace below 2020, in which case a more important top may be in place."

We did get that minor pull-back, even though we had to wait for Wednesday for it to start. A good case can be made for 2056.60 to be the high point of the counter-trend rally, but this will have to be confirmed. We could start by dropping down to about 2000 right away. That is the target for the amount of distribution which has taken place above the 2041 level.

Next week will be key in deciding if we have an intermediate top in place, or if SPX reaches for the higher counts mentioned in italics in Market Overview. Cycles may not cooperate fully until later in the week.

Andre

FREE TRIAL SUBSCRIPTION

If precision in market timing for all time framesis something that you find important, you should

Consider taking a trial subscription to my service. It is free, and you will have four weeks to evaluate its worth. It embodies many years of research with the eventual goal of understanding as perfectly as possible how the market functions. I believe that I have achieved this goal.

For a FREE 4-week trial, Send an email to: info@marketurningpoints.com

For further subscription options, payment plans, and for important general information, I encourage

you to visit my website at www.marketurningpoints.com. It contains summaries of my background, my

investment and trading strategies, and my unique method of intra-day communication with

subscribers. I have also started an archive of former newsletters so that you can not only evaluate past performance, but also be aware of the increasing accuracy of forecasts.

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.