The Imminent Multi-Trillion Dollar Surge In Social Security & Medicare Costs

Economics / Government Spending Dec 07, 2016 - 02:57 AM GMTBy: Dan_Amerman

For decades we have known that the time would come when Social Security & Medicare costs would begin a rapid and explosive growth upwards. That time is no longer the distant future - but something that will take place next year, and the year after, and the year after. The long expected storm is now upon us, and as can be seen below, the amounts involved are staggering and they will arrive much faster than most people realize.

For decades we have known that the time would come when Social Security & Medicare costs would begin a rapid and explosive growth upwards. That time is no longer the distant future - but something that will take place next year, and the year after, and the year after. The long expected storm is now upon us, and as can be seen below, the amounts involved are staggering and they will arrive much faster than most people realize.

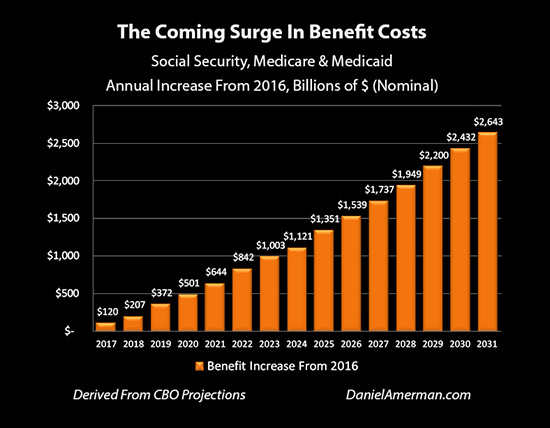

Based on Congressional Budget Office projections, total costs for Social Security, Medicare and Medicaid are likely to be about $120 billion greater in 2017 than 2016. Then almost double that amount in 2018, with an annual increase of $207 billion. Then almost double that amount again by 2019, with an increase of $372 billion compared to last year.

The half trillion dollar a year mark is likely to be hit by 2020 - before the next U.S. presidential election. With an annual increase in benefit spending that will continue to accelerate.

Benefit costs are anticipated to be a trillion dollars a year greater than their current cost by the year 2023. They'll be one and half trillion dollars a year greater by 2026. And if current estimates are accurate, benefit costs will be $2 trillion greater than now - on an annual basis - by 2029.

The implication are profound for the national debt, retirement savings and benefit payments.

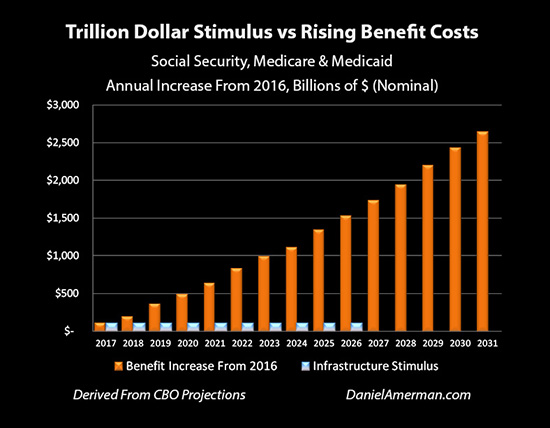

To add some perspective, let's compare this to the massive, trillion dollar infrastructure stimulus program that is currently being proposed.

The proposed program is vast, with the idea being to rebuild roads, bridges and airports across the entire nation over ten years, pumping $100 billion a year into the economy in an attempt to stimulate growth. The stimulus program is so expensive that it may never get past Congress, at least not in whole.

Yet as demonstrated above, the increases in costs associated with the trillion dollar stimulus are effectively trivial in comparison to the increases in the scheduled costs of paying retirees their promised benefits.

Both Expected & Entirely New

What is coming with Social Security and Medicare (as well as Medicaid) is both expected - and entirely new.

