Maps That Show The US’ Strategy In Asia-Pacific

Politics / GeoPolitics Feb 15, 2017 - 07:17 PM GMTBy: John_Mauldin

BY GEORGE FRIEDMAN AND JACOB L. SHAPIRO : Secretary of Defense James Mattis recently wrapped up his first international trip whose purpose was to “listen to the concerns of South Korean and Japanese leaders.”

BY GEORGE FRIEDMAN AND JACOB L. SHAPIRO : Secretary of Defense James Mattis recently wrapped up his first international trip whose purpose was to “listen to the concerns of South Korean and Japanese leaders.”

The two countries are crucial US allies in Asia, and both face serious threats in their near abroad.

Discussing security threats, though, wasn’t the main goal of Mattis’s trip. He was there to assure both countries that the Trump administration will not abandon the US alliance structure in the Pacific.

In light of Mattis’s visit, let’s take a look at current US military and investment positions in the Asia-Pacific region.

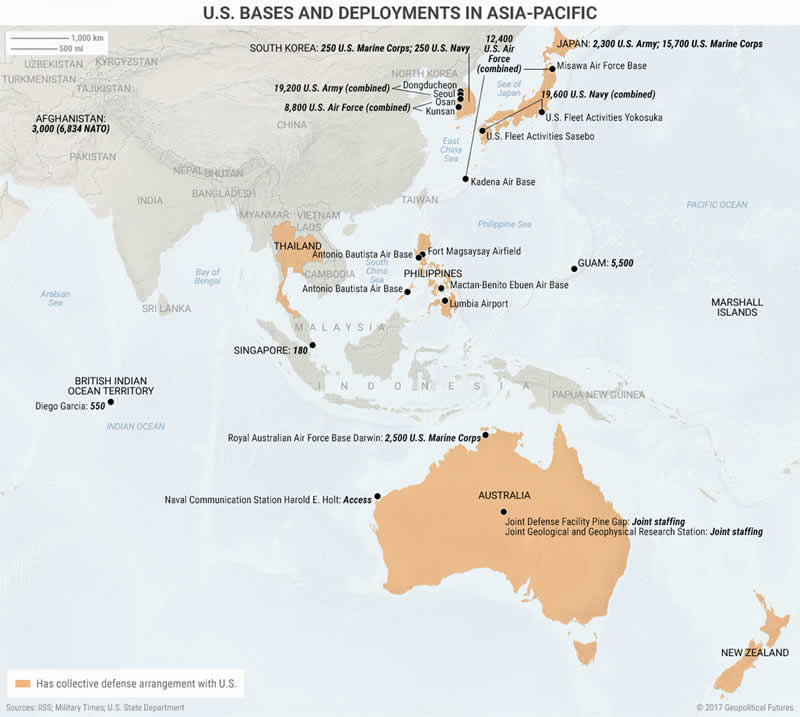

US Military Commitments in Asia-Pacific

The map above shows that the US is using containment as its main strategy with China.

US military assets stationed in Asia-Pacific countries have two purposes. First, they ensure US naval power projection in the Pacific Ocean. Second, they help keep Chinese ambitions in check.

Besides Guam (which is US territory), the US has no sovereign soil in the Western Pacific Ocean. That means the US must have good relationships with strategically located countries in the Pacific where it can base ships and soldiers.

Japan, South Korea, and Australia are the most important US allies in the region. The US also maintains varying degrees of cooperation with countries like the Philippines, Thailand, and Singapore.

The Philippines is a key part of US strategy, but it is also being courted by China.

At present, China is the second-largest economy in the world. It is pouring money into its military. It is also trying to attract cooperation from other countries… like the Philippines.

The Mutual Defense Treaty between the US and the Philippines remains in place, but the two sides only recently agreed on which Philippine bases the US can use. The US still hasn’t been allowed to return to the much-coveted naval base at Subic Bay. And the Philippine president is full of anti-US rhetoric.

As we’ve written before, the US wants naval control of the oceans. It has a strong navy, but a navy by itself isn’t enough. Containing China is a major part of its Pacific strategy. Even if China could be contained by means other than the US, the US would still want Pacific partners to help project its naval power.

Beneath all the noise is the simple fact that the US maintains an impressive military presence in the Pacific. Mattis will remind US allies how important they are to US interests.

