FTSE Soars, Stock Markets Bounce on LEAVE Polls Surge, Bookmakers Widen BrExit Odds

Stock-Markets / Stock Markets 2016 Jun 20, 2016 - 12:32 PM GMTBy: Nadeem_Walayat

The first string of opinion polls following the killing of Labour MP Jo Cox apparently in the name of "Freedom for Britain" or "Britain First" have now swung markedly in REMAINs favour, reversing an earlier LEAVE polls lead with REMAIN now marginally ahead on 45% against LEAVE on 42% with 13% Don't Knows as the following list of recent polls illustrates that until the killing of Jo Cox LEAVE had been in the lead but now have LOST that lead due to the actions of a radicalised right-wing extremist.

The first string of opinion polls following the killing of Labour MP Jo Cox apparently in the name of "Freedom for Britain" or "Britain First" have now swung markedly in REMAINs favour, reversing an earlier LEAVE polls lead with REMAIN now marginally ahead on 45% against LEAVE on 42% with 13% Don't Knows as the following list of recent polls illustrates that until the killing of Jo Cox LEAVE had been in the lead but now have LOST that lead due to the actions of a radicalised right-wing extremist.

REMAIN's poll surge is further backed up by the bookmakers where for instance Betfair's odds in favour of REMAIN have now vastly improved from 1.6 to 1.30. Whilst LEAVES odds have widened from 2.60 to 4.2, again reversing earlier momentum in favour of LEAVE that now gives Brexit an implied probability of just 20% and thus conversely REMAIN on an implied probability of 80%, which in trading markets terms is VERY HIGH, an 80% probability for a particular outcome is VERY, VERY HIGH. For instance where market positions concerned I tend to commit to a particular direction on probabilities starting from about 60%. So a 80% probability implies that BrExit is now looking VERY unlikely.

So it is no wonder that the stock market is soaring, reversing Junes weakness with the FTSE currently up 2.77% at 6188, not because REMAIN will be better for Britain than a LEAVE referendum outcome but because it would remove a major factor for uncertainty for at least the next 2 years and probably 5 that the markets had been discounting by marking stock prices lower. Uncertainty nearly always tends to result in markets discounting stock prices lower, whilst certainty tends to result in market premiums, regardless of whether the factor is in the long-term best interests of a market or not (usually the case, but not always).

And its not just the FTSE that's soared for the relief rally is taking place right across europe that have typically put on upwards of 3%, which should not come as much surprise as BREXIT would cost the European Union far more in terms of instability than for Britain. This also suggests to expect a similar strong move from the Dow when Wall Street opens in a few hours time that I am sure will lift european markets higher still, so we may see the FTSE close up more than 4% today!

Dax +3.39%

Dax +3.39%- CAC +3.3%

- MIB +2.7%

- IBEX +3.1%

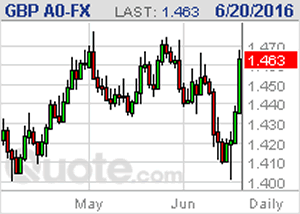

And the stock markets are not rallying on their own as the British Pound has also leapt higher by 1.7% to stand at 1.463, near its recent trading high of 1.47, though the GBP has been in a tight range of 1.47 to 1.40 for much of this year. Crude oil is also higher on discounting greater european demand as a result of diminishing BrExit risks.

See my latest video on how the killing of Jo Cox has impacted the EU Referendum campaign, and if LEAVE / BREXIT can recover it's lost lead by Thursday 23rd June.

VOTE FOR FREEDOM on June 23rd - BrExit Campaign

The sum of my analysis of the past year comprising more than 120 articles and over a dozen videos concludes that LEAVE is in the best long-term interests of the British people. Therefore with just 3 days to go until voting day and opinion polls still relatively tight then it's a case of now or never for Brexiteers! You too can help towards achieving a LEAVE victory by supporting our BrExit campaign in this final push towards attempting to secure Britain's long-term future free from an emerging european superstate that IS destined to FAIL.

By Nadeem Walayat

Copyright © 2005-2016 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.