The 45th Anniversary of The Most Destructive Event In Modern Monetary History

Interest-Rates / Financial Markets 2016 Aug 18, 2016 - 12:17 PM GMTBy: Jeff_Berwick

The US government, bankrupt yet again after another disastrous war of aggression, had its back pushed to the wall in 1971.

The US government, bankrupt yet again after another disastrous war of aggression, had its back pushed to the wall in 1971.

Up until that point, foreign central banks could redeem US dollars directly with the US Treasury in exchange for gold. And, recognizing that the US was essentially bankrupt, foreign central banks, especially France, began to demand gold instead of the dollar.

And then, on August 15, 1971, Richard “I’m Not A Crook” Nixon announced the monetary shot heard around the world.

He announced that due to the shadowy and intangible “money speculators” he would “defend” the dollar by removing its convertibility into gold “temporarily”.

It was, unquestionably, the most destructive event in modern monetary history… yet hardly anyone remembers it or knows about it.

Prior to 1971, the US government and Federal Reserve were restricted in the amount of debt they could go into and the amount of money it could print.

Afterwards, everything changed.

When discussing how massive of an event it was I often show long term historical charts on the market and the economy. Notice, EVERYTHING changed in 1971… and not for the better.

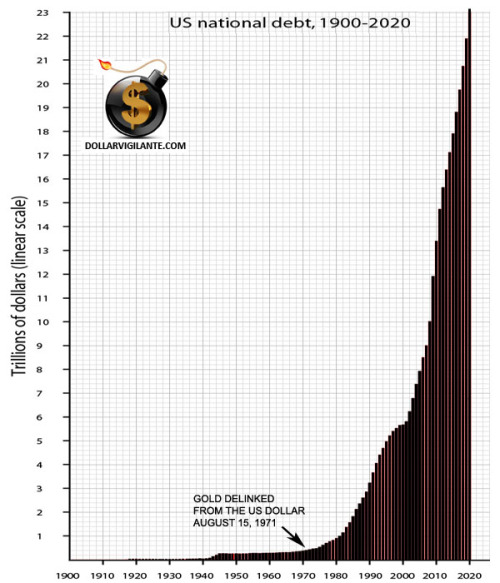

US GOVERNMENT DEBT

In 1970 the total US debt was $370 billion. On the chart below it seemed fairly tame up until 1971.

As of today it stands at $19.4 trillion.

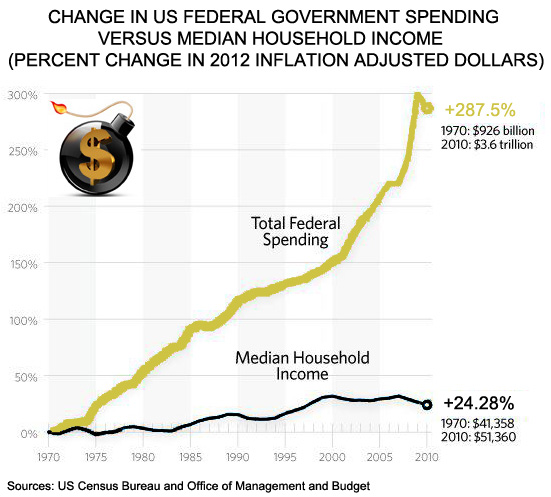

Back in 1971, government spending roughly rose at the same rate as median household income.

Quickly, after 1971, that link was broken as government spending has since grown nearly 300% in inflation-adjusted dollars while median household income has only risen 24%.

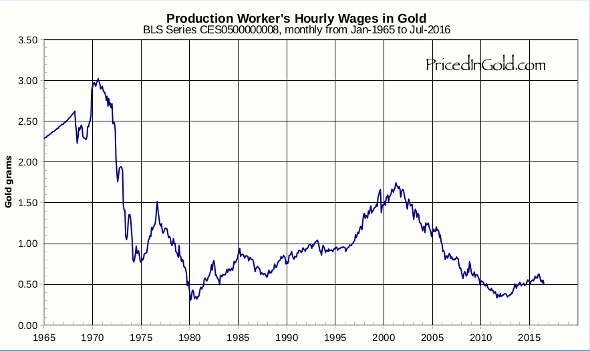

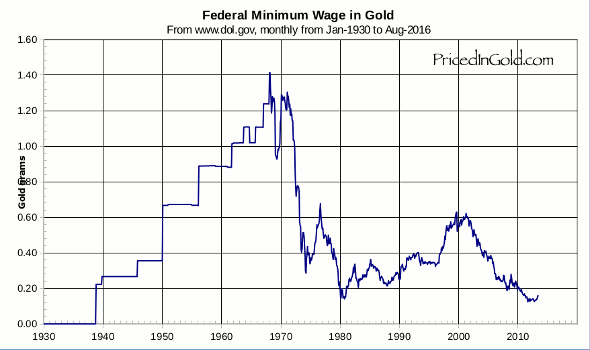

Since the US dollar has been rapidly falling since 1971 it is best to compare long term price charts to gold, rather than the dollar.

