Bad U.S. Jobs Report Prompts Stocks Bear Market Rally Towards New All Time Highs!

Stock-Markets / Stock Markets 2016 Jun 07, 2016 - 12:04 AM GMTBy: Nadeem_Walayat

Friday's US jobs report was apparently one of the worst of President Obama's presidency, that saw the US economy add a good 100k fewer jobs than the market consensus was expecting (38k against 160k). That and severe profits warnings from the likes of the mega-bank Citicorp sowed the seeds for what the bears had been praying for all year, finally the bear market that apparently began in August 2015 was now set to resume with a vengeance with even some calling for an opening flash crash!

Friday's US jobs report was apparently one of the worst of President Obama's presidency, that saw the US economy add a good 100k fewer jobs than the market consensus was expecting (38k against 160k). That and severe profits warnings from the likes of the mega-bank Citicorp sowed the seeds for what the bears had been praying for all year, finally the bear market that apparently began in August 2015 was now set to resume with a vengeance with even some calling for an opening flash crash!

So Friday morning, whilst the Dow did open lower, falling by about 150 points, however it did not last as the Dow recouped the losses ending higher on the day at 17,807. What about today? Monday? Was Friday an anomaly? A random quantum market fluctuation that sees bull and bear markets flash into existence only to annihilate one another by the following days open?

Well as of writing the Dow has continued Fridays rally in the face of BAD NEWS to stand near 100 points higher just shy of 17,900. Which begs the question was Friday's Jobs report really so bad? Or are most analysts stuck within their perma-worlds and missed the blindingly obvious?

US Jobs Report

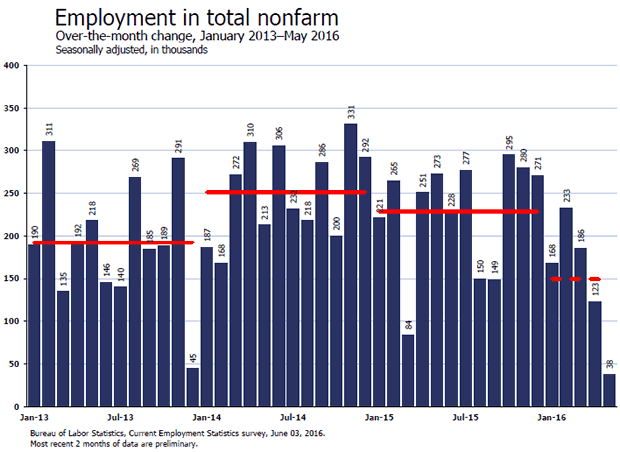

According to the bears, Fridays US jobs report was disastrous, as the US economy only added 38k jobs against market expectations for typically 150k to 200k. With the bears focusing on the following chart in particular that highlights the plunge in job creation.

However the reality of what is closer to the true picture of the US jobs market is better presented by -

