Gold’s strong summer may be harbinger of things to come

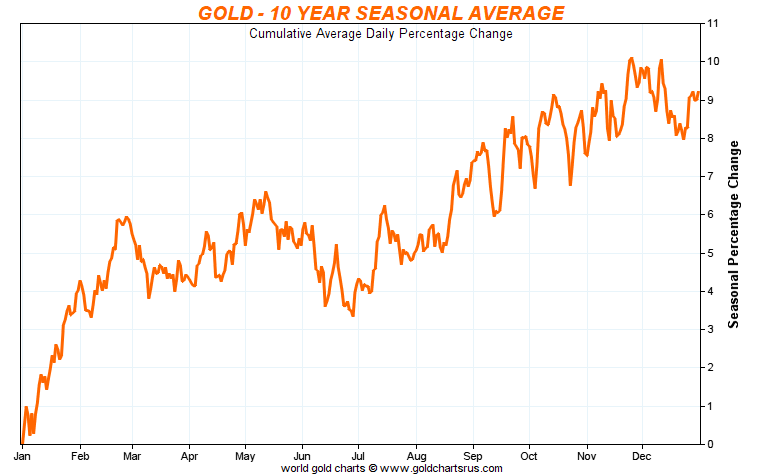

Commodities / Gold and Silver 2016 Aug 31, 2016 - 12:48 PM GMT We are now wrapping up one of the stronger summers in memory at USAGOLD and heading into the strongest time of year seasonally for gold and silver – September through February. Normally the summer months are the quiet part of the year, but 2016 has been an exception. The price of gold is up 9% since the beginning of June and silver over 18%. ETF gold inventories reached highs in July and August not seen since 2009, the year after the collapse of Lehman Brothers and the launch of the so-called credit crisis. Some see the stronger than usual summer showing for the precious metals markets as a harbinger of things to come.

We are now wrapping up one of the stronger summers in memory at USAGOLD and heading into the strongest time of year seasonally for gold and silver – September through February. Normally the summer months are the quiet part of the year, but 2016 has been an exception. The price of gold is up 9% since the beginning of June and silver over 18%. ETF gold inventories reached highs in July and August not seen since 2009, the year after the collapse of Lehman Brothers and the launch of the so-called credit crisis. Some see the stronger than usual summer showing for the precious metals markets as a harbinger of things to come.

Credit Suisse, for example, forecasts gold will be trading in the $1475 range in the fourth quarter of 2016, and see $1500 in the early part of 2017. Similarly, Deutsche Bank’s commodity desk believes gold should be trading now in the $1700 range based on the top four central banks’ aggregate balance sheet expansion – some 300% since 2005.

A large grouping of analysts compare stocks now with the market in the 2007-2008 time frame. The primary reason for the deja vu is that all the major indices once again appear to have been elevated in a Fed-induced price bubble. The list of famous names warning of a severe correction is long and grows by the day and with each new record high.

It includes:

Bill Gross (Janus Funds)

Carl Icahn (Icahn Enterprises)

Paul Singer (Elliiott Management)

Robert Schiller (Yale University)

Russ Kostereich (Black Rock)

Ray Dalio (Bridgewater Associates)

Jeff Gundlach (Doubleline Capital)

Jim Cramer (CNBC)

David Stockman (former Budget Director)

Stanley Druckenmiller (Duquesne Capital)

Jacob Rothschild (RIT Partners)

. . . . . just to name a few. Even presidential candidate Donald Trump has joined the chorus of naysayers warning of a financial bubble.

Paul Singer, who was awarded this year’s Manager Lifetime Achievement Award by Institutional Investor magazine in New York, is one among a good many in the group just listed who advocate investing in gold. He warns that “the ultimate breakdown (or series of breakdowns) from this environment is likely to be surprising, sudden, intense, and large.” Earlier this summer, he announced “we’re very bullish on gold, which is the anti–paper money, of course, and is underowned by investors around the world.”

Similarly RIT Partners, run by Lord Jacob Rothschild, has raised its exposure to “other currencies [not the dollar], gold and precious metals.” “The geopolitical situation,” says Rothschild, “has deteriorated and the slowing down of economic growth will surely lead to problems. Conflict in the Middle East continues and growth remains anemic, with weak demand deflation in many parts of the developed world. In times like these, preservation of capital in real terms continues to be as important an objective as any.” The connection between the legendary Rothschild name and gold ownership runs deep in European history. It will not go unnoticed in the financial community that a prominent branch of the family has once again turned to gold for defensive purposes.

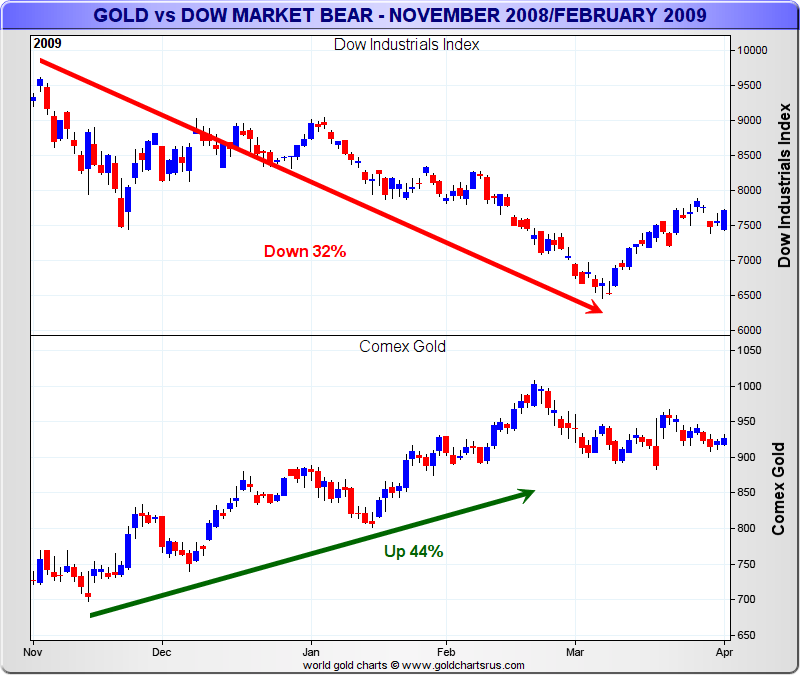

The 2007-2008 financial meltdown provides a good case study on diversification as a means to wealth preservation. $100,000 invested in stocks and stocks only in November 2008 would have been worth $68,000 by February of 2009. A $100,000 portfolio diversified with 30% gold (our top end recommendation) would have been worth $91,000 and that was at the $925 gold price in February 2009. As we all know, gold went substantially higher from there – all under continuing crisis conditions.

_______________________________________________

If you want to catch up on the gold market going into the Fall investment season, you might gain from the latest issue of News & Views – USAGOLD’s newsletter. In this month’s issue we cover a range of interesting topics including

What prompted France to send a battleship into New York harbor in the 1970s?

Why did Financial Times call gold “a shiny financial aspirin?”

What chart offers the rationale for $1700 gold?

What are the year’s biggest winners and losers through August 2016?

What did Keynes have in common with Copernicus?

What is the Quiet Crisis brewing in financial markets?

And more. . . . . . . . . .

We invite you to register here. Complementary subscription. Immediate access. Your participation is welcome.

NEWS & VIEWS

Forecasts, Commentary & Analysis on the Economy and Precious Metals

In-depth, cutting-edge coverage of the gold and silver markets for over 25 years. 20,000+ subscribers.

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.