SPX May have made its Reversal

Stock-Markets / Stock Markets 2016 Sep 07, 2016 - 05:13 PM GMT Good Morning!

Good Morning!

Today is proposed to be a Trading Cycle pivot day, so this may be what we have been looking for.

This decline may go directly to the belly of the Beast, as Wave (3) of [1] appears to be capable of making a Primary Cycle low on or around September 21. Primary Cycles are often awe-inspiring in their strength and breadth. This is also the decline into point 8 of the Orthodox Broadening Top, which is often a panic low.

There is also a Pi Date on September 25 (the following Sunday). If so, it may extend into the first hour of Monday the 26th, to make a 12.9 day decline.

The bubble is out in the open, for all to see. ZeroHedge reports, “Unlike Morgan Stanley's Adam Parker, who yesterday opted to flip back from bearish to bullish after previously berating and mocking those would blindly buy this "market" (even as he boosted his target S&P500 P/E multiple from 18x to 19x in the "bullish" case), one of our favorite junk bond analysts, BofA's Michael Contopoulos refuses to throw in the towel. Instead, he continues to watch in quiet amazement at what is taking place in the "market", where even Bloomberg has now admitted that "Mario Draghi is creating a monster credit bubble, and he doesn't seem to care. In fact, that seems to be his goal."

VIX also appears to have completed its retracement. A rally above 12.93 – 13.27 gives us a confirmed buy (SPX sell) signal. However, urging you to go short on Friday does not appear to have had any strong repercussions.

Things may become more impulsive, especially after the 50-day Moving Average is crossed in the VIX as well as SPX.

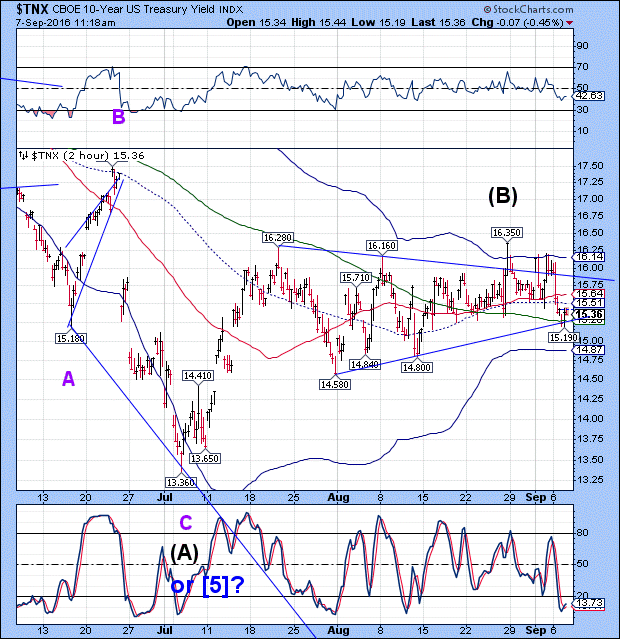

TNX appears capable of a bounce, but it is sorely overdue for a Master Cycle low. Today is day 271, 13 days beyond the average time allotted for a Master Cycle. The outer limit (17.2 days over) would also be early Monday morning.

If my Wave structure is correct, it may decline to as low as 10.81 in the next few days. The alternate view is that it may fall short of the July 8 low at 13.36. However, Triangle formations don’t usually form in Wave 2s.

The converse of this is that USB may break out to an all-time new high, should TNX make the targeted low mentioned above. Hot on its heels, USB is scheduled to make its Master Cycle low during the week of September 26. This may be very chaotic, to say the least.

In short, Treasuries may not be the safe haven they were once thought to be.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.