Why Putin Might Be on His Way Out

Politics / Russia Aug 25, 2016 - 03:49 PM GMTBy: John_Mauldin

BY GEORGE FRIEDMAN : Russian President Vladimir Putin recently did three very interesting things.

BY GEORGE FRIEDMAN : Russian President Vladimir Putin recently did three very interesting things.

First, he fired his long-time aide and chief of staff, Sergei Ivanov, and moved him to a lower position. A few weeks earlier, Putin fired at least three regional governors and replaced them with his personal bodyguards.

Removing that many governors is a bit odd. Replacing them with bodyguards is very odd. Then removing someone like Ivanov is extremely odd.

Second, Russia raised pressure on Ukraine. The Russians claimed that Ukrainian special forces attacked Russian-held Crimea. They announced that they sent S-400 anti-air missiles to Crimea. With a 250-mile range, these missiles can reach deep into Ukraine.

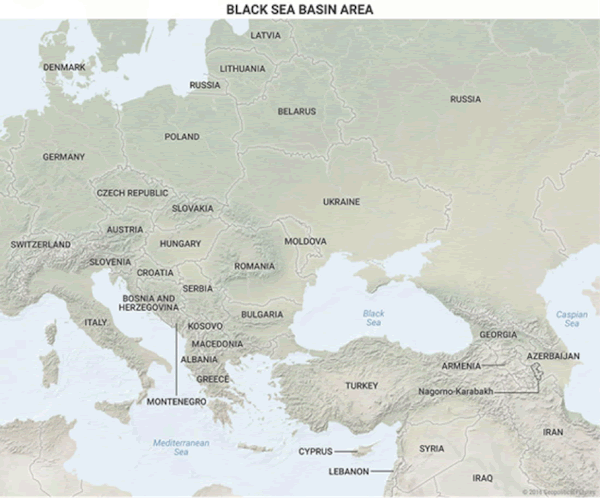

Finally, Putin has shown some signs that he may force Armenia to return parts of Nagorno-Karabakh, a contested region, to Azerbaijan.

Armenia is hostile toward Turkey over what it calls the Armenian genocide and Turkey’s refusal to apologize for it. Armenia is historically a close Russian ally, and Russian troops are stationed there.

After Turkish President Recep Tayyip Erdoğan’s visit to Moscow, Putin met with Armenian President Serzh Sargsyan and gave him the news.

This is a radical change in Russian policy .

Putin is now seen as an aggressive absolute dictator making large foreign policy concessions at the expense of close allies—for what seems like no visible gain. But the truth has always been far more complex.

Now, it is even more convoluted.

Putin's two major problems

Putin has two huge problems.

I have already written about how Russia’s economy has been in free-fall since oil prices dropped. Russia recently released its Q2 GDP estimate that showed a slowing in economic contraction. That is good news, in a way.

The second problem is Putin’s failure in Ukraine. The West sees him as the aggressor, and he was. Yet, the tale began with Western-backed protesters ousting a pro-Russian government and replacing it with a pro-Western one.

Putin seized formal control of Crimea even though Russia had broad informal control through its large military presence. He tried to incite an uprising in eastern Ukraine but failed. The Russian-backed rebels were forced to a stalemate by Ukrainian troops. Putin became aggressive after he suffered a grievous reversal in Ukraine, but it didn’t get him what he wanted.

In Russia, the sense of a national security threat eclipsed the economic crisis. At first, such threats spawn huge support for a country’s leader (the same is seen in the US). But, support fades over time when no solutions are found.

It has been two years since the twin crises happened. Putin’s support will inevitably erode.

Two layers of support

Putin has two layers of support.

One is public opinion. This is not trivial, but in the end, not decisive. The other is the elite, which in Russia consists of oligarchs and the intelligence apparatus. During the collapse of the Soviet Union, these two groups meshed in a way that benefitted both.

