Going Long The Euro Could Be The Trade Of 2017

Currencies / Euro Jan 27, 2017 - 06:06 PM GMTBy: John_Mauldin

BY JARED DILLIAN : For a long time now I've held the theory that you have to be completely insane to be a successful investor. Like, right out of your tree.

BY JARED DILLIAN : For a long time now I've held the theory that you have to be completely insane to be a successful investor. Like, right out of your tree.

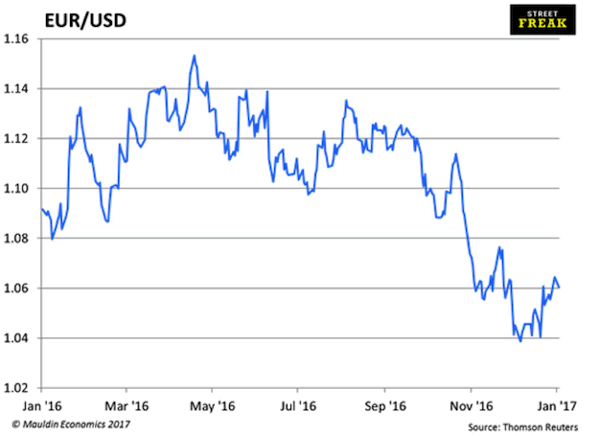

Let me put it this way: Just a few weeks ago we were all sure, 100% positive that the US dollar would continue to appreciate against the euro, because the Fed was more hawkish, and the ECB was going to have negative rates and QE forever.

In this town, your luck can change just that quickly.

Now people are not so sure.

Here’s what changed

Well, there have been a bunch of Fed speakers, and none of them sounded like raising rates was particularly urgent (I was wrong).

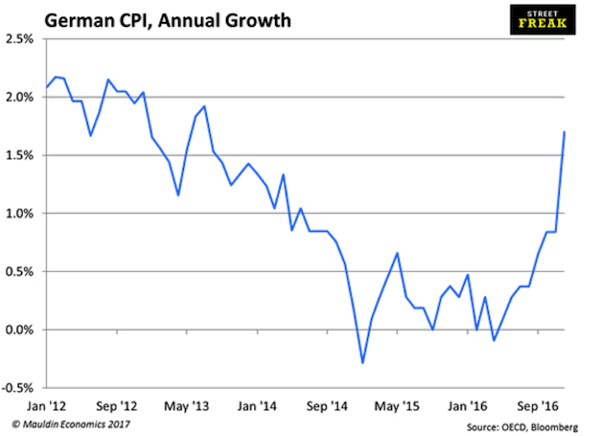

There also has been a backlash building in Europe about zero/negative rates and how they are destroying savings.

Plus, inflation is starting to ramp, especially in Germany.

Going long the euro could end up being the trade of the year.

If I had said that three weeks ago, you would have told me I was insane.

So we have to ask ourselves: what really changed, from one month to the next, aside from a few Fed speakers?

Really, not much—in December, everyone believed one thing, and in January, everyone believed the opposite thing.

You see why trading is so hard?

A few thoughts on this:

- This is the primary reason why so many people study technical analysis. The fundamentals are no help.

- Price is all that matters.

- Stocks that stop going down on bad news are a buy. Stocks that stop going up on good news are a sell.

- I don’t spend a great deal of time looking at charts, but as I've said before, when sentiment gets a little one-sided, I pay attention.

- The bull market story is always most compelling on the highs. The bear market story is always most compelling on the lows.

I have made pretty much zero money doing things that “make sense.” I have made the most money doing things that people have said were insane.

If you bought EURUSD in the 1.03 handle, you were insane. But it would have been the right trade.

The strong-dollar trade depends on Trump

One of the things the market has had a hard time understanding is the idea that we might get tighter monetary policy elsewhere in the world. I've said for a while, the Fed will hike...probably three times.

But what people were not counting on was the ECB hiking. Or the BOC hiking. Or the BOE hiking. Heaven forbid the BOJ gets hawkish.

Last month, we were operating under this model that the US was the most hawkish central bank in the world. And it sure looked like Yellen was going to rip rates on Trump, no matter how strong the dollar got. And then all this happened.

All of this is connected. And it all comes down to Trump and his ability to set inflation expectations higher.

If the market believes that we’ll grow north of 4% on Trumponomics, bonds sell off, the Fed hikes rates, and the dollar gets stronger. Yield curves steepen, the banks rally. I discussed a lot of this back in November in The 10th Man (subscribe here for free).

If the market begins to doubt that will happen (like now), bonds rally, the Fed goes slow, and the dollar gets weaker. Yield curves flatten, the banks sell off.

If Trump doesn’t stick to his campaign promises—cut taxes, cut regulations, and deliver growth—you might as well kiss the strong-dollar trade goodbye. And my personal account.

Get Thought-Provoking Contrarian Insights from Jared Dillian

Meet Jared Dillian, former Wall Street trader, fearless contrarian, and maybe the most original investment analyst and writer today. His weekly newsletter, The 10th Man, will not just make you a better investor—it’s also truly addictive. Get it free in your inbox every Thursday.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.