US Housing Market Real Estate Mania Redux

Housing-Market / US Housing Jul 14, 2016 - 09:53 AM GMTBy: Clif_Droke

Among the biggest relative strength leaders in the U.S. broad market right now are the home builders and REITs. The U.S. real estate sector is heating up and is also beginning to attract “hot money” inflows from foreign investors looking for a profitable safe haven. Real estate is building a measure of momentum not seen since before the 2008 credit crash. As such, the question as to whether a renewed property market mania is underway is a timely one and will now be addressed.

Among the biggest relative strength leaders in the U.S. broad market right now are the home builders and REITs. The U.S. real estate sector is heating up and is also beginning to attract “hot money” inflows from foreign investors looking for a profitable safe haven. Real estate is building a measure of momentum not seen since before the 2008 credit crash. As such, the question as to whether a renewed property market mania is underway is a timely one and will now be addressed.

The following graph of the Dow Jones Equity REIT Index (DJR) illustrates the growing demand for hot properties. REITs in particular have been on a rip-and-tear of late as reflected in the chart. Ultra low interest rates and continued agency bond purchases by central banks have helped bolster real estate and the related equities, among other factors we’ll discuss here.

Investors should accordingly expect to hear more enticing stories about the desirability and investment potential of U.S. commercial and residential real estate in the months to come. One such story appeared in a recent Fortune.com article entitled, “How Brexit Could Make Your House Worth More.” The author, Chris Matthews, argues that Britain’s decision to leave the EU could mean higher real estate prices for the U.S.

According to Matthews, as the Brexit vote result sent U.S. Treasury yields tumbling it will also exert a downward pull on 30-year fixed mortgage rates. This in turn will make U.S. real estate more attractive to investors both foreign and domestic.

He also quotes KC Sanjay, an economist with Axiometrics, who said, “International investors have been increasing their holdings in the U.S. over the past several years, as they have gained a better understanding of the American apartment market and an appreciation of the sector’s profitability.” This means, says Matthews, that investors are primed to view the U.S. real estate market as a favorable alternative to the London market.

British property investors have indeed taken a blow in the wake of the Brexit vote. It was reported earlier this month that three financial firms stopped trading in their respective U.K. commercial property funds on the heels of a “rapid increase” in investors trying to sell their holdings. The move was cast by the financial press as a “temporary measure” to help avoid another credit event like the one seen in 2008. It further underscored the exodus out of overseas property holdings and the corresponding increase in U.S. real estate demand.

A further incentive for foreign investors to increase their financial exposure in the U.S. is provided courtesy of U.S. government rules easing the tax burden on foreign real estate investments. A non-U.S. investor, for instance, can now own up to 10 percent of a REIT before incurring federal taxes. That percentage is up from 5 percent prior to the new rule being implemented in December 2015. As is normally the case, federal policy is paving the way for a future asset craze.

In a recent issue of The Campbell Real Estate Timing Letter (www.RealEstateTiming.com), real estate timer extraordinaire Robert M. Campbell points out that U.S. housing prices should continue appreciating based on several fundamental factors. Campbell notes that the current market is still appreciating at a vigorous inflation beating pace of over 3% per year, and the data suggests real estate has continued upside potential.

He also points out that the momentum behind the CoreLogic Home Price Index increased by 6.7% year-over-year in March 2016. Momentum increases in this index have historically been followed by additional upside in U.S. housing prices in the months ahead. Moreover, the U.S. home ownership rate has plummeted to its lowest level since the 1960s as more and more Americans are renting. When adjusted for population growth, the supply of homes to rent hasn’t been keeping up with demand which means more units will have to be built. This is but one facet of the strong real estate sector performance this year.

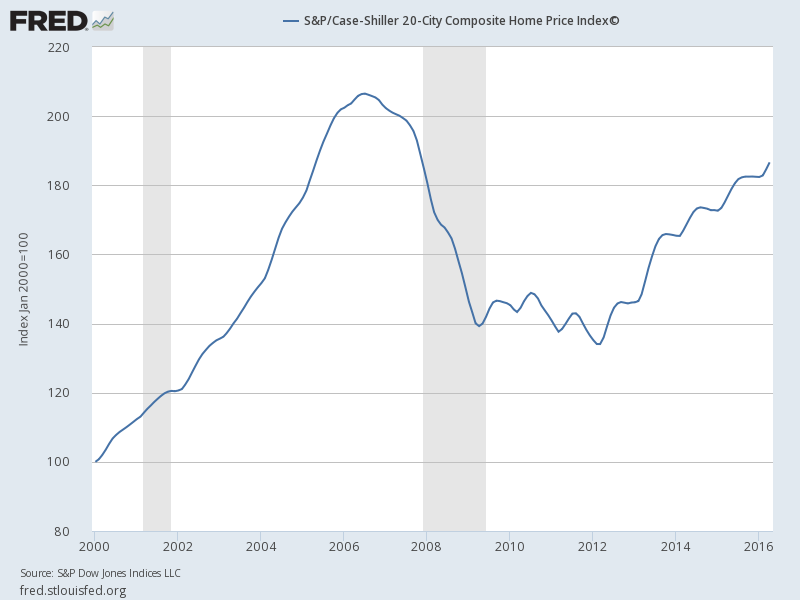

Most of the increasing demand for property is coming not from the middle class, as was the case in the previous real estate run-up, but from the upper middle class. The greed of gain and the inveterate tendency for the upper middle and upper classes to ostentatiously display their wealth is translating into a race to build the biggest house. This in turn is one of the driving forces behind the expansion in the U.S. residential real estate market. Below is a graph of the Case-Shiller 20-City Composite Home Price Index showing the steady increase in home prices since the 2010-2012 market bottom.

No socioeconomic class is immune from the inexorable pull of runaway greed, and no class ever fully escapes punishment from extreme greed. As the upper middle class emerged relatively unscathed from the housing bust aftermath, it remains for them to be drawn into the vortex of real estate mania before the next big housing bubble expansion and subsequent collapse occurs. In the end, they too will endure much the same fate as the U.S. middle class in the years since the last housing bust.

Kress Cycles

For the summer months only, the book “Kress Cycles” is available at a special discount to readers of this commentary. The book reveals the key to interpreting long-term stock price movement and economic performance, namely the famous Kress series of yearly and weekly cycles. This work was undertaken based on popular demand and was written in a style that casual readers and experts alike can enjoy and understand. The book covers each one of the weekly yearly cycles in the Kress Cycle series, from the 4-week through 120-week cycles and continuing through the 120-year Grand Super Cycle.

The book also covers the K Wave and the effects of long-term inflation/deflation that these cycles exert over stock prices and the economy. Each chapter is lavishly illustrated and explains in layman’s terms precisely how the cycles influenced stock market past performance and explains where the peaks and troughs of each cycle are located and how the cycles can predict future market and economic performance. Order your autographed copy today while supplies last:

http://www.clifdroke.com/books/kresscycles.html

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.