Where Next for Gold, Stocks and Bonds?

Stock-Markets / Financial Markets Aug 05, 2008 - 11:54 AM GMTBy: Brian_Bloom

Hmmm? Seems like the gold price itself doesn't agree with the experts views on where it's headed. That's the problem with sticking your neck out. When you get it right you're a genius. The problem arises when you get it wrong.

Hmmm? Seems like the gold price itself doesn't agree with the experts views on where it's headed. That's the problem with sticking your neck out. When you get it right you're a genius. The problem arises when you get it wrong.

Unfortunately, at the end of the day, there are no certainties. It's all about a balance of probabilities.

Let's see if we can get a fresh perspective from the charts.

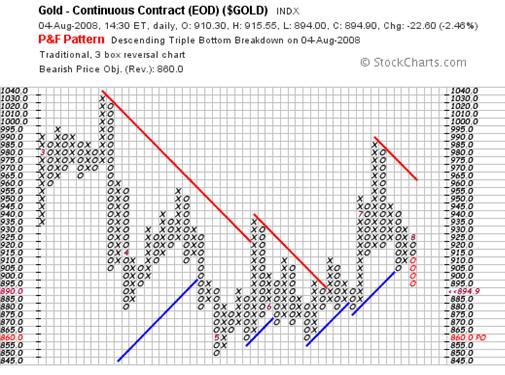

The first (and probably the most important) chart is the 3% X 3 box reversal Point and Figure Chart below (courtesy stockcharts.com )

It is clear from this chart that the $850 an ounce level is very important. If the gold price falls below that level then the previous up-move may turn out to be a ‘false' move, and the price could come all the way back to around $700 an ounce.

What's the probability of that happening, and what will that mean?

For an answer to these questions let's look at the monthly chart below – courtesy decisionpoint.com

If you look carefully, you will see a hint of a downturn in the PMO oscillator, but that has happened twice before in the past two years and the price of gold rose ever higher. It's really a question of whether gold is in a parabolic rise – which will lead to an upward explosion and a probable subsequent collapse – or whether the gold price will pull back in a healthy move within a primary bull trend. The fact is that a pullback to $700 would still leave gold in a primary bull trend and that would be healthy.

But will it pull back? Maybe the weekly chart below can throw some light.

Interestingly, today is Monday in the US and the opening price for the week was lower than the closing price for last week. This caused a downside gap to manifest on the chart; and a gap is a sure sign of emotionally driven behaviour. Most gaps are subsequently covered, so if the price does fall from here it will very likely pull back up to cover the gap when sanity returns. The PMO oscillator looks like it might have some distance to travel in a southerly direction – so the possibility of “consolidation” at around these levels is high. That doesn't necessarily mean that the gold price has to fall. Over time, if the gold price remains flat, the PMO will fall relative to historical.

Of interest is that the 43 week moving average line in the price chart has not been seriously penetrated on the downside since the commencement of the chart's time scale in June 2004. In this context, $860 - $865 looks like a reasonable support level.

If we now have a look at the $1 X 3 box reversal P&F chart, the $860 level is confirmed as a downside target.

This chart shows $860 as a target level on the vertical count and $885 as the target level based on the horizontal count. At this stage, based on the high probability that the gold price is on a primary bull market, the horizontal count target is more believable – and that happens to be smack on the moving average line of the weekly chart.

The caveat is this: If the $860 level is reached, although it will be above the long term rising trend line, it will also have realised the vertical downside count. In turn, this will indicate that a lot of hype will have gone out of the market and we might see some significant period of consolidation.

But, speaking of gaps, we need to revisit the monthly chart which has been enlarged below. Note how it is still showing an uncovered gap between $840 and $850 an ounce.

Interim Conclusion

Right now, the jury is out. It seems fairly certain that gold is due for some consolidation, and the duration of the consolidation will be dependant on whether the $885 level is breached on the downside and the $840 - $860 level is reached.

Given that the world economy is looking like such a basket case, why would the gold price be pulling back?

There are a couple of possible explanations:

- Gold is not a currency and, like other commodities, it was being pushed up on a wave of commodity price inflation hysteria. If the economy is softening, then demand for commodities in general will soften.

- The world economy may look like a basket case, but maybe there is greater underlying strength than is immediately apparent.

Interesting how these two arguments are diametrically opposed to each other: The gold price is pulling back because times are going to be bad. The gold price is pulling back because times are not as bad as they seem. Make you think?

