Stock Market Bulls, Stock Market Fools - Market Crash Next or Just an Illusion

Stock-Markets / Stock Markets 2016 Dec 21, 2016 - 07:43 PM GMTBy: Sol_Palha

"A learned blockhead is a greater blockhead than an ignorant one." ~ Benjamin Franklin

Since the markets bottomed in 2009, one naysayer after another has penned many an obituary for this market. Alas, all those obituaries were based on fantasy and false perceptions; the bull is alive and kicking while many of those experts are either bankrupt or have bankrupted their clients several times over. We repeatedly stated over the years that the era of low interest fostered an environment that favoured speculation over hard work. This is why so may companies have opted to be boosts EPS via share buyback programs. Why work, when through the magic of accounting you can create the impression of growth when there is none. All is well, and when it ends, only the workers and the masses will lose for the corporate wenches will walk away with bloated accounts.

Despite the latest rate hike and the insane ramblings from the Fed that they are ready to raise rates more aggressively; yes we heard this last time and for over one year nothing happened. The reality is the economy is sick and only appears to be thriving because of the hot money that is being funnelled into the markets. This helps foster the illusion all is well when in reality everything is falling apart. Hence, while the Fed talks big, its bite will be weak. We could go on providing more reasons as to why the economy is weak such as the fake unemployment data the BLS tries to get the masses to swallow, but all of this is irrelevant. The trend of hot money is in play, and until the supply of hot money is cut, this bull market will continue to trend higher. This market will not trend higher forever; it will eventually run into a solid brick wall. There is no point of fixating on what will happen one day when its far more profitable to focus on the now.

The three charts below illustrate why this bull market still has legs

![]()

The semiconductor sector needs to be in a strong uptrend for a market to rally on a prolonged basis. A quick look at the above chart (semiconductor index) shows that the index is an in a very strong uptrend. It is trading above its main uptrend line and has continued to trade to new highs over the past five years. It could drop all the way to 650, and the outlook would remain bullish.

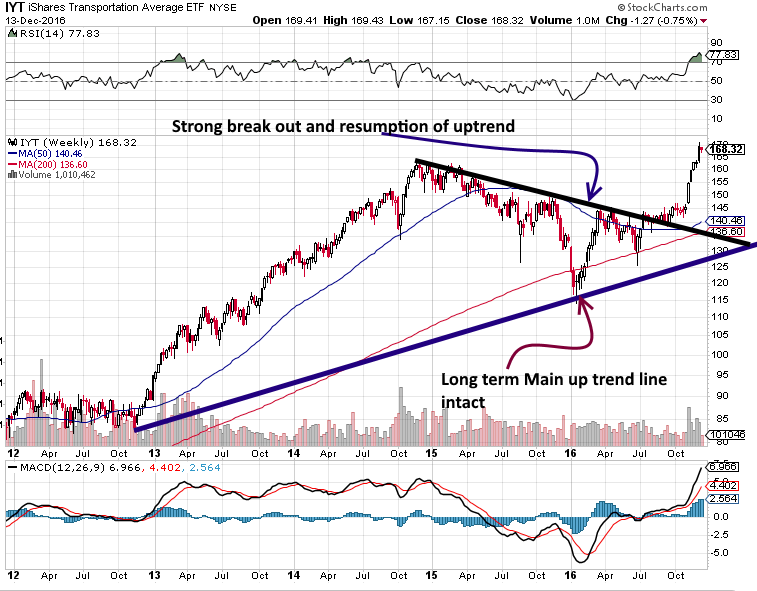

IYT (an ETF that mimics the Transports), is trending upwards again after experiencing a nice cleansing correction. A monthly close above 165 will pave the way for a test of the 195-205 ranges.

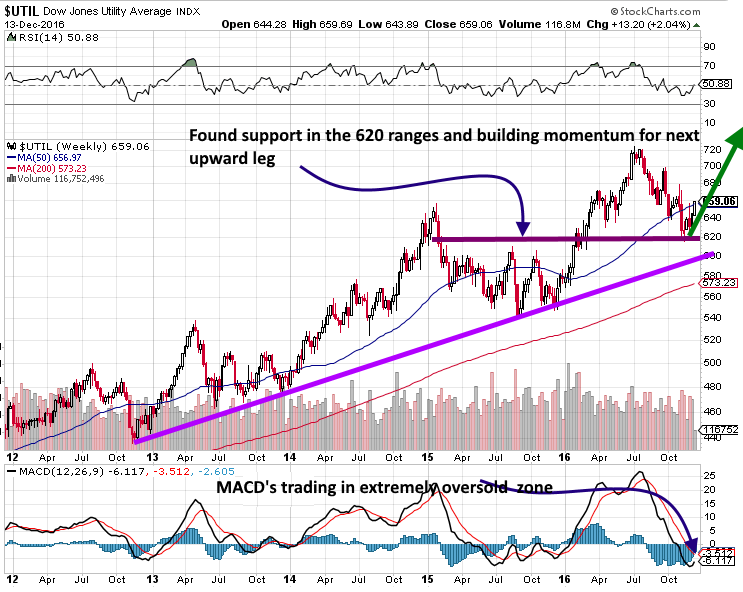

Finally, as we stated in the alternative Dow theory, the Utilities appear to be getting ready to trend higher.

As they are coming out of a correction, they are likely to play around the 625-640 ranges for a bit before breaking out. The utilities lead the way up, so a breakout to new highs should be watched closely. If they break out to new highs, it would indicate that after a correction that could range from mild to strong, the Dow industrials should follow the same path.

Conclusion

The Drs of doom will continue to chant the same monotonous and agonisingly painful song of death, instead of the markets collapsing they will be handed their heads on a platter again. If you had listened to these fools that masquerade as experts, you would have bankrupted yourself several times over. This bull market will end but that day is not upon us yet. The supply of hot money needs to be eliminated, and more importantly, the masses have to embrace this bull market. Over the short term, the markets have gotten slightly ahead of themselves and so some bloodletting probably next year would not surprise us. However, a correction and a crash are not the same things, something the Naysayers have a hard time recognising or coming to terms with. When the markets start to pull back again, they will feel emboldened and crawl out of the woodwork screaming the same rubbish they always do. Don't listen to them; we can even provide a small preview of what will happen.

The lower the markets pull back, the more courageous these fools will become; they will start to spew ridiculous targets, and the masses will buy into this rubbish as they always do. Remember it takes one to cry, two to tango and three to have a party; just when it looks like the naysayers are going to be vindicated the markets will bottom and reverse course. These poor fools will then have the sharp displeasure of watching all their profits vanish into thin air. Let's think about it if they followed their advice they would have lost all their money several times over. Hence, they are not following their advice; they are singing a false song of misery but apparently not putting their money into the game. The truth is not always to spot, but when you spot, it should set you free. Those that think it hurts are living in a world of denial as they still cling to the old ways hoping that like a broken clock they might have the chance to be right. The trend is your friend and rubbish is your foe; trend wisely.

"Have the courage to be ignorant of a great number of things, in order to avoid the calamity of being ignorant of everything." ~ Sydney Smith

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2016 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.