There is a great deal of infighting in these groups, and Putin has cracked down on some oligarchs who were seen as a threat to his power. Structurally, though, there is a coalition of elites in Russia to whom Putin must answer.

Boris Yeltsin—Putin’s predecessor—was deposed by a coalition of elites because he allowed the economy to virtually disintegrate and the US to embarrass Russia during the Kosovo war.

Putin was elevated to leadership to fix the economy and restore Russia as a great power. For Russians, this means a great deal. They remember what Stalin’s lack of preparedness in World War II did to them.

Questionable loyalties

It is now 2016, and the elites—and increasingly the public—are realizing that the economy is not going to recover.

They know that slowing the economic decline is the best they can hope for. They also realize that Ukraine has not been secured, and that the grand foray into Syria has become a stalemate.

The Russian situation was much better in 2013. There was no reason to question Putin’s leadership. What lurked under the surface could be ignored. But today, the wealthy are hurting.

This is not to say that Putin is without power. He has a strong network of supporters, money, control of the security services, and so on. His problem is that the Russian elite is uneasy, and loyalties can shift. It is not paranoia to be uncertain about who remains loyal and who is plotting.

Putin is not nearly as powerful as Erdoğan, so using a coup to purge the entire country isn’t going to work because it might succeed.

Explaining Putin’s moves

Putin can act on two principles. When he detects a threat, he can move against it very quickly. Or if he doesn’t detect a threat, he can assume one still exists.

In that case, he would destabilize a potential threat by removing key players. Whether they were an actual threat or not doesn’t matter.

Everyone else will wonder.

Further, Putin would replace former key players with people who never dreamed of attaining such a high rank. They know that if anything happened to Putin, they would be return to the cold.

That explains the firings and replacements. I think that Putin knows there is a threat but is uncertain of its origin. His actions are a way to declare that he knows more than he actually does.

That will not be enough.

He must do something substantial, and that can only happen in the area of national security. He has been courting China for a significant alliance, but the Chinese don’t see how Russia can help them.

The coup in Turkey—and Erdoğan’s apology for the downing of a Russian jet—opened the door for him. A strategic alliance with Turkey would disrupt the American containment policy and allow Russian influence in the Middle East to surge.

Putin needs to convince Erdoğan to enter into an alliance. As a down payment, he offered Armenia’s national interests. I doubt that Erdoğan is buying, but he will use it to extract concessions from the Americans.

Putin must also address his Ukraine problem, and that is precisely what he is doing.

In my view, the Russian military is still not in a position to move into and occupy Ukraine, even without resistance. And Putin knows it is not a slam dunk.

His actions create the image of confronting the Ukrainians. It could mean war, as I might be wrong about either Russia’s military or Putin’s eagerness. But I think it is a prelude to negotiations.

Putin wants a neutral Ukraine, without Western weapons or guarantees. If Putin can force a negotiation and come away with a concession, it will do wonders for his image.

In the meantime, Putin looks good in Russia when he really needs to shine.

Putin should survive until 2018

Putin’s personal future is of little consequence. Whoever replaces him will come from the same elite. Any newcomer will face the same problems and lack of options.

And this is Putin’s highest card.

The prize for anyone who topples him is to become the leader of a country in deep economic and strategic crisis. It would be much easier to let Putin carry the blame (and what little glory he can extract).

But, this is where Putin’s pre-emptive moves on personnel become dangerous. He may convince powerful people that they are in danger, forcing them to defend themselves.

I think that Putin will survive until the end of his elected term. But fear makes politics unpredictable, and geopolitical analysis doesn’t work on the thinking of worried men drinking vodka to calm their nerves.

Join 250,000 readers of George Friedman’s Free Weekly Newsletter

George Friedman provides unbiased assessment of the global outlook—whether demographic, technological, cultural, geopolitical, or military—in his free publication This Week in Geopolitics. Subscribe now and get an in-depth view of the forces that will drive events and investors in the next year, decade, or even a century from now.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.