UK Government Surrenders to China / France to Build Nuclear Fukushima Plant At Hinkley Point C

Politics / Nuclear Power Sep 19, 2016 - 12:41 PM GMTBy: Nadeem_Walayat

Theresa May's government has once more shown its inherent weakness where after putting the French / Chinese Hinkley Point C nuclear build on hold in July has now backed down under Chinese threats of withholding investments by giving the go ahead to build a nuclear reactor that had never been proven to actually work with potentially disastrous consequences for our small densely populated Island.

Theresa May's government has once more shown its inherent weakness where after putting the French / Chinese Hinkley Point C nuclear build on hold in July has now backed down under Chinese threats of withholding investments by giving the go ahead to build a nuclear reactor that had never been proven to actually work with potentially disastrous consequences for our small densely populated Island.

Britain is not Russia, or rather the Ukraine with enough land mass to move whole cities from nuclear wastelands, a nuclear disaster on the scale of Chernobyl or Fukushima would mean Britain can say good bye to its place in the world, and be further diminished to the history books with the last entry being on how Hinkley point was the final nail in Britain's coffin. Where even in a best case scenario Britain could expect cancer rates to soar as a consequence of waste seepages and spills.

And this is even before one considers the security aspects of effectively of giving the chinese totalitarian state (that is busing building a fleet of aircraft carriers that it seeks to launch every other year, to sail the worlds ocean and increasingly making its imperial presence felt as it competes against the Anglo- American empire) a kill switch on Britain's economy by means of its electricity supply would be a great strategic move for China and if the cold war between the US and China ever hot's up then so would the Somerset coast!

The Chinese threat is already making its presence felt in the South China Sea and beyond.

Apparently it had not dawned on the likes of MI5 that China would literally have built in a kill switch to ensure Britain a decade or so down the road would become subservient to the emerging super power, or rather Axis powers of Russia and China that just over a decade from now would militarily out match the US and its allies such as Britain, heralding a new world order, and thus threats of protracted series of wars fought across the world towards which the Chinese empire will have successfully neutralised many of America's allies through infrastructure investment kill switches and infiltration.

The magnitude of the governments error is even more blatantly self evident when we look at the price the UK consumer will be paying for energy from the chinese / french nuclear power station. For instance today's whole sale price is £42 per megawatt hour, whereas the Hinkley price is fixed at £92.50 per mwh in TODAY's MONEY! Which means that it will rise in line with inflation for the first 35 years, so the price will always be MORE THAN DOUBLE today's market price in REAL TERMS! It's like going to a car dealer and instead paying the SALE price of £10,000, you pay £25k, MORE THAN DOUBLE even if the car does not work!

The cost of the nuclear plant has already ballooned from £6.8 billion to £30 billion which means by the time construction is complete it could yet double once more to over £60 billion. Which would translate into an EXTRA £100 cost added to every households electricity bill for 35 years!

Another example of the nuclear madness is that solar panels at an average cost of £4k, then £30billion would fund FREE solar panels for 7.5 million households that with an annual average output of 2000kwh would generate 15giga watt hours of energy per year which is against 25.5 gwh's from an operational Hinkley Point C, that is at the current estimated cost of £30 billion, if the costs double once more then that falls to an equivalent 12.5gwh's (£30 billion).

However another cost issue is that there is no plan for what will happen to all of the nuclear waste that will be produced ? Where will it go ? Nowhere, it will be kept on site so that whenever the next climate change storm comes around it will flood into the North sea, contaminating much of the North sea and the east English shore line, resulting in clean up costs that could potentially rival what the plant cost to build!

And remember that the reactor design being used is unproven i.e. a decade down the road they may conclude that it is unworkable and be forced to abandon and literally start from scratch at a huge waste in time and money. This is not an environmentalists point of view but direct from EDF board members, many of whom did not want the build to go ahead precisely because they have failed to successfully build the plants elsewhere (Finland and France) that have been under constriction from more than decade but still nowhere near completion due to a series of problems that keep cropping up such as failure of the reactor pressure level under tests, which means Hinkley Point even with Chinese investment could end up killing EDF as the plant definitely will over run the planned 10 year build as all others have and may even never work.

Therefore EDF risks bankruptcy whilst the UK consumer will pay DOUBLE the market rate should the plant be built, where the only winner will be China. So where EDF is concerned it boils down to internal French politics of wanting to develop a european monopoly on constructing nuclear power plants, regardless of whether they actually work.

Jobs creation is one of the trumpet calls for welcoming Chinese investment into cites across the UK such as Sheffield. And where Hinkley Point is concerned no one has mentioned the fact that many multiple of jobs than the estimated number of 25,000 would be created if the UK spent £30 billion on renewable's rather then today's estimated cost of building at Hinkley point, perhaps as many as 100,000 UK jobs, all without the consequences.

However what no one is asking jobs created for whom? British workers or thousands of Chinese workers brought over on work visa's? An economic invasion, for that is what the immigration statistics suggest is underway that apparently no one in the mainstream press is picking up on.

