Overnight Markets Struggling to Stay Flat

Stock-Markets / Financial Markets 2016 Jun 17, 2016 - 02:04 PM GMT Good Morning!

Good Morning!

The SPX Premarket is struggling to stay near yesterday’s closing price for the close of index options at the open this morning. Today is Quadruple Witching day, which has the probability of being very volatile.

ZeroHedge writes, “Traders are still stunned by the dramatic move in risk assets during yesterday's US session. As a reminder, at the lows for the day in the mid-morning Eastern Time, we saw the DAX at -1.81%, FTSE -1.13%, S&P500 -1.03%, US 10y yield 1.516% (lowest since August 2012) and GBPUSD 1.401. By the various closes these rallied to -0.59%, -0.27%, +0.31%, 1.580% and 1.420 respectively!

What changed?”

Did the news affect the market, or Vice-Versa? Or was it a pure coincidence that the press had to use to explain the Wave action?

In any event, we may still see some positive action this morning as the Wave structure appears incomplete.

Although the 60-minute and 2-hour charts do not agree with the data, the pattern suggests completion to the upside and near-completion in the retracement.

VIX ETFs are positive in the overnight market, suggesting that buying has resumed.

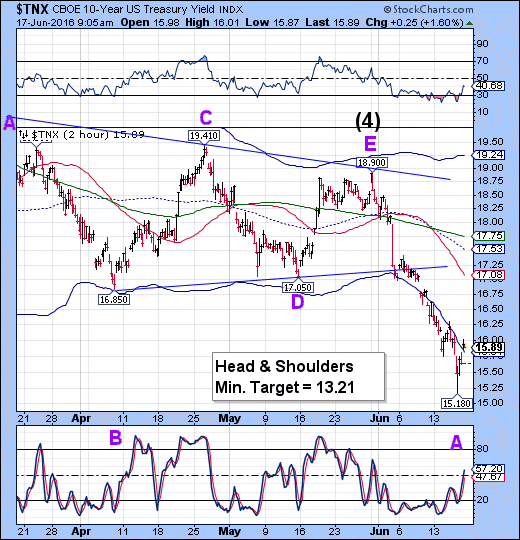

TNX extended its retracement this morning. However, the oversold condition may be relieved enough for a reversal at any time. TNX must be monitored for its reversal, since it may be a leading indicator for equities.

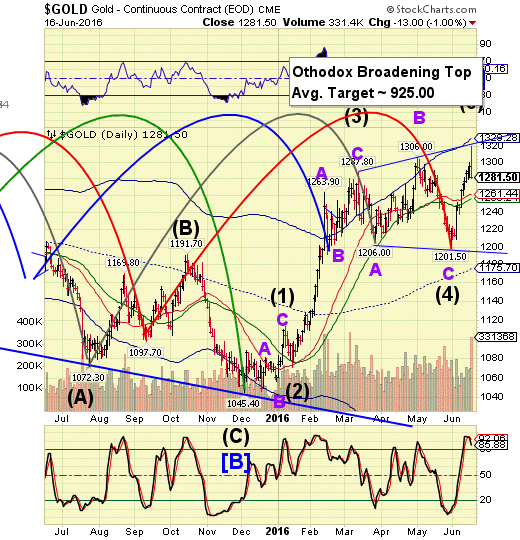

Gold reached its target and began its reversal yesterday. There is a bounce that may be taken as an aggressive short entry on gold. It appears that commodities may also decline along with equities. It is also expecting to see a Master Cycle low near the end of the month.

Crude oil appears to be bouncing from its 50-day Moving Average at 46.14 this morning. It may retrace as high as its Intermediate-term resistance at 47.75. Then its game over for crude as well. Short entries may be taken at the highest retracement that you are comfortable with. It may not last.

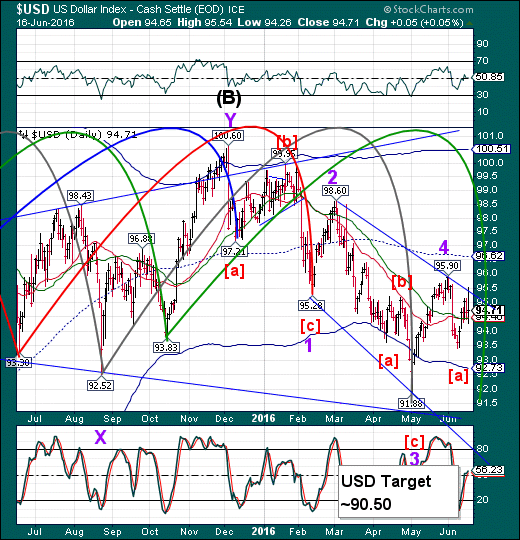

USD appears to have dropped beneath its 50-day Moving Average at 94.46 this morning, suggesting the decline has resumed.

USD/JPY continues its decline to match the low seen on August 23, 2014. This is proving to be a liquidity drain on the markets.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.