China, Now the World's Largest Investor - Gold to benefit

Commodities / Gold & Silver Mar 21, 2007 - 09:27 AM GMTChina, now the world's largest Investor

This report is written in the light of an overlooked conclusion on the objectives of China. China realizes that it is an emerging giant. It realizes it has the capacity to outperform the developed world in manufacturing of all kinds [by following a path similar to Japan and other Asian nation - but on a far greater scale]. It is not China's intention to sit in the shadow of the U.S. or Europe, but to become the dominant global player, with its extremely low cost manufacturing cost structure.

The Chinese government wants China to be number one in the world and not just in manufacturing, but in designing a new government relationship to its economy, far removed from the structure used by either the U.S. or Europe. As such it will comply with the world's requests for change if it suits China's future. Such compliance will lessen as it grows to be indisputably the driver of the world's economy. It will do whatever it takes to access the resources with which to secure such a future, without asking anything of the nations with whom it contracts. It is naïve to think that China is likely to kowtow to the developed world. Because of these aims gold & silver has a place in the globe's monetary system.

China's impact on the rest of us .

The trip of Treasury Secretary Hank Paulson to China highlighted one of the reasons why we are so positive on the long-term future of gold. Generally the perception of China in the developed world is that it is an up and coming emerging [giant] economy that will move in the same direction as all other now-developed economies that were formerly emerging nations. It is fully expected that China will adopt the same economic shape as these nations too. To us in the face of the facts coming out of China, this is at best arrogant.

China's future economy, its banking system, foreign exchange rate policies, reserve policies and its overall economic and political objectives are of paramount importance to all other nations and markets. To misunderstand or to underestimate the Chinese government would be the greatest mistake all of us could make in terms of our future investments. With China now setting up a hugely funded agency for investments [$200 billion of a potential 1 trillion and rising at the rate of $250 billion a year] their policies will affect us all dramatically. Mr Jin said the new agency would report to the State Council, China's cabinet, and not the finance ministry, confirming our understanding that the reins of power rest solidly in the hands of the government.

China's future economy, its banking system, foreign exchange rate policies, reserve policies and its overall economic and political objectives are of paramount importance to all other nations and markets. To misunderstand or to underestimate the Chinese government would be the greatest mistake all of us could make in terms of our future investments. With China now setting up a hugely funded agency for investments [$200 billion of a potential 1 trillion and rising at the rate of $250 billion a year] their policies will affect us all dramatically. Mr Jin said the new agency would report to the State Council, China's cabinet, and not the finance ministry, confirming our understanding that the reins of power rest solidly in the hands of the government.

And where next? Look at Toyota's performance in the U.S. Just wait until China gets the hang of exporting cars [they've got to get quality right first]. China overtook U.S. passenger car output for the first time last year. Chinese production was tabulated at 5.2m autos and the U.S. output at 4.4m autos. As late as 1997, Chinese production was only about 5% of U.S. output.

And where next? Look at Toyota's performance in the U.S. Just wait until China gets the hang of exporting cars [they've got to get quality right first]. China overtook U.S. passenger car output for the first time last year. Chinese production was tabulated at 5.2m autos and the U.S. output at 4.4m autos. As late as 1997, Chinese production was only about 5% of U.S. output.

The rest of this report looks at "The world's biggest Investment fund" - "What China wants China gets" - "U.S. Bankers to structure Chinese Banking?" - "Central Bank Gold Sales" - Plus many other items as well as a finger on the pulses approach to Gold Silver and Platinum markets and shares.

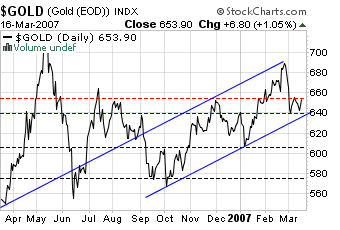

Buy on the falls

The markets on all fronts are looking as though they are nearing their low points. So what does one do? We have been recommending that one should "buy the dips" constantly. However, at the moment the market could go sideways for a while longer and may even attack the lows recently seen.

The markets on all fronts are looking as though they are nearing their low points. So what does one do? We have been recommending that one should "buy the dips" constantly. However, at the moment the market could go sideways for a while longer and may even attack the lows recently seen.

At Gold and Silver Forecaster we would recommend that a very good policy in a market such as these, where we continue to be certain of future rises, but would like to get the lowest entry point possible, is to buy on those days that fear rises and prices fall in an atmosphere of looming catastrophe so we follow a policy of "Buy on the falls" . It is sometimes nerve racking to do so, so one must be certain, but in such markets one often finds the dealers don't have that much stock themselves, sell it to you and then mark the price up. The dealers are vulnerable at this point and don't want to hold stock on their books. If one wants to buy quantity, one has to do this for as long as doubts sit in a consolidation area.

But be certain of the level of liquidity of the share you are buying into and adjust your dealing accordingly. We wish you every success!

Please subscribe to www.GoldForecaster.com for the entire report.

By Julian D. W. Phillips

Gold-Authentic Money

Copyright 2007 Authentic Money. All Rights Reserved.

Julian Phillips - was receiving his qualifications to join the London Stock Exchange. He was already deeply immersed in the currency turmoil engulfing world in 1970 and the Institutional Gold Markets, and writing for magazines such as "Accountancy" and the "International Currency Review" He still writes for the ICR.

What is Gold-Authentic Money all about ? Our business is GOLD! Whether it be trends, charts, reports or other factors that have bearing on the price of gold, our aim is to enable you to understand and profit from the Gold Market.

Disclaimer - This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Gold-Authentic Money / Julian D. W. Phillips, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; Gold-Authentic Money / Julian D. W. Phillips make no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Gold-Authentic Money / Julian D. W. Phillips only and are subject to change without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.