Do ETFs' Flows Drive the Gold Price?

Commodities / Gold and Silver 2016 Apr 08, 2016 - 03:57 PM GMTBy: Arkadiusz_Sieron

What are ETFs? The ETFs, or Exchange-Traded Funds, are funds that track indices, commodities or securities. The ETF shares are securities that closely resemble the yield and return of its native index, but - unlike mutual funds units - can be traded just like common stocks. The gold ETFs are a special type of ETFs that track the price of gold. The ETFs are backed by physical bullion (or gold derivative contracts), but investors do not own any gold and they cannot even redeem their shares in gold (only authorized participants can do that, thus private investors liquidate their holdings by selling their ETF shares on the open market). The two largest gold ETFs by assets are the SPDR Gold Trust (GLD) and the iShares COMEX Gold Trust (IAU).

What are ETFs? The ETFs, or Exchange-Traded Funds, are funds that track indices, commodities or securities. The ETF shares are securities that closely resemble the yield and return of its native index, but - unlike mutual funds units - can be traded just like common stocks. The gold ETFs are a special type of ETFs that track the price of gold. The ETFs are backed by physical bullion (or gold derivative contracts), but investors do not own any gold and they cannot even redeem their shares in gold (only authorized participants can do that, thus private investors liquidate their holdings by selling their ETF shares on the open market). The two largest gold ETFs by assets are the SPDR Gold Trust (GLD) and the iShares COMEX Gold Trust (IAU).

We can think of several reasons for investing in securities which merely replicate the performance of the yellow metal. The gold ETFs are quoted on stock exchanges, so they are very convenient to trade and liquid. Since they are not actively managed and they are associated with minimal expenses. ETFs also often enjoy tax advantages. But perhaps the most important feature of the EFTs is the fact that one share usually corresponds to one tenth of one ounce of gold. Therefore, it is relatively easy to buy ETFs even for individual investors. Some analysts even say that introduction of gold ETFs in the 2000s made the gold market finally accessible for private, retail investors. According to them, this revolution contributed to the 2000s bull market.

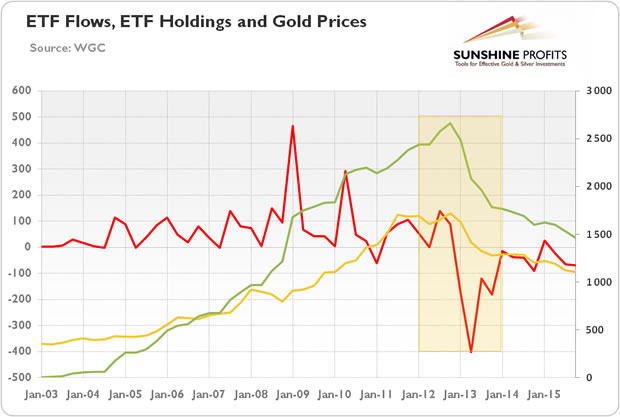

Is that true? What is the relationship between the ETF flows and the gold price? Let's analyze the chart below, which shows the net inflows of gold bullion into ETFs and the price of gold. As one can see, there is a visible positive (but not always strict) correlation between gold prices and the net inflows into ETFs. When the price of gold rises, we see inflows to ETFs. Conversely, during the last bear market, we witnessed huge outflows from ETFs. Consequently, the cumulative holdings of ETFs track the price of gold.

Figure 1: The price of gold (yellow line, right axis, P.M. London fixing, in the U.S. dollars per ounce), the net demand for ETFs and similar products (red line, left axis, in tons) and the cumulative ETFs holdings (green line, right axis, in tons) from 2003 to 2015.

The close relationship between the ETFs' flows and the price of gold should not surprise us, given the fact that the very aim of gold ETFs is to replicate the behavior of gold. As the chart below shows, the SPDR Gold Trust (GLD) does its job pretty well.

Figure 2: The price of gold (yellow line, right axis, London P.M. fixing) and the price of SPDR Gold Trust (red line, left scale, closing prices) from December 2004 to February 2015.

Now, the crucial question is whether the ETFs' inflows and outflows drive the price of gold or rather are they driven by the changes in gold prices? Some authors claim that trading activity in gold ETFs moves the price of gold. However, the cause and effect actually work the other way around. When the price of gold rises, traders of ETF shares tend to get more optimistic and boost their prices above the net asset value (NAV). When the price of ETFs' shares rises relatively to the NAV, it prompts arbitrage - financial institutions enter the scene, buy the ETF's underlying assets (gold), and simultaneously sell ETF shares. Since they buy bullion, the ETF's inventories increases, which explains why the ETF's holdings moves generally in tandem with the price of gold.

Moreover, the largest gold ETF trades an average of 24 million shares (GLD) daily, representing 2.4 million ounces of gold. It is only an eighth of what is traded in the Comex. Additionally, the annual change in ETFs' bullion inventory is a tiny fraction of the total size of the gold market (the SPDR Gold Trust, the largest gold ETF held merely 642.4 tons of gold at the end of December 2015), therefore it is unlikely that a few hundred tons per year inflowing or outflowing from the ETF's vaults could significantly affect the price of gold.

To sum up, the gold ETFs are an interesting option for investors wanting to gain exposure to the price of gold, without owning the bullion. Given the significant correlation between ETFs' holdings (flows) and the price of gold, some argue that the former drives the latter. However, the amount of bullion moving into or out from the ETFs' inventories is too small to significantly affect the price of gold. Moreover, the relationship between these two variables can be fully explained by the arbitrage process inherently associated with the creation/redemption mechanism. We will analyze in detail the complicated ETFs' actions in the next part of the report.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.