Alignment Of The Dow, Interest Rates, Debt and Silver Cycles Will Deliver A Fatal Blow

Stock-Markets / Financial Markets 2016 Jun 15, 2016 - 06:58 PM GMTBy: Hubert_Moolman

Since the inception of the debt-based monetary system (with its fractional-reserve banking), the banks have been playing a nasty game of Russian roulette. The only reason that the system has not blown-up is because the relevant cycles have not adequately lined up to deliver a fatal blow.

Since the inception of the debt-based monetary system (with its fractional-reserve banking), the banks have been playing a nasty game of Russian roulette. The only reason that the system has not blown-up is because the relevant cycles have not adequately lined up to deliver a fatal blow.

They have been allowed to play it long enough, and it now appears that the fatal blow will be delivered soon (just like Russian roulette when you play it long enough). The coming Dow crash is the likely trigger that will deliver this blow.

Below, I have three charts to show how the timing of current major Dow peak, perfectly lines up with some key turning points in the markets. These suggest that the coming Dow crash will be the worst ever.

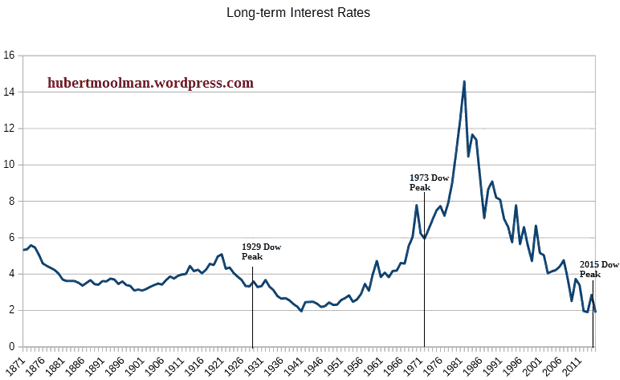

Below, is a chart of interest rates on the 10-year treasury bonds, since 1900 (R Schiller Online Data):

On the chart, I have marked three major Dow peaks (1929, 1973 and 2015). The 1929 and 1973 peak occurred roughly halfway through an interest rate cycle - far from a key turning point.

The 2015 Dow peak is close enough to a turning point for interest rates (2012). Not only is the Dow's turning point close in terms of time (remember that 3 years are close, given a 40-year cycle), but also in terms of how close the interest rate at the time of the Dow's peak is to the interest rate at the turning point in 2012.

Depending on the relationship between the cycles (in this case the Dow and interest rates), this could be disastrous. The Dow's major peak is close to the major low in interest rates, but is this disastrous? Like I said, it depends on the relationship between the Dow and interest rates.

Generally, when interest rates are decreasing, then conditions are good for the Dow. When interest rates are increasing, then conditions are bad for the Dow. It does not mean that the Dow cannot rise when interest rates are increasing. It is just like running against a strong wind - you can still run, but it is much harder. A Dow crash starting at a time when interest rates are at a bottom, is therefore, a very bad economic scenario.

Therefore, based on the relationship of the Dow and interest rates, the closeness of the turning points mentioned spells disaster for the Dow.

So, if the 2015 Dow peak and 2012 interest rates bottom is valid, then the coming decline of the Dow could be disastrous, since the increasing interest rates will further fuel the decline.

