Only Winners of the US Presidential Election Are…

Stock-Markets / Financial Markets 2016 Nov 11, 2016 - 05:49 PM GMTBy: Chris_Vermeulen

HSBC,(https://en.wikipedia.org/wiki/HSBC), is projecting gold to rise to $1,500 an ounce, since the ‘real-estate magnate’ triumphed up from behind in the election results (http://www.bloomberg.com/news/articles/2016-11-01/buy-gold-no-matter-who-wins-the-election-hsbc-says). It is protection against everything!

HSBC,(https://en.wikipedia.org/wiki/HSBC), is projecting gold to rise to $1,500 an ounce, since the ‘real-estate magnate’ triumphed up from behind in the election results (http://www.bloomberg.com/news/articles/2016-11-01/buy-gold-no-matter-who-wins-the-election-hsbc-says). It is protection against everything!

The U.S. Debt-to-GDP ratio is 125% and will be growing. ‘Main Street America’ has been told that these are measures required to stimulate economic activity, to prevent crises, increase employment, and soothe the financial markets.

There are those who believe that we can keep spending money that is not generated from economic growth by continued borrowing. This “mindset” believes that the debt does not have to be re-paid. It is this mentality that will make gold soar to new unprecedented highs.

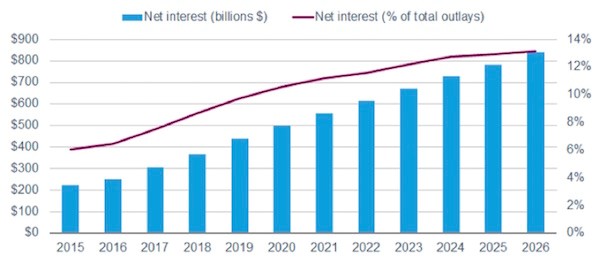

The Congressional Budget Office is showing that the interest on our current debt is about $250 billion for fiscal 2016. These annual interest payments will be growing to over $800 billion in less than 10 years. We are on an “unsustainable” path!

(https://www.treasurydirect.gov/govt/reports/ir/ir_expense.htm)

The Trump Economy:

President Elect- Trump has promised more spending. The budget deficit will probably balloon by at least $450 billion. The key part of Trump’s platform is massive deficit spending on infrastructure and a lot of pro-growth policies Then comes jobs.

There is a better chance that governments could coordinate their timing on a spending plan after the German and French elections in 2017.

While Helicopter money (fiscal stimulus) is not the “sea of cornucopia” to our financial woes, it could complement the ongoing easy monetary policy and potentially generate some real economic growth. In a good scenario, it could help to normalize interest rates. Fiscal expansion could allow the FED to raise interest rates. Vice-chairman Stanley Fischer has suggested that every one percentage point of GDP growth would allow rate rises of 50 basis points.

Global Central Banks will need to continue to purchase their own bonds otherwise, yields will need to rise to attract more investors into the market to purchase up the additional supply.

The clearest message sent by President – Elect Donald Trump was delivered in his election victory speech, a focus on greater infrastructure spending in the U.S. Goldman Sachs Group Inc. analysts said in a Nov. 9th, 2016 report. “Without specific details, it is hard to quantify the impact on commodity demand, however, such policies would support steel, iron ore, zinc, nickel, diesel, and cement.”

This week I locked in 20.7% profit on shorting the emerging markets with EDZ, and go long natural gas using UGAZ for another 14% profit in just two days… global indexes and commodity ETFs are going to provide massive opportunities going forward.

Invest In The Next Bull Market!

Fears over US election spur investors’ dash for cash. (http://www.cnbc.com/2016/11/04/fears-over-us-election-spur-investors-dash-for-cash.html). The real direction of the market’s next move is the most important!

Courtesy of Sentiment Trader

There will continue to be sharp price swings in all markets, especially precious metals and currencies, usually up at first and then down towards the end. However, when one begins the other ends, it will be fireworks that last at least a couple of weeks if not longer.

Famous investor, Jim Rogers, calls the U.S. dollar ‘the most flawed currency’. The Yen is a ticking time bomb, considering the unmanageable debt of Japan and the actions of the Swiss Central Banks led to large bankruptcies in January, 2015.

This brings us to the final safe haven which has stood the test of time; Gold. It has maintained its value during the last five-thousand years and the current rise in gold during the market collapse is proof that its’ safe haven status is intact. Imagine how high gold will go when the real crisis hits the world economies. Gold is money.

Everybody I talk to are holding unprecedented cash positions, they are scared and do not know what to do. So, they believe the only way out right now is to play the stock market. This is an ‘illusion’ as all hope in a new bull market will not be realized. We have just experienced the second largest bull market in history.

How high can gold go? I believe it can go as high as $5000/oz. during a full-blown financial crisis. With a limited downside risk and huge profit potential, readers should accumulate gold. In fact, with this week’s start of the 5th and final leg down in mining stocks we should have a great opportunity to get long metals and miners shortly.

I will inform my subscribers about the next asset class that will go up, as and when I see a pattern developing. I have advised many times that one wants to set aside cash for future investments as a reserve for liquidity and buying in volatile markets. Let me help you achieve your financial goals.

Chris Vermeulen – www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.