He will also convey that US intent can be measured in commitments, not headlines.

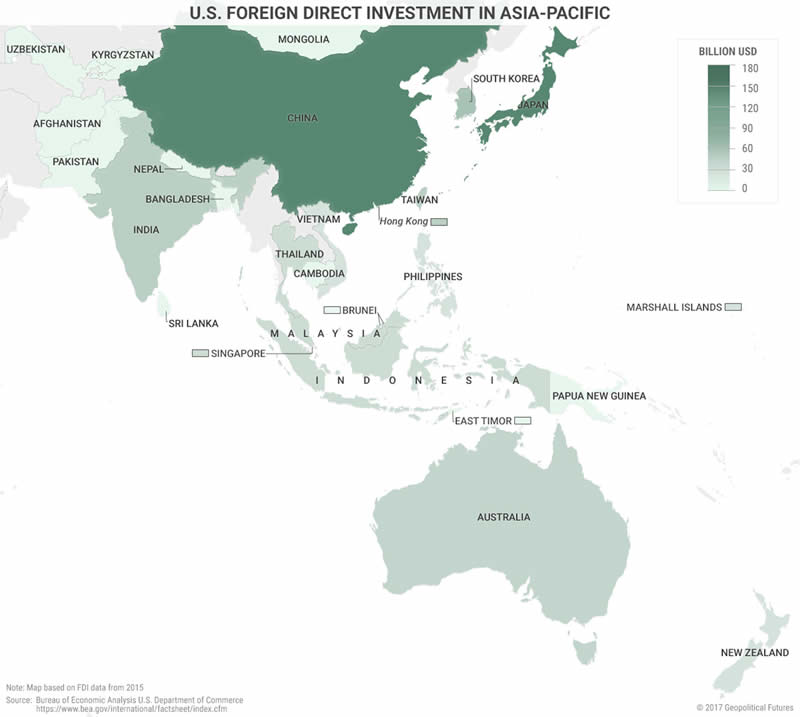

US FDI in Asia-Pacific

In addition to its military strategy, the US is using an economic strategy. It wants countries to see the economic benefits of cooperating with the US. As the largest economy in the world, the US used its economic power very effectively in the past.

The first thing to note from the map above is that the largest destination for US foreign direct investment (FDI) in the Asia-Pacific region is China. China’s economy is in the midst of a huge transition. The US-Chinese economic relationship is important to both sides, but even more so for China.

The US is China’s largest export market. This happened in part because US companies could profit by moving production to China. Now, Beijing needs to move up the value chain by attracting foreign investment and technology. The US is a major source for this. If China seriously challenges the US, it risks the loss of these economic benefits.

The next five largest beneficiaries of US FDI in the region are crucial American allies and partners. Japan, South Korea, and Australia are at the top of the list. Singapore (located on the strategically important Strait of Malacca) is next.

The map above is a contrast to the first, which shows military strategy. This map of US FDI distribution shows a strategy not of containment but of widespread US economic influence across Asia-Pacific.

It should also be noted that some US FDI is directed to small countries, such as the Marshall Islands. The amount of FDI is lower because these are smaller economies, but the investments are arguably more important for the economic development of those countries.

Being a US ally or partner means access to US investment. The price of being a US ally can be high, but it also comes with key benefits.

Mattis’s Message

These two maps are snapshots of US power… and US needs. The US imperative is to maintain its dominance of the world’s oceans. Ships need ports. Planes need bases.

For these basic needs, the US must have good relations with strategically located countries in the Pacific. In turn, these countries rely on the US for protection and for preservation of the status quo.

The Trump administration wants more from its allies… not less. Mattis’s job will be to convey that US security guarantees are reliable. He will also remind these countries that their relationships with the US exist because of shared interests.

The US asking more of these countries does not mean US presence will decrease. admitting US presence will not solve all their problems.

admitting US presence will not solve all their problems.

Prepare Yourself for Tomorrow with George Friedman’s This Week in Geopolitics

This riveting weekly newsletter by global-intelligence guru George Friedman gives you an in-depth view of the hidden forces that drive world events and markets. You’ll learn that economic trends, social upheaval, stock market cycles, and more… are all connected to powerful geopolitical currents that most of us aren’t even aware of. Get This Week in Geopolitics free in your inbox every Monday.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.