The Serious Warning No One’s Talking About

Stock-Markets / Financial Markets 2016 Jul 22, 2016 - 04:44 PM GMTBy: Casey_Research

By Justin Spittler

By Justin Spittler

On Tuesday, a huge event happened in the investing world.

But if you’re like most Americans, you probably haven’t even heard about it.

The mainstream media didn’t discuss this event much. It was too busy pointing out that the S&P 500 and Dow Jones Industrial Average have hit new all-time highs.

Meanwhile, something much bigger was happening on the other side of the world.

Today, we’ll tell you what this event was…and why it means big trouble is likely on the way for investors.

• Earlier this week, the Japanese yen plummeted…

It fell 1% over Monday and Tuesday.

This might not sound like a big deal. But it was the yen’s biggest two-day slide since November 2014.

Japanese Prime Minister Shinzo Abe triggered the plunge when he surprised the world with an announcement on Tuesday. Bloomberg Business reported:

The currency fell by more than 1 percent against all of its 31 major peers after Abe said he planned to add fiscal stimulus after his victory in last weekend’s upper house election. The premier indicated Tuesday he will order ministers to prepare plans for further measures aimed at supporting domestic demand.

According to The Wall Street Journal, “The prime minister is widely expected to compile a new spending package worth more than ¥10 trillion ($96 billion) in the autumn.”

“Further measures” could also include more monetary stimulus. Bloomberg explained:

BOJ [Bank of Japan] Governor Haruhiko Kuroda has repeatedly said the central bank won’t hesitate to expand stimulus. More than half of economists surveyed before the June meeting were predicting a move on July 29.

• Governments often use reckless monetary policies to try to stimulate their sluggish economies…

Since the 2008 financial crisis, desperate governments have printed trillions of dollars and cut interest rates to unnaturally low levels.

But if you’ve been reading the Dispatch, you know Japan is the worst offender of all. As we’ve explained, it has gone “all in” trying to stimulate its economy, even before Abe’s big announcement.

The BOJ is currently pumping 80 trillion yen ($671 billion) into Japan’s financial system each year through quantitative easing (QE). That’s when a central bank creates money from nothing and injects it into the financial system. QE is the modern-day version of money printing.

The BOJ also introduced negative interest rates in January. Regular readers know negative rates basically flip your bank account on its head. Instead of collecting interest on the money you keep in the bank, you pay the bank to look after your money.

In short, these "stimulus" measures haven't worked. Japan’s economy hasn’t grown since the 1990s. Its stock market is doing poorly too. The Nikkei 225, Japan's version of the S&P 500, is down 12% this year.

And now, it looks like the BOJ is about to do something even more drastic…

• Former Federal Reserve Chair Ben Bernanke met with Abe yesterday…

As you probably know, Bernanke ran the Fed from 2006 to 2014. Under his watch, the Fed cut interest rates to effectively zero. And he pumped $3.5 trillion into the U.S. financial system using QE.

According to Bernanke, there’s still a lot more the BOJ can do to jumpstart Japan’s economy. The Wall Street Journal reported:

Bernanke rejected the notion that the Bank of Japan is short of ammunition when he met with Prime Minister Shinzo Abe Tuesday.

Mr. Bernanke noted during the face-to-face meeting that Japan’s central bank still has a range of monetary easing measures at its disposal, according to Chief Cabinet Secretary Yoshihide Suga.

You may also know Bernanke by his nickname, “Helicopter Ben.” He earned this nickname in 2002 when he said Japan should use “helicopter money” to jumpstart its stagnant economy.

“Helicopter money” is a highly experimental government policy that involves handing people free cash. Until recently, most economists didn’t take it seriously. But just a few months ago, Bernanke wrote that “Helicopter money could prove a valuable tool.”

This has led many folks to believe that "helicopter money" is coming to Japan. The Wall Street Journal continued:

Mr. Bernanke visited Tokyo at a time of intense speculation that Mr. Abe may resort to so-called “helicopter money,” a radical form of monetary easing advocated by the former Fed chief…

Koichi Hamada, a close adviser to Mr. Abe, said Mr. Bernanke may have discussed helicopter money with Japanese officials he met with during his visit.

