Stock Market First Support Level Re-Tested

Stock-Markets / Stock Markets 2016 May 16, 2016 - 04:41 AM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

SPX Long-term trend: The beginning of a lengthy correction is most likely underway!

SPX Intermediate trend: May be in the process of forming a H&S bull market top.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discuss longer market trends.

FIRST SUPPORT LEVEL RE-TESTED

Market Overview

Last week's summary stated: "SPX appears to have completed the first phase of its correction on Friday by reaching a P&F phase target as well as a strong support level. This price area also corresponded to a normal downside projection for the H&S pattern which formed as a top. It should bring about a rally which may be strong enough to carry it back to 2075 -- a 50% retracement of the move down from 2111."

This is pretty much what happened last week when the index filled its base projection of 2084, reversed, and started a correction which, by the end of the week, brought it within four points of where the rally started. But it does not look as if we are finished declining over the short term.

And then: "This retracement would enhance the possibility that it could form a right shoulder of an even larger H&S top which, when broken, would leave no doubt that we have started a major correction."

The SPX price action is becoming interesting, since I also mentioned that we might be in the process of forming the right shoulder of a larger H&S pattern whose neckline is at 2042, and if we do continue to decline for another ten or twenty points, it will make this potential formation even more realistic. Whether or not it turns out to be such a pattern (if the 2043 support level is broken) it will increase our bearish stance -- especially if this is followed by a move below the next support at 2020.

In fact, as we will see later, three in our group of leaders have already broken below a level comparable to the SPX 2043, with the TRAN "canary" being the latest by making a new low on Friday. It would be surprising if SPX and the other two do not follow suit next week.

SPX Chart Analysis

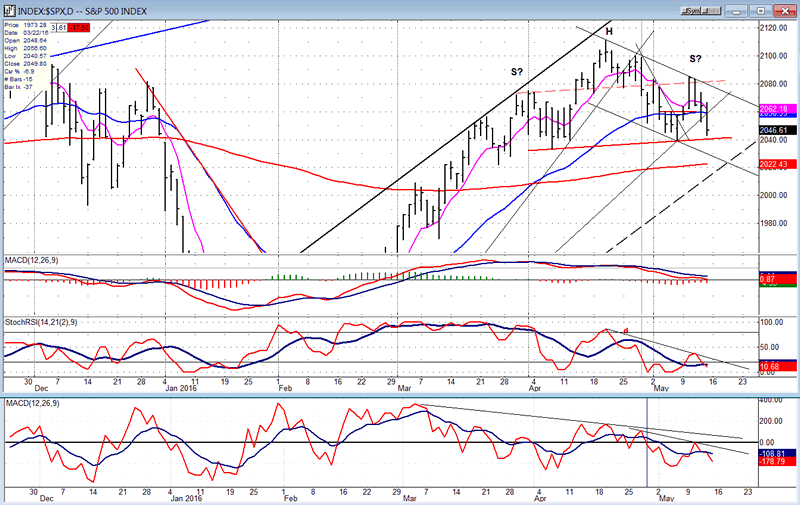

Daily chart (This chart, and others below, are courtesy of QCharts.com.)

I have sacrificed showing the rally low (1810) in order to provide more clarity for the top pattern which may be evolving as a H&S formation. I have drawn the presumed neckline with a heavy red line across the two lows. The parallel to the neckline drawn from the left shoulder is pretty much in alignment with the neckline of the smaller H&S pattern, and its extension is where the rally from 2040 stopped, giving the entire formation a symmetrical pattern. However, in order to confirm it as a H&S, the index will have to plunge below the neckline (perhaps to the bottom dashed trend line of the large rising channel or lower), rally to the neckline, and then continue the downtrend. If my intuition serves me right, next week could accomplish a good part of that confirmation process.

On the P&F chart, there is enough of a count which can be derived from the small H&S top to push prices beyond the dashed line. If recent activity is a guide, we could very well be there by the end of next week, but this is only if short-term cycles cooperate, reinforced by longer-term ones due to bottom by the end of June (credit to Eric Hadik).

The reversal from 2084 has caused the three oscillators to turn down, with the MACD ready to go negative. This will take place if we close below the "neckline", and it would be short to intermediate-term bearish. If we cannot breach the neckline and we start up from here, the whole idea will have to be scrapped and a new evaluation of the market's positon determined.