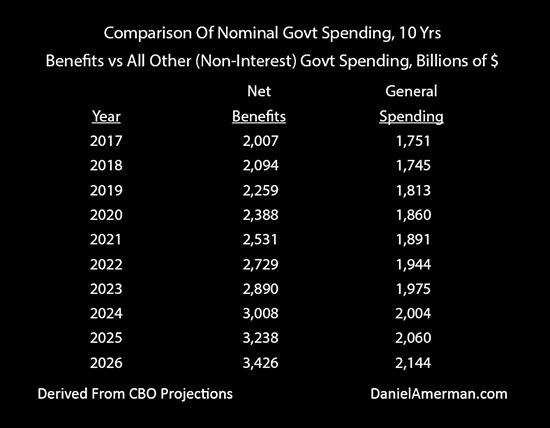

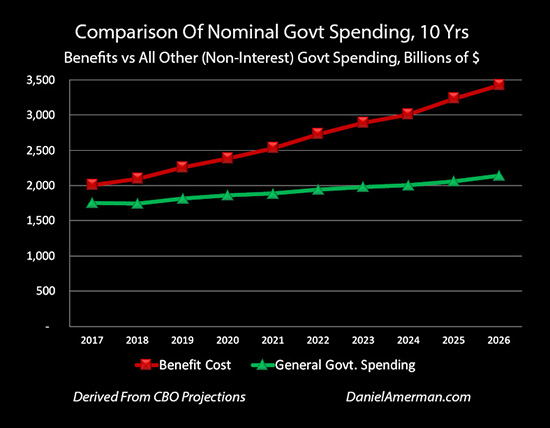

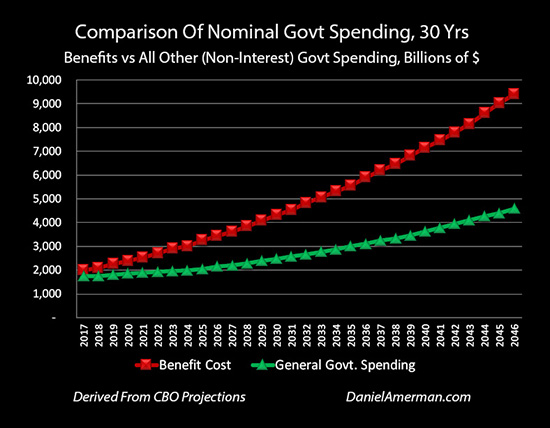

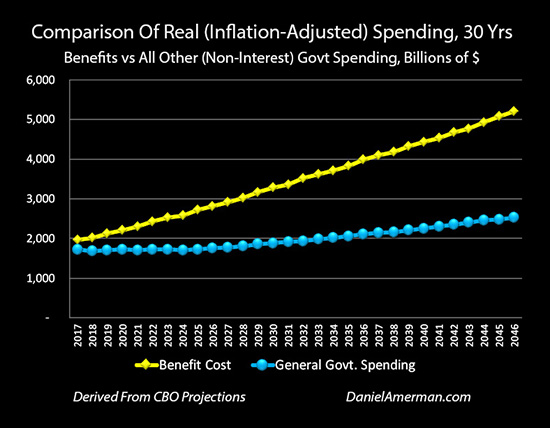

Historically, governments spent most of their money on general purposes - such as defense, infrastructure and running a large bureaucracy. That has gradually shifted over time, and by 2016, the annual costs of benefits had risen to almost $1.9 trillion, exceeding all other government spending combined (exclusive of interest payments on the national debt).

Moreover, based on Congressional Budget Office projections, benefits are expected to rapidly pull away from other governmental spending - exceeding $2 trillion for the first time in 2017, and $3 trillion by 2024.

The speed with which benefit spending will come to dominate overall government spending to an unprecedented degree can be seen in the graph below.

As extreme as the changes will be in the 2020s when compared to what we have experienced in the past, they pale in comparison to what is scheduled to arrive in the 2030s and 2040s - with benefit spending alone reaching an annual rate of almost $10 trillion a year.

Adjusting For Inflation For A Clearer Picture

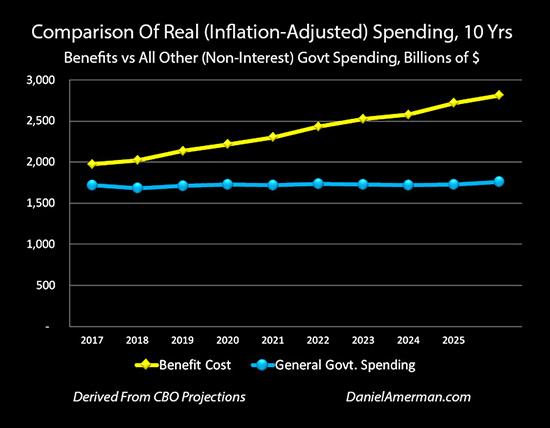

Even using the historically quite low rates of inflation projected by the CBO, much of the increases in benefit payments in the 2030s and 2040s are there because of a lower purchasing power of the dollar. When we adjust for inflation, the dollar amounts fall somewhat - but the costs are still extraordinary.