Well, let's see if we can get make some sense out of all this. Let's interrogate the charts a bit. Bright lights please and no water until the perp confesses.

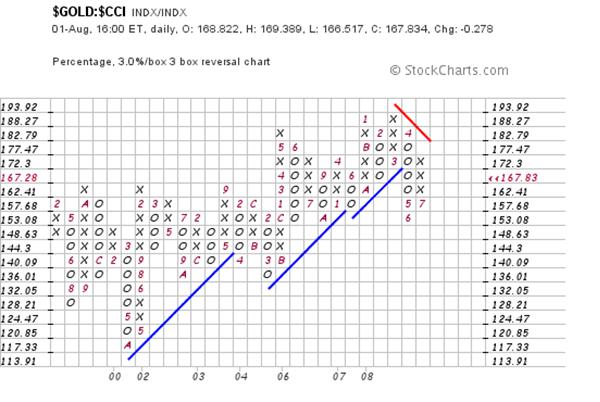

The above daily chart is a ratio of gold to the Reuters commodities index. Gold had been outperforming commodities for a few weeks, but has just given a sell signal on the MACD oscillator.

Okay! From the weekly chart below we can see why: See the gap? Gold blipped up in a rush of emotional outpouring a few weeks ago and the gap needs to be covered.

Now here's an interesting chart:

Note how gold began to outperform commodities in 2006. At that point, arguably, gold was being perceived more as a currency than as a commodity. However, if you now look at the red trend line, you will see that the picture began to change again in 2008. Notwithstanding the subprime mortgage crisis, and the debt implosion fears, the fear has been receding – evidenced by the fact that gold is now once again perceived as a commodity.

Why would this be so?

Could it be – from the following relative strength chart – that oil has peaked relative to gold and that some sanity is now coming back into the oil market?

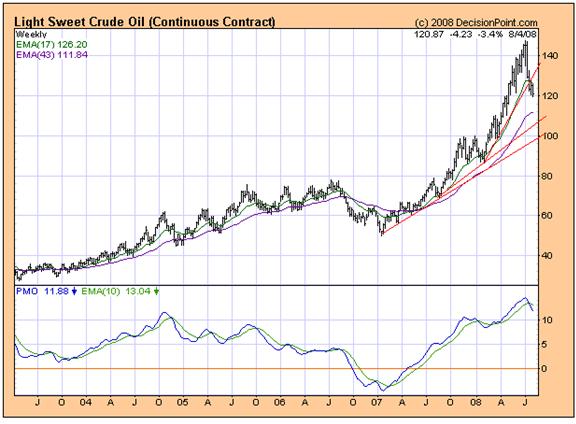

Well, from the weekly chart below – it seems clear that oil is pulling back from its heights.

Note the sell signal on the oscillator, and note the downturn in the green 17 week moving average. It looks suspiciously like oil may pull back to at least $110 and maybe even to $100 a barrel.

Why? Is the world economy going to unravel?

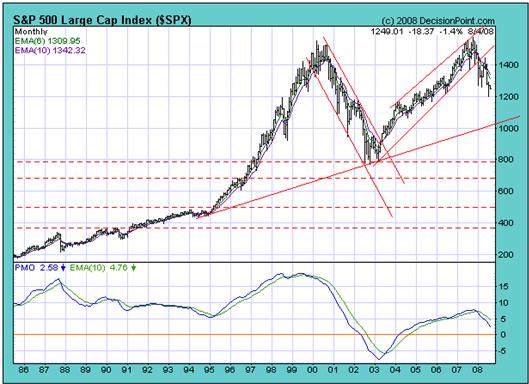

From the monthly chart of the S&P below, it would seem that the US equity markets are facing some downside potential – possibly to as low as 1000

Will the 1000 level hold?

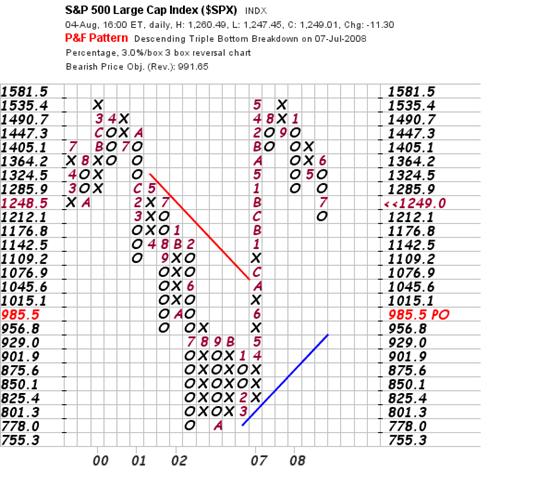

Not according to the following Point and Figure Chart which is calling for a price target of $985 based on the vertical count technique. I am prepared to accept this particular target because, from my perspective, the US equity markets are now in Primary Bear Trends.