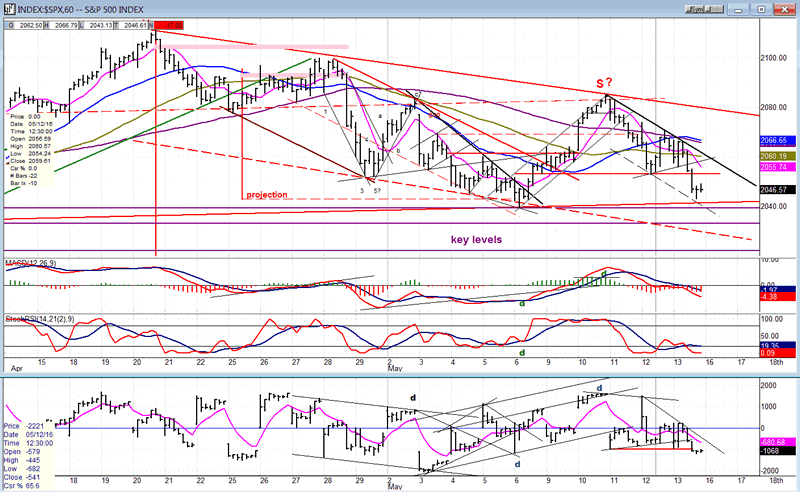

Hourly chart

The hourly chart shows that the index has been traveling in a well-defined channel with three points on the top line and two on the bottom. On 5/06, it stopped at 2040, on the highest of the three purple lines identifying key support levels. That one certainly proved itself by causing a 44-point rally. But the fact that prices have immediately retraced almost all of their previous gain cannot be considered bullish, and it strongly suggests that the lower key levels are about to be tested. In fact, the second level corresponds to the short-term projection, which could complete the second phase of the decline from 2084 as early as Monday (if we show some weakness at the opening). Then, after a bounce, we could start on the third phase of the decline (if this indeed turns out to be a declining pattern we are making) and this could take prices all the way to the bottom of the red channel, once again. That's a lot of assumptions, but not illogical.

Like the daily oscillators, the hourly are also in a declining mode, except that the A/Ds (raw data) does not show all that much weakness, which is probably due to the commodity stocks still bouncing from their oversold conditions. When they turn down again, the A/D figure should return to normal.

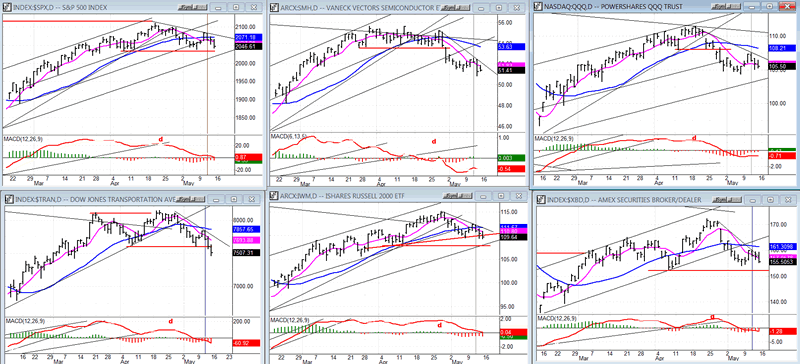

SPX et al...

The prospects for SPX to break its first support level are increasing. Two leading indices: SMH (semiconductors) and QQQ (tech stocks) already made a decisive penetration of their April lows, and last Friday, TRAN made it three. With SPX having created a congestion pattern which has short and intermediate counts which can drive it well past the 2043 support (and pivot) level, it should only be a matter of time before SPX sides with the majority. The remaining two indexes of our leaders' sample also seem poised to join the rest.

A coordinated move below that important support level would have a bearish connotation, especially since it would imply that the SPX - and perhaps IWM - are forming large H&S patterns.

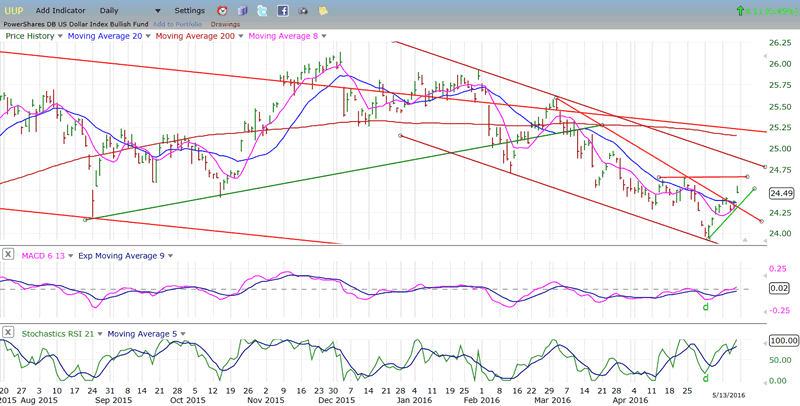

UUP (Dollar ETF)

UUP appears to be intent on reversing its short term, and perhaps intermediate, trend. Since meeting its downside consolidation target (which coincided with the bottom of a shorter trend channel), the index has had a good rebound which has already broken out of a three-month downtrend and looks ready to challenge the larger channel's top line. Everything considered, it may be more a matter of "when" than of "if"! As the dollar begins to regain some strength, it will have an effect not only on commodities, but on a stock market which has been buoyed by commodities-related stocks having an oversold rebound. This has been especially obvious in the performance of the A/D line which has far exceeded price performance. Should this trend be reversed by a stronger dollar, it would bring additional pressure on a market trend which is currently looking tentative, at best.