We are still close to a trillion dollar a year increase in annual benefit costs in about ten years. Indeed, the almost $900 billion in increased costs would pay for nine nationwide infrastructure programs simultaneously ($100 billion per year for nine programs, compared to 2016 spending).

When we look at the situation graphically - we can see a miracle of sorts. All other government spending stays flat in inflation-adjusted terms. With the exception of benefits, the government stops growing for about ten years, and is even shrinking as a percentage of the economy. Other government spending is shown as falling from 9.2% of GDP in 2016 down to 7.7% by 2026.

The reason for this "miracle" of a shrinking government (relative to GDP) within the CBO projections? It has to be assumed. Because if a way is not found to slash all other types of government spending, then there is no possible way to meet the soaring benefit costs without creating an even more impossible financial situation for the government.

There is another "miracle" of sorts that occurs by 2027. The decades-long trend of medical expenses rising faster than general rates of inflation comes to an abrupt end. How does that happen? The CBO has no idea, but the assumption was necessary. Or else the numbers after 2027 build to be substantially worse than what is shown herein.

(Digging through hundreds of pages and numerous schedules involved in making multi-decade projections from places like the Congressional Budget Office or Social Security Administration may sound like a dry and tedious task, but in fact - it is a course in miracles. For beneath the surface of the numbers are remarkably uplifting and optimistic assumptions in so many categories, whether it be reductions in governmental and medical cost growth rates, or strong economic growth, or climbing labor force participation rates, or rising real median household incomes, or remarkably productive high income immigrants in ever increasing numbers. Because without those glowing assumptions - the problems hit much faster and harder.)

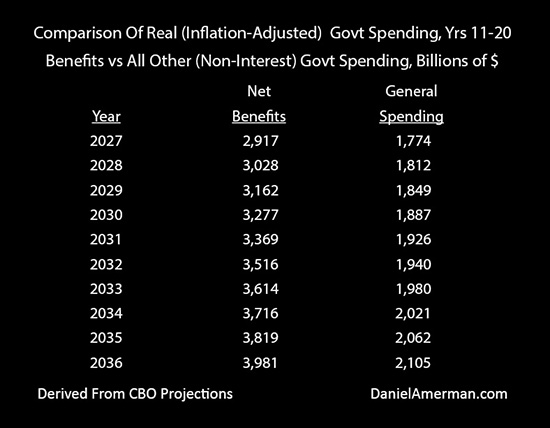

Somewhere around 2032, another very important event occurs. Even after adjusting for inflation, government spending on benefits alone exceeds the total current government revenues from all sources of about $3.5 trillion per year. Meaning there is nothing available for general government spending, or paying federal employees, or paying the interest on the (then much higher) national debt.

Now economic growth and perhaps higher tax rates may take care of quite a lot of that. But nonetheless, either there is an extraordinary increase in money available for the federal government, or the deficits soar out of control, or the benefits aren't paid - or all of the preceding together.

Keeping in mind that these are inflation-adjusted numbers, there is no slowdown in the growth in benefit expenses once we get 20 years out and all the Boomers are well past normal retirement age. Costs just keep getting higher as the average age of retirees keeps rising, meaning that Medicare costs continue to grow rapidly even as Social Security costs are projected to have stabilized relative to the economy.

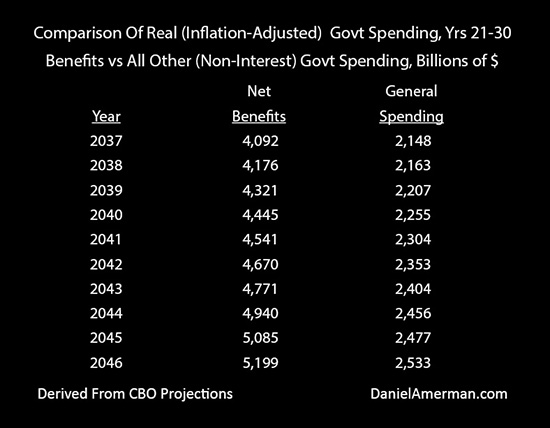

The annual cost of benefits reaches $4 trillion in current dollars by 2037, and over $5 trillion by 2045. By this time over two thirds of all federal spending is going to benefits, and the government would need to be taking in twice as much money in real terms than it is today (inflation-adjusted) to keep paying its bills, absent deficit spending.

