Bank of Ireland to Charge for Placing Cash on Deposit

Interest-Rates / Negative Interest Rates Aug 22, 2016 - 05:48 PM GMTBy: GoldCore

Deposits at Bank of Ireland are soon to face charges in the form of negative interest rates after it emerged on Friday that the bank is set to become the first Irish bank to charge customers for placing their cash on deposit with the bank.

Deposits at Bank of Ireland are soon to face charges in the form of negative interest rates after it emerged on Friday that the bank is set to become the first Irish bank to charge customers for placing their cash on deposit with the bank.

This radical move was expected as the European Central Bank began charging large corporates and financial institutions 0.4% in March for depositing cash with them overnight.

Bank of Ireland is set to charge large companies for their deposits from October. The bank said it is to charge companies for company deposits worth over €10 million.

The bank was not clear regarding what the new negative interest rate will be but it is believed that a negative interest rate of 0.1 per cent will initially be charged to such deposits by Ireland’s biggest bank.

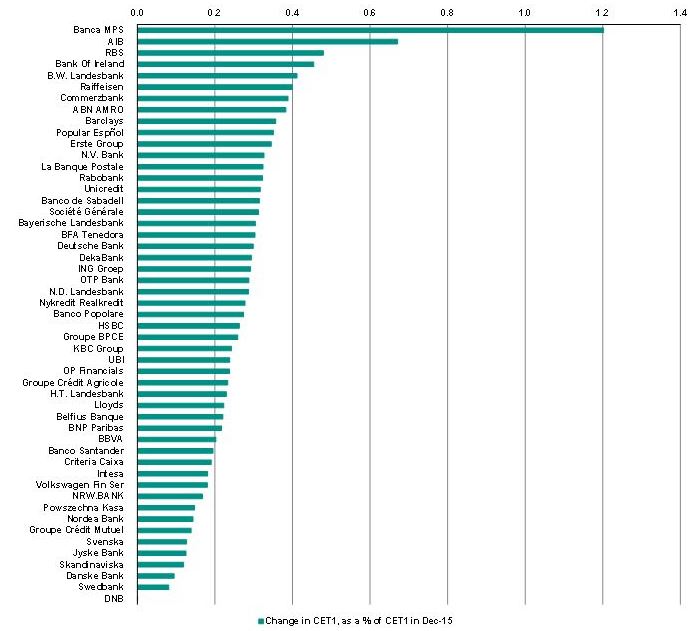

BOI was identified as one of the most vulnerable banks in Europe in the recent EU stress tests – along with Banca Monte dei Paschi di Siena (MPS), AIB and Ulster Bank’s parent RBS. All the banks clients, retail, SME and corporates are unsecured creditors of the bank and exposed to the new bail-in regime.

Only larger customers will be affected by the charge for now. The bank claims that it has no plans to levy a negative interest rate on either personal or SME customers but negative interest rates seem likely as long as the ECB continues with zero percent and negative interest rates. Indeed, they are already being seen in Germany where retail clients are being charged 0.4% to hold their cash in certain banks such as Raiffeisenbank Gmund am Tegernsee.

The news came days after it emerged that FBD, one of Ireland’s largest insurance companies, have been moving cash out of Irish bank deposits and into bonds. Fiona Muldoon, the FBD CEO cited extremely low returns on deposits and bail-ins as the reason they were withdrawing cash from Irish banks and diversifying into corporate and sovereign bonds. Muldoon said as reported by the Irish Independent that

“As they mature, and as the bank bail-in rules come into play, it’s no longer the case that for corporate investors depositing at a bank is risk free,” she added.

“To be honest, the return is abysmal now. We’ve gone back to a more typical investment portfolio for an insurance company.”“You have to be paid for the risk you take,” she added. “You might entertain the bail-in risk if you were being properly paid. But if you’ve a bank trying to charge you for leaving your money with them, you’re not inclined to take any risk at all.”

The monetary policies being pursued by the ECB and other central banks is making deposits, banks and the banking system vulnerable. Central bank policies are contributing to individuals and companies withdrawing deposits from banks which is making already fragile banks even more fragile.

It is important to note that while there are “deposit guarantees” in place in most jurisdictions in the EU, these guarantees are only as good as the solvency of the nation providing them. Many nations in the EU remain insolvent or at least border line insolvent. Thus, the deposit guarantee level of €100,000 in many EU states and £75,000 in the UK is likely to be arbitrarily reduced to lower levels in the event of deposit “haircuts” in the next banking and financial crisis.

Prudent retail, SME and corporate clients are realising the increasing risks facing their deposits. They can no longer afford to simply leave their deposits in a single bank account or indeed even in a few bank accounts. Diversification into other assets, including an allocation to physical gold, is becoming an important way to hedge the risks posed by negative interest rates and bail-ins.

Gold Prices (LBMA AM)

22Aug: USD 1,334.30, GBP 1,018.20 & EUR 1,181.26 per ounce

19Aug: USD 1,346.85, GBP 1,026.30 & EUR 1,189.67 per ounce

18Aug: USD 1,347.10, GBP 1,023.93 & EUR 1,190.84 per ounce

17Aug: USD 1,342.75, GBP 1,031.23 & EUR 1,191.96 per ounce

16Aug: USD 1,349.10, GBP 1,039.89 & EUR 1,197.33 per ounce

15Aug: USD 1,339.20, GBP 1,037.21 & EUR 1,198.85 per ounce

12Aug: USD 1,336.70, GBP 1,032.60 & EUR 1,199.02 per ounce

Silver Prices (LBMA)

22Aug: USD 18.91, GBP 14.45 & EUR 16.74 per ounce

19Aug: USD 19.42, GBP 14.80 & EUR 17.14 per ounce

18Aug: USD 19.78, GBP 15.04 & EUR 17.47 per ounce

17Aug: USD 19.57, GBP 15.04 & EUR 17.37 per ounce

16Aug: USD 20.04, GBP 15.43 & EUR 17.77 per ounce

15Aug: USD 19.90, GBP 15.40 & EUR 17.81 per ounce

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.