Systemic Risk Spreads as Gold Loses Safe-haven Status

Stock-Markets / Credit Crisis 2008 Aug 07, 2008 - 06:47 PM GMT Less than meets the eye…is a good description for the Wal-Mart July sales report . The sales results, along with cautious outlooks for August, left little hope for any lasting boost from tax rebate checks to prop up consumers headed into the back half of the year and an all-important December holiday season.

Less than meets the eye…is a good description for the Wal-Mart July sales report . The sales results, along with cautious outlooks for August, left little hope for any lasting boost from tax rebate checks to prop up consumers headed into the back half of the year and an all-important December holiday season.

"The stimulus (checks) really had a marginal effect at best and it has run its course and there's no carry-through," said Retail Metrics President Ken Perkins. "It's difficult to see where some sort of boost in spending is going to come from."

Wal-Mart, the world's largest retailer, said its July sales at U.S. stores open at least a year, or same-store sales, rose 3 percent, missing Wall Street expectations for a gain of 3.4 percent. Target's same-store sales fell 1.2 percent, while Wall Street had forecast a decline of 0.3 percent.

The Consumer Price Index was up 5.6% year-over-year in the latest report, it is fair to say that sales actually slumped 2.6% this month at Wal-Mart, in real purchasing power. But wait…there is more! Also noteworthy is the fact that the three main items that consumers go to Wal-Mart for are groceries, flat-screen television sets and gasoline. Considering that prices in energy rose 34.7% and food rose by 6.6%, this report is borderline disastrous.

After the bailout...Freddie reports massive losses.

The timing could not have been worse (or better, depending on your point of view). Four days after President Bush signed the largest financial bailout in history, Freddie Mac (FRE) reported its worst loss in history. The question in my mind is, was this information disclosed to Congress and the President prior to signing the bailout bill? In legal terms, this is called a “material fact” that could influence the decision whether we want to support this company…or not.

Instead of investigating whether Freddie and Fannie may have lobbied Washington a little too hard and possibly lied about their financial condition, the Chairman of the House Oversight Committee is on a witch hunt to see who may have leaked information about Fannie's and Freddie's true condition causing a steep decline in its stock value . Maybe the market already knew that.

Remember Ground Hog Day?

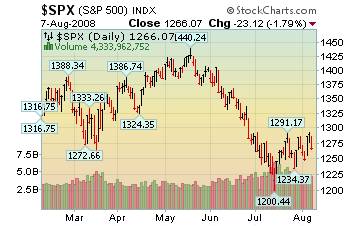

Well, we may be reliving that episode again. The market doesn't seem strong enough for a “breakout,” so it rallies up to “resistance” and fails…for the third time.

Well, we may be reliving that episode again. The market doesn't seem strong enough for a “breakout,” so it rallies up to “resistance” and fails…for the third time.

Today stocks are in retreat due to Wal-Mart's anemic sales report and AIG suffered its biggest decline in a quarter century. Will it recover from the bad news and go higher? Or will it give up and roll over? Stay tuned!

Treasury Bonds up on bad news.

There was a bid in Treasuries today, as bad news seemed to come from every quarter. Investors and traders seem to scurry for safety to treasury bonds when things are looking grim. However, treasuries are not looking that well, either. It appears that the larger picture shows a downtrend, so this may not be the safest place to put money as an alternative to stocks.

There was a bid in Treasuries today, as bad news seemed to come from every quarter. Investors and traders seem to scurry for safety to treasury bonds when things are looking grim. However, treasuries are not looking that well, either. It appears that the larger picture shows a downtrend, so this may not be the safest place to put money as an alternative to stocks.

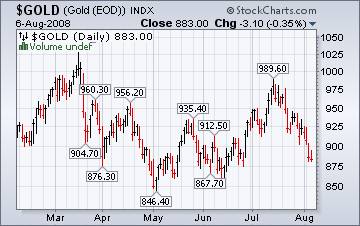

Gold has lost its value as a safe haven.