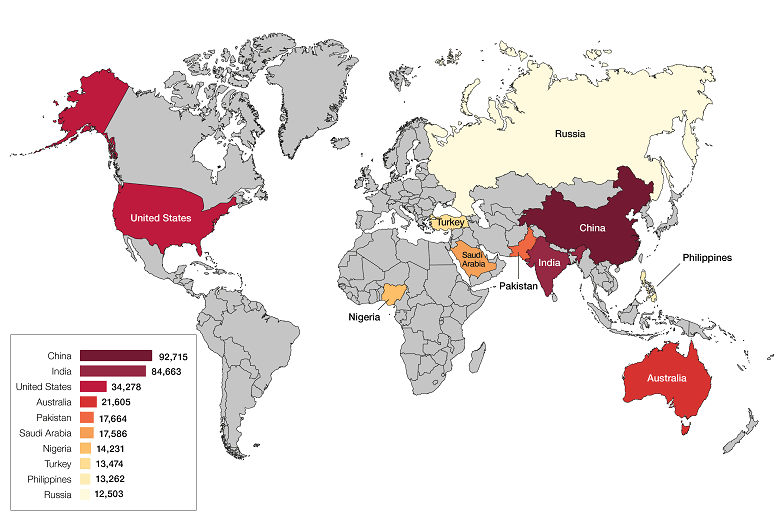

The latest ONS immigration statistics show that outside of the EU the greatest number of net migrants into the UK for permanent settlement are from CHINA as the following table illustrates which implies a stealth colonisation of Britain is in progress as part of the emerging Chinese economic and military super powers great game that few in the west are awake to the consequences of as the Chinese totalitarian state looks set to become increasingly more aggressive and demanding. So it won't be long before China starts to flex its muscles directly in the UK through attempts to stifle criticism of the actions of the Chinese totalitarian state and the great game of stealth colonisation it is playing right across the world as China carves out a Chinese Empire.

ONS Immigration Statistics

Net immigration +327k, EU +180k, Outside EU +190k, British citizens -43k. Note net outside EU immigration now exceeds EU immigration.

Study Visas

| Nationality | Study visa granted | % of total |

| Total | 204,859 | 100% |

| China | 70,194 | 34% |

| United States | 14,245 | 7% |

| India | 10,664 | 5% |

| Malaysia | 9,478 | 5% |

| Hong Kong | 9,069 | 4% |

| Other non-EEA nationalities | 91,209 | 45% |

Entry clearance visas

Nationality information on individuals that are subject to immigration controls, coming from non-EU countries.

The immigration statistics show that China has now over taken India as the greatest source of outside of EU migration into the UK, with 92kvisa's granted for settlement, which compares to 84k for Indians and 34k for Americans. This goes hand in hand with increased Chinese investment so as to create the demand for tens of thousands of work permit visas for Chinese citizens.

The bottom line is that Chinese investment into the UK is NOT good for Britain's future, for instance Britain would be far better served if the £120 billion extra spent annually employing millions of workers in China was spent on creating jobs for UK citizens. REAL investment is in building factories and businesses NOT Buying up property and land to develop into apartment blocks and amenities for thousands of imported chinese workers, that's called COLONISATION!

Therefore Chinese investment in the UK really IS a TROJAN HORSE that virtually all of our short-termist, only focused on the next election politicians remain completely blind to the long-term consequences of. What else should one expect from local Labour councilors in cities such as Sheffield awed by the big numbers, whilst completely blind to the great game being played by the new emerging Chinese Empire.

Though the China threat to Britain to date is nothing as compared to that which China poses to asian and African nations, as China has been buying up huge tracts of African lands at deep discounts from corrupt government officials and politicians that seeks to replicate the Chinese totalitarian ideology by stifling local dissent as China forges its own Imperial Empire that today only the nations of the South China sea truly understand the consequences of as each year China declares ownership of new territories following the building of artificial islands on corral reefs and then engages in battles in the shipping lanes of other nations such as Japan and the Philippines.

The South China sea confrontations have already triggered Japan to seek to rearm after 60 years of being demilitarised. In fact Japan's earlier technological investments with an opening China is one of the primary reasons why China has developed so fast, which the Japanese surely must now be regretting and realise as being the mother of all mistakes. A war is definitely brewing in the South China sea.

So what happens in a decade or so when China parks an aircraft carrier or two off the North Sea whilst it builds an artificial Island so as to claim territorial sovereignty, will the UK then find itself in a similar situation to the dozen or so nations today in the South China sea? After China will probably have approaching 3 million loyal chinese citizens stationed in the UK by then, ready to do its bidding.

Don't forget China IS a TOTALITARIAN STATE! And Britain WILL pay a heavy perhaps fatal price for doing deals with a TOTALITARIAN STATE! As BrExit from the emerging European Superstate morphs into Britain becoming subservient to the emerging Chinese Empire.

The bottom line is that China has been engaged in and winning an economic war against the west for over a decade! All whilst it's military might catches up with the U.S. which it is likely to do so by a decades time. And today's 'investments' in western nuclear projects, cities, power grids, and telecom sectors are part of the strategy for when China seriously starts to flex its military muscle. Especially as it won't be China vs the West, but rather the China / Russia Axis vs the West in inevitable resource wars triggered by climate change.

My next in-depth analysis will seek to map out a trend forecast for the stock market for the remainder of 2016, so ensure you are subscribed to my always free newsletter to get this in your email in box.

By Nadeem Walayat

Copyright © 2005-2016 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.