Stock Market Rally Runs Out of Steam

Stock-Markets / Stock Markets 2016 Jun 29, 2016 - 04:38 PM GMT If you look closely at the low, you will see a double bottom. The first is at 1991.72 and the second is at 1991.68. I have concluded that the second low is a Wave [v]. It is unusual to have that small a new low to make a wave, but no rules are broken and the pattern fits. That suggests Wave 2 may be complete or nearly so.

If you look closely at the low, you will see a double bottom. The first is at 1991.72 and the second is at 1991.68. I have concluded that the second low is a Wave [v]. It is unusual to have that small a new low to make a wave, but no rules are broken and the pattern fits. That suggests Wave 2 may be complete or nearly so.

The 61.8% Fib calculation is 2066.85, so that retracement is accomplished. In addition, Short-term resistance at 2068.05 has also been reached.

ZeroHedge reports, “Most Shorted" stocks are up a stunning 4.3% today. This is the biggest single-day squeeze since 2011 with an almost 8% spike off Monday's lows...

Yuuge squeeze since Monday's lows...”

Barclays believes that massive redemptions are coming, “

"By our measures, aggregate equity positioning by active managers is again near post-crisis highs as the market braces itself for a potential acceleration in redemptions after the equity collapse. With cash levels at equity MFs fairly low and net cyclical sector positioning near the highs, we believe managers are unprepared for outflows and lengthy risk aversion. Although there is cash on the sidelines, the current environment of heightened uncertainty gives rise to a “buyer’s strike” as investors wait for a sufficient value cushion to open up before deploying precious dry powder. Finally, short interest has considerable room to rise across cash equities, ETFs and futures."

Bloomberg’s Mark Cudmore agrees.

VIX is pulling back as investors de-hedge. However, they may be missing the bigger picture. Brexit still hasn’t been properly priced in, default rates are rising (see here and here) and earnings reports are due next week, among a slew of other items that could jolt the market.

ZeroHedge reports, “A funny thing has happened below the surface of the markets since late last year. As first The Fed, then The BoJ, and The ECB respectively saw their credibility crushed into a mumbling excuse pool of elite utterances as global bond yields crashed along with global growth and inflation expectations, professional investors have been busily buying crash protection (carefully masking their buying by managing 'normal' risk measure like VIX through endless nefarious cash, ETF, and Futures manipulation). But now, a week after 'Black Swan' bets soared ahead of the central-plan-destroying Brexit vote, the real 'fear' index has spiked to unprecedentedly high levels.

With VIX flip-flopping to and fro at the whim of every fast money trader...”

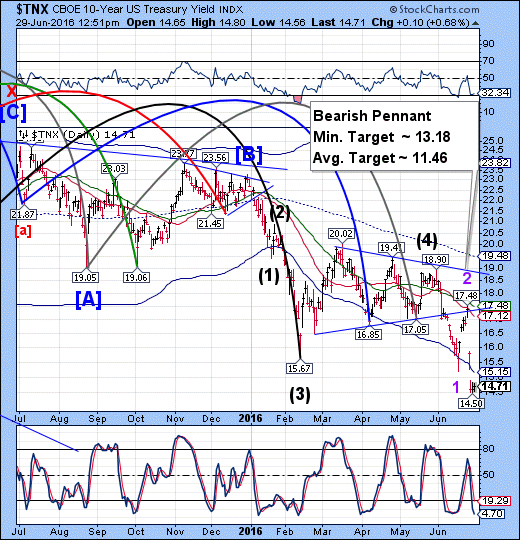

Finally, treasuries aren’t buying the rally.

ZeroHedge comments, “ow futures are now 500 points off the post-Brexit lows, having retraced half the losses...despite the worst home sales in 6 years. Just one small problem, Treasury yields are plumbing new post-Brexit lows...”

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.