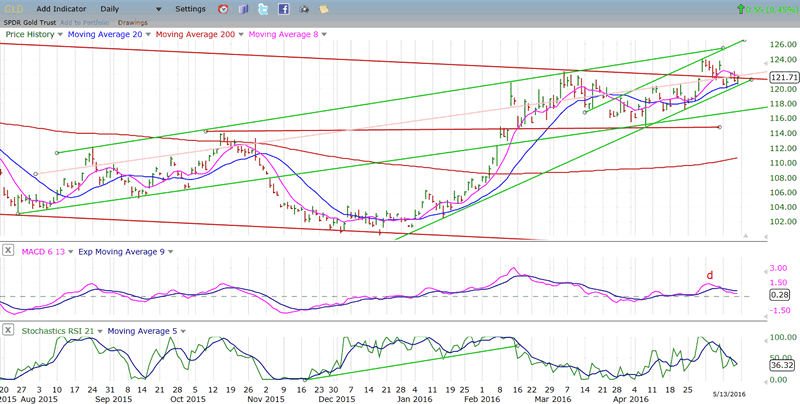

GLD (Gold ETF)

A rising dollar would also undermine gold's effort to recover from a prolonged correction. The chart of GLD is showing an index which is struggling to extend its uptrend. It is crawling along an uptrend line which has already been tested four times over the past six weeks. But I am beginning to question my thinking that the 25-wk cycle low - which should be due any day - will help the index break through its trend line and cause some temporary weakness. It's possible that this cycle, once very dominant, has faded in intensity over time and that it may even have made its low last week without being able to break through the trend line. If that's the case, GLD would then be able to reach at least 125-126 before reversing. Anyway, we don't have to speculate too much about this since GLD's near-term future is likely to be decided by next week.

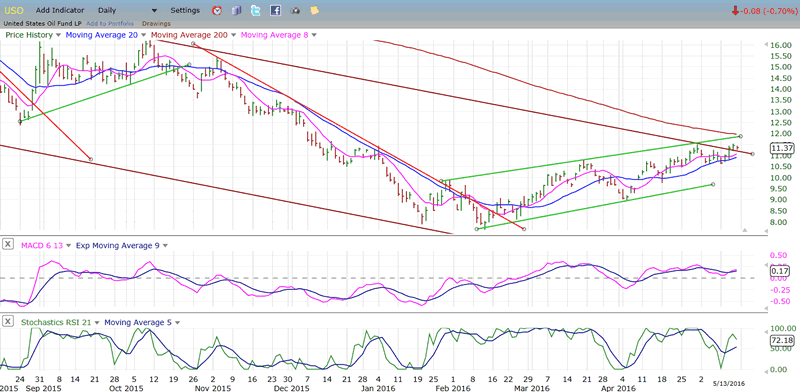

USO (US Oil Trust)

Last week, USO again tried, although unconvincingly so far, to push through its upper channel line. In its favor, it has the potential to rise to 12 before it stops trying. If it did, it would encounter the 200-dma as well as the top of its channel line, which would cap the move for now. As stated earlier, USO may not be in a position to attempt a more protracted uptrend until it has built a larger base. That would require more range-bound trading between its recent low and the current price over a period of time!

Summary

SPX may be on the verge of proving the bears' viewpoint correct. By continuing its current decline decisively below 2043, the index would not only join other leading indices in breaking a significant support level, but also further confirm that, since the end of March, it has been in the process of creating a bull market top in the form of an important H&S pattern. Should this prove to be the case, it would project a serious decline over the next few months.

Andre

FREE TRIAL SUBSCRIPTION

If precision in market timing for all time framesis something that you find important, you should

Consider taking a trial subscription to my service. It is free, and you will have four weeks to evaluate its worth. It embodies many years of research with the eventual goal of understanding as perfectly as possible how the market functions. I believe that I have achieved this goal.

For a FREE 4-week trial, Send an email to: info@marketurningpoints.com

For further subscription options, payment plans, and for important general information, I encourage

you to visit my website at www.marketurningpoints.com. It contains summaries of my background, my

investment and trading strategies, and my unique method of intra-day communication with

subscribers. I have also started an archive of former newsletters so that you can not only evaluate past performance, but also be aware of the increasing accuracy of forecasts.

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.