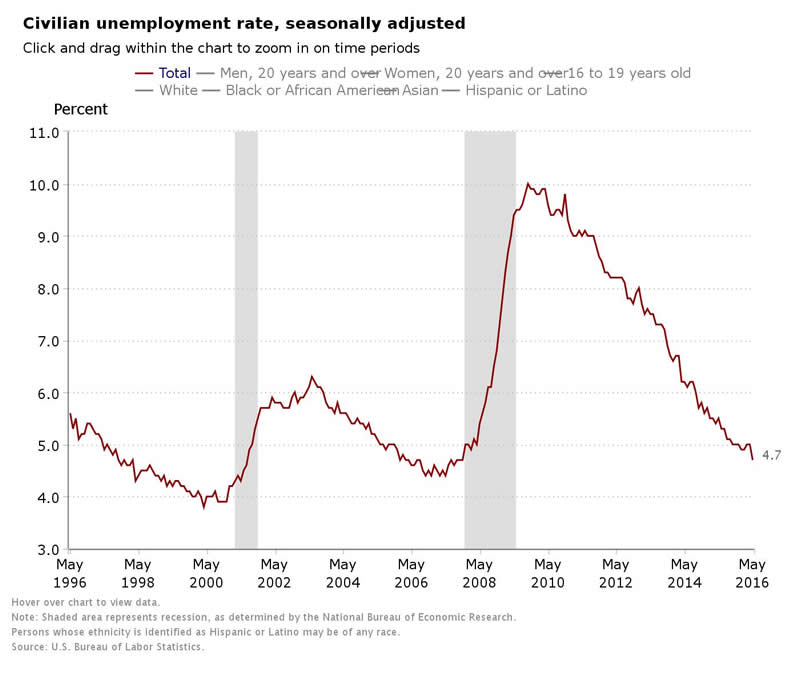

The FACTS are that the rate of US unemployment has fallen to an historically low level of just 4.7% which compares against the peak of 10% of October 2009 as George Bush had handed over an economy that was in a state of economic collapse as the chart clearly shows that unemployment was soaring into the stratosphere under George Bush which took the Obama presidency a good year to bring to a halt and then to implement a gradual trend of reducing unemployment to the present levels of half that of the 10% peak.

And similarly the fall in unemployment has gone hand in hand with the stocks bull market. A fact that the perma bears have been blind to for its 7 year duration!

The bottom line is that the trend is your friend and focusing on a single jobs report whilst ignoring a 7 year trend is truly delusional. It's akin to not seeing the forest for the trees, persistently oblivious to the big picture which is why they have MISSED a 7 year long stocks bull market!

Stock Market 2016

So where do we stand in terms of the great bear market of 2016 that apparently began off the June 2015 all time high of 18,351? Well the last trade of 17,910 puts the Dow about 450 points or 2.5% away from setting a NEW ALL TIME HIGH! If that's the best that the bears can do a year into a bear market then they either have very deep pockets so ride out the losses for the fact that most bears proclaimed the bear market was in just as Stocks were putting in a bottom during late August 2015. Some even proclaiming to be 99.7% certain that stocks were in a bear market (moneymorning.com)!

Is This a Bear Market?

It actually indicates there's a 99.7% chance we're already in a bear market.

Or more recently - Are Global Stock Markets Pointing to a Bear Market?

Which at the time I warned against being suckered by bearish rhetoric with my then September 2015 forecast resolving in a stock market trend towards Dow 18k.

13 Sep 2015 - Stock Market Dow Trend Forecast for September to December 2015

Dow Stock Market Forecast 2015 Conclusion

My final conclusion is for continuing weakness that will result in a volatile trading range with a probable re-test of the recent low of 15,370 by Mid October that will set the scene for a strong rally into the end of the year that could see the Dow trade above 18,000 before targeting a gain for a seventh year in a row at above 17,823 as illustrated below:

Whilst my consistent view for the whole of 2016 has been that after a correction into April that the stock market WOULD resolve in a trend towards NEW ALL TIME HIGHS this year as my most recent video analysis again illustrated.

Whilst my immediate focus is on the forthcoming EU referendum to be held on June 23rd. However, I will thereafter return to in-depth analysis of financial markets including concluding in a detailed trend forecast for the stock market for the remainder of 2016, so ensure you are subscribed to my always FREE newsletter to get this in depth analysis in your email in box.

EU Referendum - British People vs Establishment Elite

The latest propaganda card played by the Remain in the EU establishment camp was of George Osborne calling on his good buddy, Jamie Dimon, the head of JP Morgan to come to Britain and do his best to scare the British people into voting to REMAIN within the EU on June 23rd as being in the best interests of the British establishment who OWN Britain. So Jamie acted out the role of being the fourth horseman of a Brexit financial apocalypse that would see Britain's financial sector evaporate. Though maybe not on par with the last financial apocalypse that the likes of JP Morgan helped bring about in 2008. That saw the world's governments blackmailed into bailing out the banks to the tune of $trillions of dollars. Where even little old blighty was forced to cough up over £500 billion to bailout Britain's banks, and then had a £4 trillion noose of banking sector liabilities put around the necks of the British tax payer or else face financial armageddon...

VOTE FOR FREEDOM Starting June 23rd....

BrExit Campaign

There's now less than 3 weeks to go and with the opinion polls neck and neck on 45%, it's a case of now or never, the final push to secure freedom for the British people.

By Nadeem Walayat

Copyright © 2005-2016 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.