Gold futures fell more than $5 an ounce Thursday to tally a loss of almost 5% in five sessions as the dollar gained against other major currencies, dulling demand for the precious metal.

Gold futures fell more than $5 an ounce Thursday to tally a loss of almost 5% in five sessions as the dollar gained against other major currencies, dulling demand for the precious metal.

I agree with the assessment that the ultimate support for gold is in the $845-850 range. The chart is clear.

We have a failure to thrive in the Nikkei, too

Japan's stocks fell, led by banks, on concern an economic slowdown will cause financial companies to write down more assets and incur greater losses from bad loans.

Japan's stocks fell, led by banks, on concern an economic slowdown will cause financial companies to write down more assets and incur greater losses from bad loans.

The concern in Japan is the worsening fundamentals in the U.S. AIG's huge losses today reverberated across the globe, especially to countries that are dependent on trade with us.

Will bargain seekers send the Shanghai index higher?

Chinese stocks were modestly higher today, in expectation of the flood of business coming in with sightseers, athletes and attendees of the Olympic Games. Property stocks also rebounded from heavy selling earlier in the week. However, financial stocks continued their decline as uncertainty about the credit crisis in the U.S. lingers.

Chinese stocks were modestly higher today, in expectation of the flood of business coming in with sightseers, athletes and attendees of the Olympic Games. Property stocks also rebounded from heavy selling earlier in the week. However, financial stocks continued their decline as uncertainty about the credit crisis in the U.S. lingers.

Frankly, the market cannot be predicted," said Zhang Linchang, a strategist at Guotai Junan Securities in Shanghai. "I think it's higher due to investors' expectations for a big jump on the Olympics' opening day."

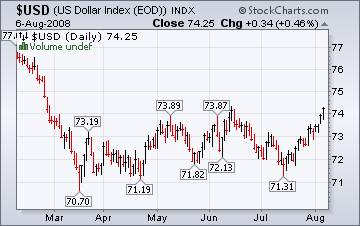

A possible breakout in the U.S. Dollar is developing.

The dollar fell from a near seven-week peak against the euro ahead of a European Central Bank meeting today at which rates may be left unchanged. But one of the things it has accomplished is a potential breakout above previous highs. The voices that have been bashing the dollar are becoming less strident. Could it be the trend has changed?

The dollar fell from a near seven-week peak against the euro ahead of a European Central Bank meeting today at which rates may be left unchanged. But one of the things it has accomplished is a potential breakout above previous highs. The voices that have been bashing the dollar are becoming less strident. Could it be the trend has changed?

What? No ATM on my house?

Morgan Stanley , the second-biggest U.S. securities firm, told thousands of clients this week that they won't be allowed to withdraw money on their home-equity credit lines , said a person familiar with the situation.

Morgan Stanley , the second-biggest U.S. securities firm, told thousands of clients this week that they won't be allowed to withdraw money on their home-equity credit lines , said a person familiar with the situation.

Most of the clients had properties that have lost value, according to the person, who declined to be identified because the information isn't public. The New York-based investment bank will review home-equity lines of credit, or HELOCs, monthly from now on, the person said yesterday. ‘ Nuff said.

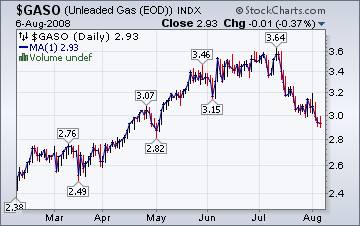

Gasoline prices are sstill higher than a year ago.

The Energy Information Administration's This Week In Petroleum tells us that; “The U.S. average retail price for regular gasoline fell for the fourth week in a row, losing another 7.5 cents to 388 cents per gallon and tumbling 23.4 cents from the all-time high set on July 7. On the East Coast, the price dropped 7.2 cents to 388.8 cents per gallon. The price in the Midwest went down 5.5 cents to 377.2 cents per gallon, and, although that price was 94.4 cents higher than a year ago, the Midwest was the only region where the one-year price differential was less than a dollar.”