When we adjust for inflation over 30 years, then the yellow line shows us a ceaseless progression, where the real cost of paying Social Security, Medicare and Medicaid benefits leaps every single year, without ever slowing down.

We've never seen this before, not on this scale. Our government has never done this, the economy has never handled this, taxpayers and bond markets have never seen it either.

But it's here. And will be growing fast. And soon.

What Wasn't Expected

Again - that this day was coming, and that it would be very financially challenging, has been known for decades. However, what was not foreseen in the long-term models was the slowdown in economic growth that would occur in the aftermath of the financial crisis of 2008. Which means the current economy is smaller than what had been expected - and tax collections are smaller than expected. So less money available means it is going to be still harder to afford what was already expected to be almost unaffordable.

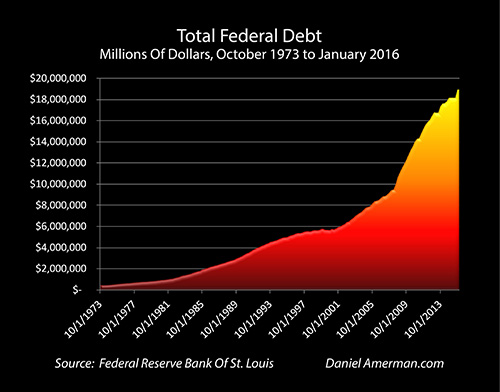

Also of great importance is that while the national debt was expected to rise, it was expected to happen in the process of paying for benefit promises. The debt was not supposed to double before the most expensive part of paying Boomer retirement promises even really got going.

But that is exactly what happened, as shown above. The national debt doubled in the aftermath of 2008, and is now over 100% of GDP. As analyzed here, there are methods of reducing national debts which effectively pass on the costs of debt reduction to the savers of the country in a manner that is not understood by most people. This has worked in the past, and a version of this is being attempted right now in the United States.

However, the coming rapid increases in required benefit payments are not at all compatible with efforts to reduce debts, but lead to something quite the reverse. When we start with a debt that has already doubled, and then stack endlessly increasing benefit costs on top of that, we get something that is much worse than either by itself.

Even current government projections (including some quite optimistic assumptions) are that the national debt will soar far past current levels, as money is borrowed to make benefit payments that would otherwise be unaffordable.

This then not only sets off a massive increase in debt that allows very little room for such things as stimulus packages, but also can rapidly increase an expense that was left out of this analysis. We just had two lines - one for benefits, and one for non-interest governmental expenses.

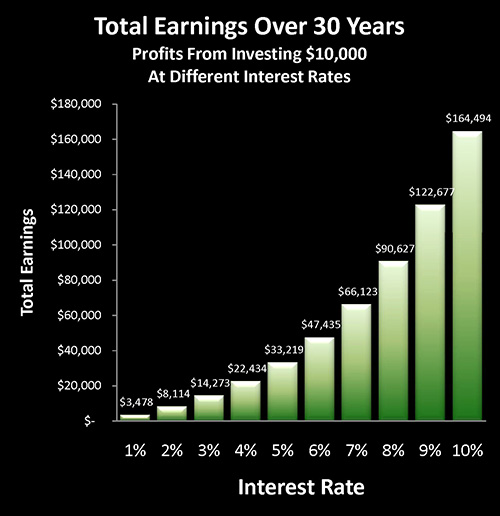

But, interest needs to be paid. And generally speaking, if the debt is soaring, then interest payments on that debt are soaring. And we then have two rapidly growing governmental expense categories, each of which are consuming ever more cash while pushing annual deficits - and future interest expenses - still higher.

As analyzed here, this creates an acute conflict of interest between governments and savers. Savers need higher rates to build wealth, as shown above, but governments need very low interest rates to keep interest payments on the national debt at manageable levels. When rising benefit costs further increase that debt load - and the potential extreme expense of higher interest rates - this situation may force still lower interest rates for savers, and still lower investment earnings that could last for decades into the future.