In gold terms, US wages have fallen dramatically since that ignominious year, 1971.

And the US is embroiled in a constant “minimum wage” debate as people in the US have found that they can barely survive at today’s minimum.

Little do many know, but if the US dollar was never taken off the gold standard, it would have been worth more than five times higher than today. That’s right. Today’s $7 minimum wage would be closer to $35/hour.

But, thanks to this one event, that has been buried by time and determined avoidance (certainly it’s not referred to in government indoctrination camps – schools – nor in the media), your average American has been massively impoverished.

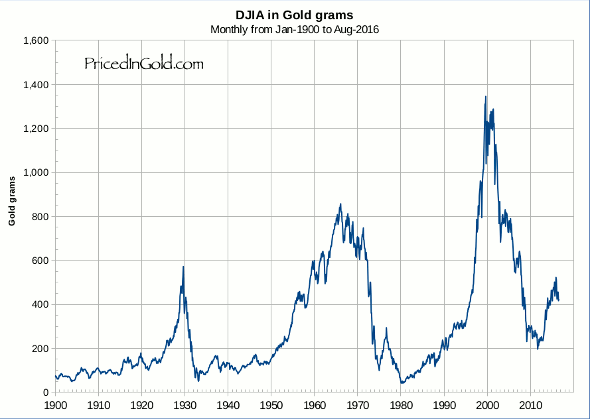

US stock markets are currently hitting all-time nominal highs and the media and government trumpets it as a victory. But it’s not.

When compared to gold, again, the US market went down dramatically after 1971.

It only reached new highs by 2000 when, after the internet became widely used, productivity increased massively.

But it’s been all downhill since then, and now the US stock market, when priced in gold, is at the same level it was at in the early 1970s.

And, here’s the kicker. It’s not over yet.

Central banks are now fully in charge of printing as much money as they want and manipulating interest rates to zero or below. Meanwhile, the US government, unrestrained by a gold standard, is going into obscene amounts of debt.

We are soon about to witness the end stages of what began in 1971: the complete and total collapse of the economy and the financial and monetary system as well.

The government isn’t going to tell you this. Nor is the mainstream media. Even your state-approved financial advisor has no idea what’s about to happen.

And, remember, the severance of the dollar and gold was no coincidence. It was, in fact, part of a larger, long-term movement to bring the dollar to its knees.

That movement is ongoing even now. Starting right around the end of the Jubilee Year at the beginning of October, the yuan is formally integrated into the IMF’s SDR currency basket. Also, the World Bank is beginning to issue international bonds denominated in yuan (RMB).

This is a further death knell for the dollar that people don’t fully understand. Eventually, shocked US citizens will discover they can no longer fund endless military aggression and wasteful social programs by simply printing more currency. This trend will be combined with the continued, agonizing dysfunction of the world’s economy and the Pentagon’s continued, endless agitation abroad.

If you want to read more about this upcoming scenario, please subscribe to our newsletter HERE. The latest issue, coming out tomorrow, goes into some detail about this scenario and what it means for you and your pocketbook.

And, again, to reemphasize, please note the yuan/SDR conversion is taking place right at the end of the Jubilee Year. This is no coincidence. We have shown conclusively that both celebratory seasons contain repetitive timelines that include economic, military and sociopolitical disasters. Until we pointed it out here at TDV, even the savviest investors were unaware of these repetitive, planned occurrences.

But now we understand them, and others do too – thanks to TDV analysis. We thus have advance warning of significant events and the damage that will occur as a result.

Please continue to read TDV blogs and consider acting on the information we provide, especially in the newsletter. You need to take it upon yourself to protect your assets, and even profit from the coming collapse.

Everything changed on August 15, 1971… and it’s all about to change again. Be prepared.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2016 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.