7 Gold And Silver Mining Investment Tips For 2016

Commodities / Gold and Silver 2016 Apr 18, 2016 - 06:20 PM GMTBy: InvestingHaven

This article is based on a live webinar which was hosted by InvestingHaven.com on Wednesday April 13th during which 15 questions where answered by panelist Rob Tovell, market analyst at RobTovell.com and investor/trader for 4 decades covering all markets including precious metals, and panelist John Newell who manages the “Global Precious Metals Program” fund at Field House Capital. The first part of the webinar was focused on gold and silver mining questions, and the second part about the gold/silver price as well as gold futures market.

This article is based on a live webinar which was hosted by InvestingHaven.com on Wednesday April 13th during which 15 questions where answered by panelist Rob Tovell, market analyst at RobTovell.com and investor/trader for 4 decades covering all markets including precious metals, and panelist John Newell who manages the “Global Precious Metals Program” fund at Field House Capital. The first part of the webinar was focused on gold and silver mining questions, and the second part about the gold/silver price as well as gold futures market.

This article higlights seven helpful investment insights about gold and silver miners, and related investment opportunities in 2016, answered by John Newell from Field House Capital.

Will precious metals companies find difficulty obtaining financing if/when a new crisis comes?

Currently, companies with good projects are being merged or taken over. There is money for good projects again. Case in point: John Paulson and his hedge fund group recently took a position in Midas Gold.

Back in 2008, Nova Gold got into trouble and Electro Group came in to provided fund so the company could continue. It is very difficult to raise money for anything in a market like 2008. However, the current market has really changed over the last year which is a proof that good projects can get finance, even in very hard times.

Which miners have a strong balance sheet?

A lot of companies recently raised money, which is the result of a strong balance sheet: Iamgold, Endeavour Mining, Detour Gold, Condex, Kirkland Lake, Oceana Gold, Tahoo Resources, Alamos, Argonaut (although it had some production issues).

A lot of money is being raised currnently to expand projects, like for instance Semafo. Companies are being cashed up given the current strength in this precious metals market.

Which are the most promising gold and silver junior miners?

I should be careful to say that precious metals explorers are extremely volatile and risky to invest in. There are basically three categories in the gold mining industry: exploration companies, miners that are developing projects to put them into production, and producers. Exploration companies are very thinly traded, and their share prices can be volatile. Almaden (symbol AMM on the Toronto Exchange and AAU in the US) is developing a project in Mexico with 5 mio in measured and indicated gold, Midas Gold (symbol MAX) is developing a +5 mio deposit in Idaho, Dalradian (DNA) is developing a not very large project in Ireland but with good exploration results.

Companies that have made the strongest moves during the recent gold rally are the ones that have the opportunity to have 5 mio ounce deposits. They are nice acquisition targets as producers are moving out of ore in the future and are looking to acquire quality deposits, say high grade projects that have ability to be 3 to 5 mio ounces.

What is the outlook for First Majestic Silver (AG)?

First Majestic Silver is part of the portfolio of the “Global Precious Metals Program”. In 2008/2009, the stock collapsed from $5 into $1 only to rise to $25 in 2011. Last year, the stock was down to $5 and is now trading well above $10. The stock can do very well, it is the second largest silver producer in Mexico.

First Majestic has acquired a couple of companies in the past 9 months, through which it added to its ounces in the ground. It is run by keen silver bull Keith Neumeyer. First Majestic is one of the top silver stocks.

Which juniors are potential takeover candidates in this bullish gold cycle?

In Canada, there have been 5 takeovers in the “Global Precious Metals Program” fund since 2013. Companies are starting to geographically diversify. Think of Oceana Gold which is based in Australia but has been actively acquiring properties in Nevada. Also, Detour Gold, on the border of Quebec, is a potential takeover. Almaden and Richmont are potential takeovers as bigger companies want to replace their reserves.

This market reminds me a lot to what I have seen between 2001 and 2005, in which a series of mergers and take-overs took place, seeking to create economies of scale.

What is Detour Gold’s upside potential after its recent huge rally?

Yes, there is definitely a lot of potential in Detour Gold. The stock came down from $45 back in 2011. Since then, oil prices came down a lot, economies of scale have changed dramatically, and a new management team was brought into the board of the company.

We have Detour Gold in our portfolio, and are not selling it. The stock is quite volatile as it can move fairly regularly with 10%. We have not worked out an exact price target but we see this company going back to its old highs.

We are extremely bullish on Canadian precious metals companies.

Moreover, our focus is on relative strength in the weakest group. Over the course of the last 4 years, precious metals were the weakest group, and in there Detour Gold was the strongest of that group. That is everything an investor needs to know.

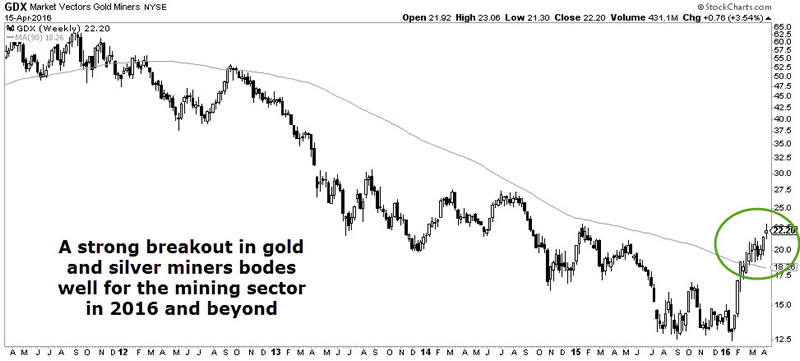

What is your 1, 2 and 5 year outlook for gold mining ETFs?

We expect gold miners to perform similar to the Dow Jones in 1982 which rallied some 60% without any significant correction. If gold went up from its January lows to $1700, gold shares would rise 2 to 3 times more than physical gold which is basically similar to what happened between 2001 and 2010. If, and that’s a big IF, gold would go up 70%, gold shares would rise 2 or 3 times more. We are extremely bullish on gold miners.

What is the outlook for silver bullion vs silver mining stocks in 2016? Which pitfalls should investors take into account when looking at silver miners?

Silver stocks have vastly outperformed silver bullion well before silver started to move in recent weeks. Great Panther is breaking out to a new high. Bear Creek went from 60 cents to 2 dollars, Alexco from 60 cents to 1.60 dollars. Tahoo Resources is a strong silver stock that still deserves to be bought today. We are extremely bullish on good silver stocks.

Silver stocks, however, are a small segment in the market, so investors should be very careful. There are pitfalls in silver stocks which should be taken very seriously, as some silver companies could have the word “silver” in their company name but will never make it to produce even one ounce of silver. We are looking at companies that are able to produce physical silver or are close to that point. We do not have a problem if a silver company shuts down its production because of a low silver price.

With that in mind, our favorites are Alexco, Great Panther, Bear Creek, Endeavour Silver, First Majestic, Tahoo Resources (having the highest grade silver in the world). Those companies should be bought on down days rather than up days.

Analyst Team

The team has +15 years of experience in global markets. Their methodology is unique and effective, yet easy to understand; it is based on chart analysis combined with intermarket / fundamental / sentiment analysis. The work of the team appeared on major financial outlets like FinancialSense, SeekingAlpha, MarketWatch, ...

Copyright © 2016 Investing Haven - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.