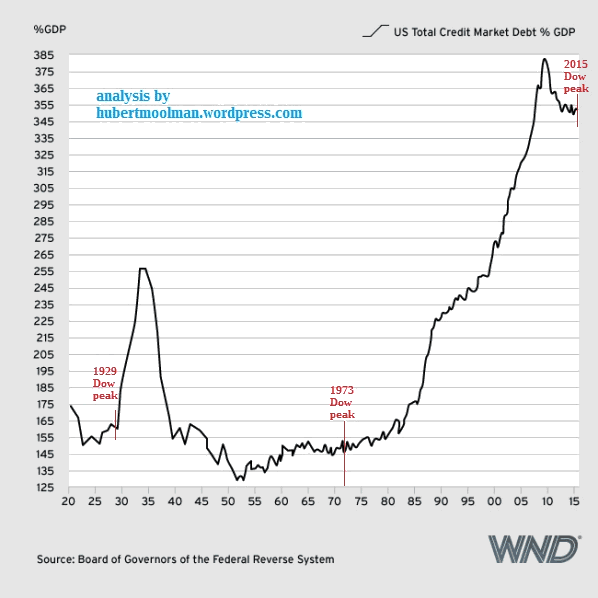

Below, is a long-term chart of US Total Credit Market Debt as Percentage of GDP (from wnd.com):

On the chart, I have marked the three major Dow peaks (1929, 1973 and 2015). The most important thing to note is the fact that the 2015 Dow peak occurs when this ratio is close to its peak, whereas the 1929 and 1973 peaks occur nearer to the bottom. In other words, the 2015 Dow peak occurs at a time when debt is at its most overvalued, whereas the other two peaks occurred when debt was relatively undervalued.

This means that the current Dow peak occurred at a time where it is more likely that credit could collapse, and also where it becomes more difficult to extend more credit. Again, collapsing credit will be like a strong wind, hindering any rise in the Dow, but providing a huge boost to any fall. It is my view that the coming credit collapse will be more like a nuclear wind (this is since credit is so pervasive in the economy today), destroying anything that derives its value from debt.

The crash that followed the 1929 Dow peak was extremely bad, since the Dow lost more than 88% of its value. That crash did not have a "strong wind" helping it on further. With more ideal crash conditions, the coming crash will likely far exceed the 1929 crash.

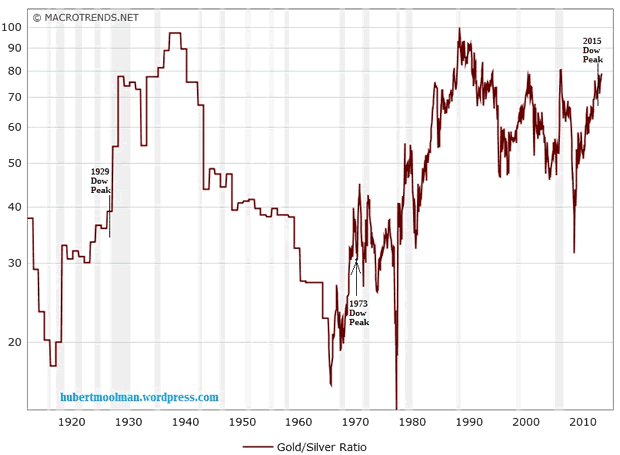

Below, is a long-term chart of the Gold/Silver ratio (from macrotrends.net):

Again, on the chart, I have marked three major Dow peaks (1929, 1973 and 2015). Notice how the 2015 Dow peak occurs closer to the peak in the Gold/Silver ratio. In a previous article, I wrote about how the debt-based monetary system has created what I call a "mirror-effect", whereby silver is pushed down in value, to a similar extent as to which paper assets such as general stocks are pushed up in value.

Therefore, generally, the more undervalued silver is, the more overvalued the Dow is. A high Gold/Silver ratio is an indication that silver is undervalued (given that silver is around its most undervalued when this ratio is high).

So, the 2015 Dow peak occurred at probably the worst possible time relative to the Gold/Silver ratio. That is the worst possible time for the Dow and the best possible time for silver. This is especially true, given the likelihood that this ratio will crash towards the levels reached in 1980, in a straight-down path. In other words, silver will rise significantly, while the Dow will crash.

For more on this and this kind of fractal analysis, you are welcome to subscribe to my premium service. I have also recently completed a Silver Fractal Analysis Report as well as a Gold Fractal Analysis Report

Warm regards

Hubert

“And it shall come to pass, that whosoever shall call on the name of the Lord shall be saved”

http://hubertmoolman.wordpress.com/

You can email any comments to hubert@hgmandassociates.co.za

© 2016 Copyright Hubert Moolman - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.