The Energy Information Administration's This Week In Petroleum tells us that; “The U.S. average retail price for regular gasoline fell for the fourth week in a row, losing another 7.5 cents to 388 cents per gallon and tumbling 23.4 cents from the all-time high set on July 7. On the East Coast, the price dropped 7.2 cents to 388.8 cents per gallon. The price in the Midwest went down 5.5 cents to 377.2 cents per gallon, and, although that price was 94.4 cents higher than a year ago, the Midwest was the only region where the one-year price differential was less than a dollar.”

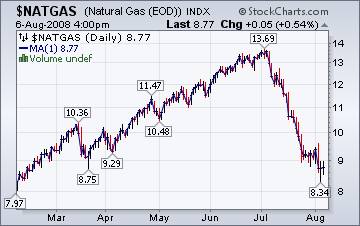

Edouard was no threat.

The Energy Information Agency's Natural Gas Weekly Update tells. “ Price decreases during the report week were significant in the majority of trading locations in the Lower 48 States, as mid-summer temperatures were relatively moderate and a threatening tropical storm system did not significantly interrupt supplies in the Gulf of Mexico . Unlike storm systems that form in the Atlantic Ocean and track through the Caribbean, Tropical Storm Edouard formed in the Gulf of Mexico last weekend, giving the industry very little time to implement emergency precautions such as evacuations. However, the threat of interruptions to offshore supplies proved short-lived despite the storm's proximity to infrastructure along the Louisiana-Texas border. Shut-in production never exceeded 1 Bcf per day and all affected platforms and rigs are expected to be re-populated soon,

The Energy Information Agency's Natural Gas Weekly Update tells. “ Price decreases during the report week were significant in the majority of trading locations in the Lower 48 States, as mid-summer temperatures were relatively moderate and a threatening tropical storm system did not significantly interrupt supplies in the Gulf of Mexico . Unlike storm systems that form in the Atlantic Ocean and track through the Caribbean, Tropical Storm Edouard formed in the Gulf of Mexico last weekend, giving the industry very little time to implement emergency precautions such as evacuations. However, the threat of interruptions to offshore supplies proved short-lived despite the storm's proximity to infrastructure along the Louisiana-Texas border. Shut-in production never exceeded 1 Bcf per day and all affected platforms and rigs are expected to be re-populated soon,

Talk of financial system breakdown moves from the fringe to the mainstream .

David Hirst gives us a good overview of the emerging line of reasoning about our economy. Until recently, no one could imagine that our financial system could be so broken. After promises upon promises that the crisis was finally over, we now realize it was even greater than we could have imagined.

THE "systemic risk" and "systemic failure" of the West's financial system have been concepts hanging around the fringes of economic thought for months. The expressions, suggesting a complete breakdown in the complicated arrangements by which money is channeled around the world, attracting fees and doing little else, were shunned by the bulk of the economic community.

But by late this week, they suddenly seemed to be on the lips of economic pundits. This followed the announcement that big banks and brokerage firms had agreed to policy changes aimed at "easing the risk of a collapse in the $US62 trillion market for credit-default swaps".

Apart from some of those who have been highlighting systemic risk and/or failure for some time, the fact this was suddenly a topic of conversation for bankers and regulators might explain the extraordinary plunge in financial stocks on Wednesday in New York .

We're on the air every Friday.

Tim Wood of www.cyclesman.com , John Grant and I are back in our weekly session on the markets. This week we debate what the market is telling us, near-term. It should be fascinating. You will be able to access the interview by clicking here .

New IPTV program going strong.

This week's show on www.yorba.tv is packed with information about the direction of the markets. I'm on every Thursday at 4:00 pm EDT . You can find the archives of my latest programs by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.