Americans Prefer Pets to Kids After the Great Recession - How to Cash In

Stock-Markets / Investing 2017 Jan 05, 2017 - 03:02 AM GMTBy: John_Mauldin

BY PATRICK WATSON : More and more Americans seem to prefer pets to children… and the resulting demographic trend has massive economic and investment implications.

BY PATRICK WATSON : More and more Americans seem to prefer pets to children… and the resulting demographic trend has massive economic and investment implications.

The numbers are startling and affect everyone—whether you’re a parent, a pet owner, neither, or both. It’s also an investment opportunity you might try in 2017.

4 million missing babies

While the memories of the Great Recession may be fading, the effects are still very much with us. Among other places, the impact shows up in demographic data.

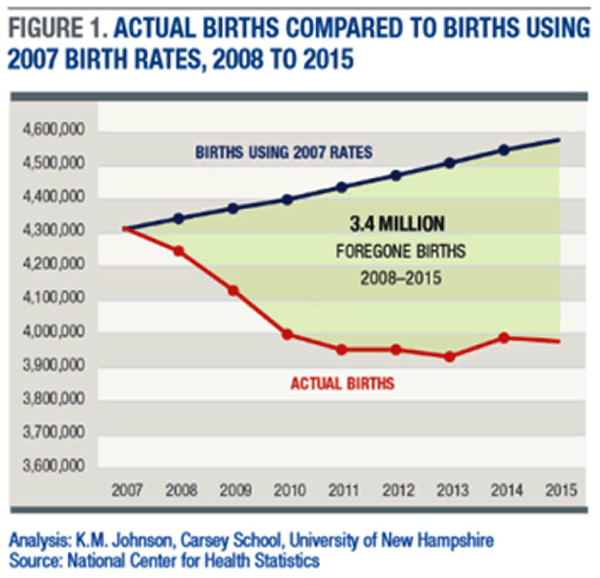

Last summer, I ran across some fascinating analysis by University of New Hampshire sociologist Kenneth M. Johnson. He found that US fertility levels dropped sharply beginning in 2008 and have yet to recover.

All those babies we didn’t have add up to a big number.

Professor Johnson calculated that if births had continued at the pre-recession rate, Americans would have had 3.4 million additional babies in 2008–2015.

He found no evidence to suggest that this trend changed in 2016, so the total is likely near 4 million by now.

This happened even though the number of women of childbearing age actually increased during this period.

It’s no mystery why

People who are experiencing economic and financial difficulty are less likely to have children.

The missing babies have a macroeconomic effect. All those jobs that would have been created in hospital maternity wards and eventually day care centers, kindergartens, and public schools aren’t materializing.

And then there’s the billions of dollars that aren’t spent on baby food, diapers, and clothes. Plus, sometime around 2025, we may start noticing fewer new workers entering the labor force.

This plunge of birthrates is not a new phenomenon, by the way. Contrary to what many people believe, the developed world has been on the fast track to population decline since at least the 1970s—a trend visible in many countries, from Germany to Japan.

However, even without children, the primal human urge to care and nurture has to find an outlet. Which is where our furry friends come in.

A recession-proof industry

For many people, pets serve as a less expensive and less burdensome substitute for children. You get an idea just how much Americans adore their pets when you walk into PetSmart and see how much people spend on animal food, beds, and toys.

Pets make our life better… but they definitely aren’t free.

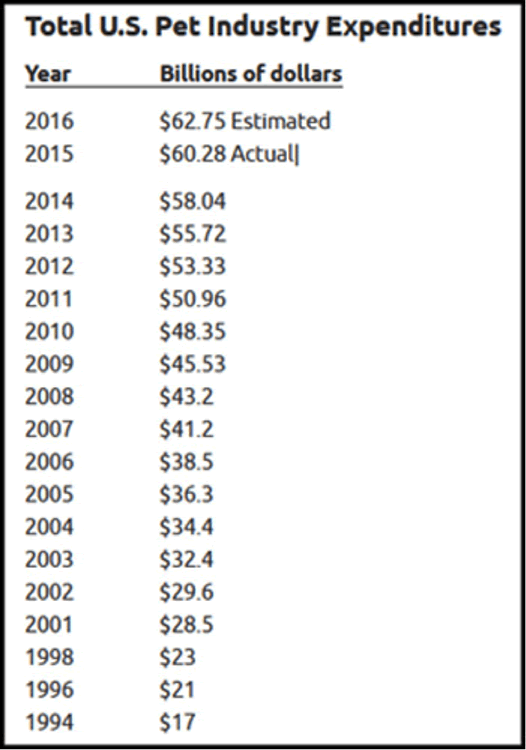

According to the American Pet Products Association (APPA), US consumers will spend $62.75 billion on pet food, supplies, and services this year.

Even more interesting is the growth curve in pet spending. It’s been rising at the same time as human birth rates have been falling.

The APPA data shows that pet spending in 2007, before the Great Recession, was $41.2 billion. That means the market has grown over 50% since then, far faster than most other sectors of our sluggish economy.

Furthermore, pet spending has grown steadily every year for more than two decades.

You would think people cut back on pet expenses in recessions, but amazingly, that’s not the case. It’s that caring instinct again. Just as parents put their children’s needs ahead of their own, many pet owners will tighten their own budget in order to provide for their animals.

Subscribe to Connecting the Dots—and Get a Glimpse of the Future

We live in an era of rapid change… and only those who see and understand the shifting market, economic, and political trends can make wise investment decisions. Macroeconomic forecaster Patrick Watson spots the trends and spells what they mean every week in the free e-letter, Connecting the Dots. Subscribe now for his seasoned insight into the surprising forces driving global markets.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.