Jim Rickards: Trump “Will Probably Win” and Gold “May Rise $100” Overnight

Commodities / Gold and Silver 2016 Oct 28, 2016 - 04:47 PM GMTBy: GoldCore

The US election is just two weeks away on November 8th, and one of Hillary Clinton’s most vocal critics on the business side is finance commentator and monetary expert Jim Rickards. Jim is in Sydney this week, armed with his latest book, hot off the press entitled ‘The Road to Ruin – The Global Elites’ Secret Plan for the Next Financial Crisis’ and gave an interesting television interview to ‘The Business’ on ABC Australia.

Rickards says that Trump “will probably win” and, if he does, stock markets will crash 10% and gold will rise $100 over night.

The markets and polls believe Clinton will win and that is priced into markets in the same way that a ‘Bremain’ was priced into markets prior to the ‘Brexit’ vote.

Kilkenomics 2016 – Where Comedy Meets Economics

“If Hillary wins nothing happens, if Trump wins you will have an earthquake.”

Should Trump win, which looking at the polls is not an impossibility, gold would likely surge $100 per ounce overnight, says Rickards.

What Hillary did was appalling Rickards says in relation to the Hillary email scandal. There will be ‘another reckoning on November 8th’ which the market has failed to price in, creating a good scenario for gold. He says you don’t have to agree that Trump will win, but agree that that in reality he could win.

For Rickards, this is an excellent opportunity for investors, particularly those who have an allocation to physical gold which he believes is set to rise in the coming months and years.

Jim is editor of Strategic Intelligence for Agora Financial as well as the founder of the James Rickards Project: an inquiry into complex dynamics of geopolitics and capital. He is also the author of New York Times bestsellers The New Case for Gold, Currency Wars: The Making of the Next Global Crisis and The Death of Money: The Coming Collapse of the International Financial System.

Jim’s newest book, The Road to Ruin will be published in November and he is appearing at Kilkenomics 2016 where he will speak at a number of events.

Watch extended interview with Rickards on ABC Australia here

Kilkenomics was Europe’s first economics festival and is taking place November 10th (Thurs) to November 13th (Sunday) in beautiful Kilkenny, Ireland.

Often referred to as ‘Davos with jokes’, Kilkenomics brings together leading economists, financial analysts and media commentators with some of the funniest stand-up comedians around.

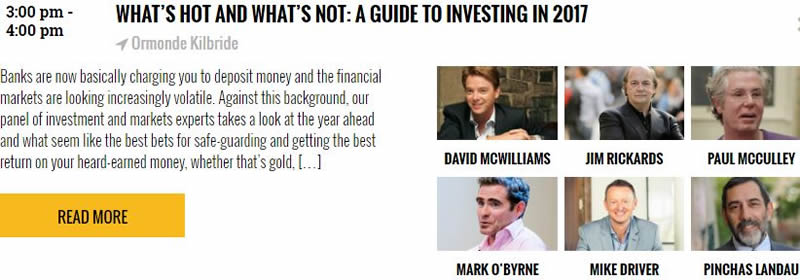

This year GoldCore are one of the sponsors and are speaking on a panel with Jim Rickards and David McWilliams, the founder of Kilkenomics, on the Saturday, November 12th at 3pm. Click here for more info:

A Guide to Investing in 2017

Excellent contributors this year include:

- Nicolas Taleb

- Paul McCulley

- Steve Keen

- Dan Ariely

- Dara Ó Briain

- Linda Yueh

- Wolfgang Münchau

- Bill Black

- Matthew Bishop

- Liam Halligan

Tickets are on sale now and will sell out fast. More information about the event and bookings can be made here

Buy tickets for Kilkenomics 2016

Gold Prices (LBMA AM)

28 Oct: USD 1,265.90, GBP 1,042.47 & EUR 1,160.96 per ounce

27 Oct: USD 1,269.30, GBP 1,038.29 & EUR 1,162.93 per ounce

26 Oct: USD 1,273.90, GBP 1,043.45 & EUR 1,166.13 per ounce

25 Oct: USD 1,269.30, GBP 1,037.53 & EUR 1,165.85 per ounce

24 Oct: USD 1,267.00, GBP 1,034.89 & EUR 1,163.61 per ounce

21 Oct: USD 1,263.95, GBP 1,033.79 & EUR 1,160.69 per ounce

20 Oct: USD 1,269.20, GBP 1,034.65 & EUR 1,156.75 per ounce

Silver Prices (LBMA)

28 Oct: USD 17.61, GBP 14.51 & EUR 16.13 per ounce

27 Oct: USD 17.66, GBP 14.41 & EUR 16.16 per ounce

26 Oct: USD 17.66, GBP 14.46 & EUR 16.17 per ounce

25 Oct: USD 17.73, GBP 14.49 & EUR 16.30 per ounce

24 Oct: USD 17.64, GBP 14.41 & EUR 16.19 per ounce

21 Oct: USD 17.51, GBP 14.34 & EUR 16.08 per ounce

20 Oct: USD 17.60, GBP 14.35 & EUR 16.03 per ounce

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.