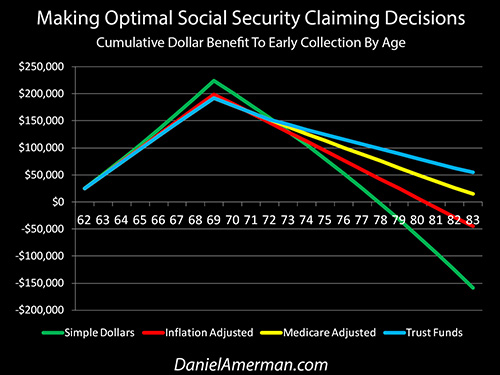

There are also major implications when it comes to the widespread advice that the best financial choice is to delay claiming Social Security benefits for as long as possible, in order to increase the size of the eventual payments.

The assumption is that we can absolutely rely on our benefits being paid in full and exactly on schedule. Yet, in looking at those decades of so many trillions of dollars of rapidly rising expenses, I think that it probably crossed most people's minds that maybe, just maybe those benefits might not all get paid.

Indeed, as shown above and analyzed here, even if we take the very "gentle" approach of assuming that the government doesn't change the law - but does take full advantage of the ability to lower benefits in accordance with current law - then all of our decisions could change. The best choice may be to claim as soon as possible rather than as late as possible.

Accepting Reality

This analysis is not intended to be gloomy or pessimistic, but rather to simply present the numbers as they are. Reality just is what it is. And the reality is that the big changes are finally here - and they will be accelerating in the near future. There will be no wishing it away. Refusing to think about it will not be particularly helpful either.

I've been studying Boomer retirement issues for close to 20 years now. During that entire time I've known that 2027 was a key year. For based upon ages and expected lifespans, we've known that the late 2020s are the peak years for the maximum number of Boomers who are simultaneously of traditional retirement age and are still alive. Those are not the peak expense years, for as shown above - those just keep growing. But it is a time where everything has necessarily changed, because of the sheer numbers of people eligible for Social Security and Medicare.

When we look at what has been promised, the projections are that those costs will require an extra $1.7 trillion dollars a year, compared to 2016. That amount goes down when we adjust for expected inflation, but that is still close to a trillion dollars a year over and above what the federal government is spending today.

We have to get there from here - and we have to do it fast. That is what the numbers show. There is a very fast ramp-up period to get from here to there, the numbers have to be of staggering size, and the numbers have to be relentless to get us there.

Because the numbers are so large - they will likely impact everything. From economic growth, to deficits, debts, interest rates, bond markets, stock markets, real estate, precious metals, currency values, tax laws, to retirement account regulations - everything will be in play.

Unfortunately, the usual financial and retirement planning approach is to prepare for this time by ignoring it. This includes investment and saving decisions - and Social Security claiming decisions as well.

Pretending this isn't happening, however, is a luxury that only works when the changes are in the distant future. What the numbers herein quite plainly show is that we will be rapidly losing that luxury over the coming years. And plans that do not take a new and dominant reality into account - may not perform as desired.

Let me suggest that being fully aware of what will be happening in the next several years and also the next ten years and beyond should be one of the foundations of any retirement or financial planning process. Hopefully, this analysis has been helpful for you in that regard. It is also one piece of a much larger body of related work that is available on my website.

Daniel R. Amerman, CFA

Website: http://danielamerman.com/

E-mail: mail@the-great-retirement-experiment.com

Daniel R. Amerman, Chartered Financial Analyst with MBA and BSBA degrees in finance, is a former investment banker who developed sophisticated new financial products for institutional investors (in the 1980s), and was the author of McGraw-Hill's lead reference book on mortgage derivatives in the mid-1990s. An outspoken critic of the conventional wisdom about long-term investing and retirement planning, Mr. Amerman has spent more than a decade creating a radically different set of individual investor solutions designed to prosper in an environment of economic turmoil, broken government promises, repressive government taxation and collapsing conventional retirement portfolios

© 2016 Copyright Dan Amerman - All Rights Reserved

Disclaimer: This article contains the ideas and opinions of the author. It is a conceptual exploration of financial and general economic principles. As with any financial discussion of the future, there cannot be any absolute certainty. What this article does not contain is specific investment, legal, tax or any other form of professional advice. If specific advice is needed, it should be sought from an appropriate professional. Any liability, responsibility or warranty for the results of the application of principles contained in the article, website, readings, videos, DVDs, books and related materials, either directly or indirectly, are expressly disclaimed by the author.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.