The Light at the End of the Tunnel of the Financial Crisis?

Stock-Markets / Credit Crisis 2008 Aug 05, 2008 - 11:00 AM GMTBy: Adam_Perl

Covered bonds to stimulate the housing sector, GDP of 1.9%, Jobless claims of 448,000 and unemployment that reached a new level of 5.7% - those were just a few of the things that painted the screens red last week, as the major indices erased Monday and Tuesday's bullish sentiment, showing optimists that it is still to early to jump for joy. In addition to the data released in the U.S, showing a dire situation, global economies continue to lag behind the US , affected by high inflation and slow economic growth. Taking a glance at the chart below, one can see that five of the main economies are still showing real negative growth, due to high inflation, accompanied by high unemployment.

Covered bonds to stimulate the housing sector, GDP of 1.9%, Jobless claims of 448,000 and unemployment that reached a new level of 5.7% - those were just a few of the things that painted the screens red last week, as the major indices erased Monday and Tuesday's bullish sentiment, showing optimists that it is still to early to jump for joy. In addition to the data released in the U.S, showing a dire situation, global economies continue to lag behind the US , affected by high inflation and slow economic growth. Taking a glance at the chart below, one can see that five of the main economies are still showing real negative growth, due to high inflation, accompanied by high unemployment.

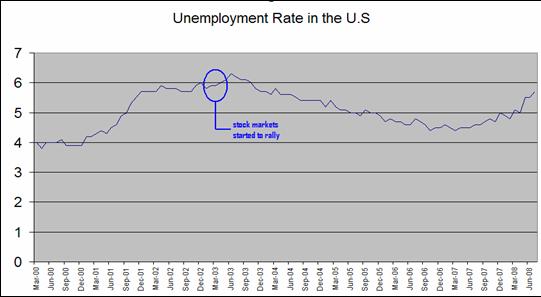

In addition looking at the following chart, one can see that the root of the problem, the economy responsible for starting this current landslide, doesn't seem to be improving. Comparing unemployment levels to those of the dot.com bubble, which led to the 2001-2003 recession, one can see that current unemployment levels are slowly approaching previous ones. Based on the analysis below, could we say that the economy is on the verge of turning around? Are we approaching the light at the end of the tunnel?

Even though the markets have experienced a nice bounce the last couple of weeks, that bounce has been accompanied by declining volume. The financial sector, the gauge of the current economic situation has bounced off its lower monthly trend line, and most of the major indices have broken the first major rule of technical analysis, when defining a downtrend - the major indices have formed a higher trough in a downtrend; or as technical traders call them a “higher low”.

XLF- Follows the financial sector

*courtesy of bigcharts.com

While some analysts are claiming that current trading patterns are signs that the markets have reached a bottom, it is a bit hard to be optimistic when economic data is still showing the situation is dire and current rallies could be slightly artificially affected by SEC's implements- prohibiting short selling on 19 of the largest financial firms.

Looking forward, volatility should increase this week as employment numbers and rate decisions are coming out from some of the largest economies. Eyes will focus on the Fed's decision, especially as the ECB have just raised their rates. While there is a slim chance of a rate hike in the U.S, traders will focus on comments from the Fed, helping them to determine future monetary policy, especially as continuously low interest rates could spark additional commodity buying. This trend could arise out of expectations of increasing inflation and geo-political conflicts in the Middle East that could decrease the supply of oil - increasing prices due to a current high demand.

In addition, during the first half of August, the SEC will be removing their recent implements, allowing traders to short the financial sector.

While the markets and volatility have managed to stabilize, upcoming data will have an effect on the financial markets and should set the tone at least for the upcoming month. One has to remember that during market bottoms financial securities tend to consolidate, re-testing bottoms until confidence has returned, finally heading up, developing a new market cycle. Conservative traders should watch out for a break of recent highs on the major indices in order to enter long.

By Adam Perl

I am a currency strategiest, I have over 6 years of personal experience trading stocks on the American stock exchange and the Foriegn Exchange. I am also a private trader and coacher for the financial markets. I am also launching a website over the summer.

Information reliability and liability : The contents are solely aimed for the use of "Experienced" investors in the financial markets who are fully aware of the inherent risk of trading. I, “Adam Perl”, do not accept any liability for any loss or damage whatsoever that may directly or indirectly result from any advice, opinion, information, representation or omission, whether negligent or otherwise, contained in our trading recommendations. I make no warranties or representations in relation to the Information (including, without limitation, in relation to its accuracy or otherwise) and do not warrant or represent that the services will be error free or uninterrupted.

Copyright : This article is subject to and protected by the international copyright laws. Use of the information brought in this article is subject to making fair use only in accordance with these laws. It is not permitted to copy, change, distribute, or make commercial use of the information except with permission of the holders of the copyright.

Risk Disclosure : The risk of losses involved in the transaction or speculations in the financial markets can be considerable. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. Speculate only with funds that you can afford to lose.

Adam Perl Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.