The good news seems to be that the markets are not (yet?) starting to worry about a collapse. It looks more like they are about to enter a prolonged period of consolidation as the world economy catches its breath.

If we look at the ultra long term chart of the S&P (courtesy Decisionpoint.com), the level of 750 seems to offer significant support – which is close enough to the 778 support level in the above chart to be believable. This would be painful, but it wouldn't be a catastrophe.

This observation – that the world may not be about to end – is corroborated by the monthly chart of the US Dollar below:

Note the non-confirmation of the PMO oscillator and the price chart: Higher lows on the PMO and lower lows on the price chart. The oscillator normally points the “true” direction.

Whilst the dollar may or may not rise from here, it seems as if the dollar is looking to bottom around this level.

In turn, the ultimate reason for this may be that US interest rates seem to have bottomed – as can be seen from the series of rising bottoms in the oscillator section of the monthly chart below of the 30 year bond yield.

Note how the current yield is giving an uptick in the PMO in the right hand chart. This is very subtle, and the implication is more reasonable that the yield has bottomed rather than that it will rise further in the future.

Conclusion

The charts are telling their story. Whilst the US markets are probably in a bear market, the “panic” is starting to recede. The oil price and the gold price are pulling back. The oil price is pulling back relative to the gold price whilst the gold price is pulling back relative to commodities in general. Order is returning to the markets. The US Dollar looks like it is bottoming for the time being – as is the long dated bond yield.

On balance, the current picture looks more likely to be one of long term consolidation than of markets unravelling.

Why? How could it be that with all the bad news out there, the markets seem to be softening but not collapsing?

The answer may have more to do with the collective state of mind than with economic conditions.

Those who are aware of the fact that I have recently published a factional novel entitled Beyond Neanderthal, will also be aware that I am absolutely convinced that Carbon Dioxide has not been the cause of Global Warming; and that there are several alternative energy technologies which can be used to replace oil in particular. (You can order a copy at www.beyondneanderthal.com )

What I have noticed in the past couple of weeks is that climate experts are starting to come out of the woodwork who are now openly agreeing with the view that raised CO 2 levels have not caused global warming. The latest was Dr. Roy Spencer, an Atmospheric Scientist, formerly of NASA who gave evidence before a US Senate Committee hearing on July 22 nd . (See http://epw.senate.gov/public/ index.cfm)

One implication of this is that we can now start rolling up our sleeves to appropriately address the issues of climate change and peak oil and a couple of other thorny problems which were being held at arms length whilst the politicians ran with the IPCC's initial findings and confused the hell out of most people.

Overall Conclusion

The evidence suggests that a wave of “sanity” is once again washing across the face of the planet. Yes, we are in for some tough times ahead as the excesses of the past few decades are unwound – but, right now (and this could change) it appears that we are moving to address and manage our problems.

So where should one be invested?

Personally, I like gold as a long term investment – for reasons outlined in detail in Beyond Neanderthal. I'm also of the view that some money in strategically targeted investments like health care services makes sense in an environment where the ratio of health care expenditure to GDP is trending towards 25% in the USA. It also seems appropriate to switch from real estate to cash for the time being because the return on cash is greater than the rental return on real estate. I think we may be heading for a credit crunch and I can't see capital gains in real estate for the foreseeable future. It's going to be tough navigating the next few years, but (for the moment) it seems manageable. It all depends on what our sun is going to do. Therein lies the rub. If our sun starts to quieten down, then we will have to start worrying about global cooling – and that's a whole different ball of wax.

By Brian Bloom

You may now order your copy of Beyond Neanderthal from www.beyondneanderthal.com . My guess is that we will both be glad you did. The feedback from readers has been very positive, and I am grateful for that. Via its light hearted storyline, the novel points a direction as to what we should be doing in the event that global cooling starts to manifest; and it also sows some seeds of ideas on how we might defuse the clash of civilisations

Copyright © 2008 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.