• Helicopter money won’t fix Japan’s economy…

It will only destroy the value of the yen.

That’s what happens when a central bank prints money. You end up with more paper currency chasing the same amount of goods and services. Everything from a gallon of milk to a new house costs more.

Consider what’s recently happened in Venezuela and Argentina. As we explained last month, these countries tried to jumpstart their economies using helicopter money. Both times, it sparked a full-blown currency crisis.

Inflation in Argentina is currently running about 40% per year. It’s even worse in Venezuela.

Last year, inflation in Venezuela hit a record high of 181%. And it’s only heading higher. According to the International Monetary Fund (IMF), inflation in Venezuela could skyrocket to 1,642% next year.

The same thing will happen to the yen if the BOJ continues to recklessly print money.

If you have money in Japanese bonds or yen, we encourage you to get it out as soon as possible.

• But Japan isn’t the only government you need to worry about…

Every major central bank in the world has gone overboard with easy money.

According to MarketWatch, central banks have cut rates more than 650 times since the 2008 financial crisis. They’ve “printed” more than $12 trillion.

Eventually, central bankers will destroy the paper currencies they’re supposed to defend.

That's why it's critical to own gold today, before it's too late.

As we often remind you, gold is real money. It’s preserved wealth for centuries because it has a rare set of attributes: It’s durable, easy to transport, and easily divisible. Its value doesn’t depend on a government or central bank. That’s why the price of gold often soars when governments do reckless things like print money.

This year, gold is up 26%. It’s trading at the highest level in two years. But it will likely head much higher. Casey Research Founder Doug Casey says gold prices could easily triple in the coming years.

To learn why, watch this short presentation. It explains why the world is in the early stages of a global currency crisis. By the end, you’ll understand why we’ve been pounding the table about gold so much recently. Click here to watch this free video.

Chart of the Day

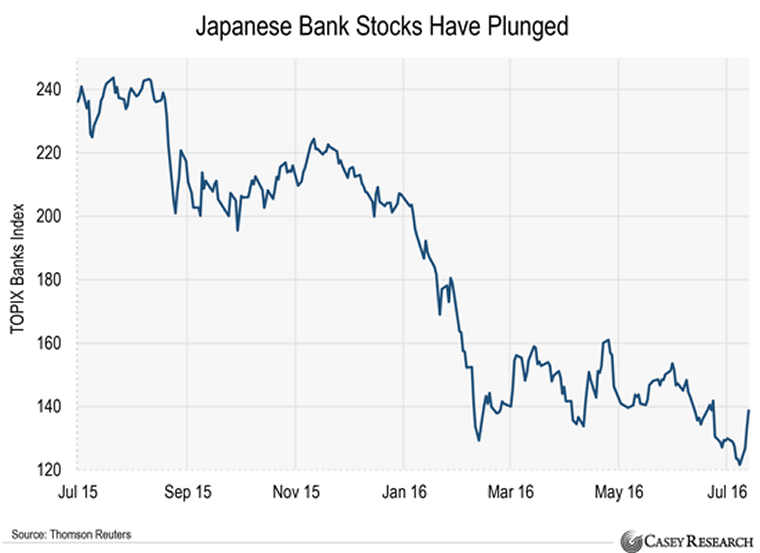

Japanese banks are trading like a major crisis is coming.

Regular readers know we watch bank stocks closely. That’s because banks are pillars of the global financial system. They keep money flowing through the economy. If they’re in trouble, it often means something is wrong with the financial system.

If you’ve been reading the Dispatch, you know that’s exactly what bank stocks have been saying lately. As we've shown readers, many of the world’s biggest bank stocks have crashed recently. Some are now in free fall. For example, Deutsche Bank (DB), Germany’s biggest lender, has plunged 52% over the past year. Swiss banking giant UBS (UBS) is down 56%.

This selloff has hit European banks the hardest. But, as you can see below, Japanese banks have crashed too.

Today’s chart shows the performance of the TOPIX Banks Index over the past year. This index tracks Japan’s biggest banks. You can see that it’s plunged 40% since last July. This tells us Japan’s banking system has serious problems…and it's another reason to be concerned about a global banking crisis.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.