Bounce in SPX, TNX and USD

Stock-Markets / Financial Markets 2017 Mar 08, 2017 - 03:10 PM GMT The SPX futures are mixed this morning. There is a better than even probability that SPX may rally to the potential targets (2380.00 to 2384.00) outlined yesterday afternoon. The reason why is that the Cycle has completed only 29 hours thus far. It must complete 30.1 hours. That gives us a potential rally until 10:00 am. Otherwise yesterday’s afternoon action counts as a horizontal correction. These formations are rare and must be taken with a grain of salt. However, the ensuing decline may provide us with more opportunities to see this phenomenon.

The SPX futures are mixed this morning. There is a better than even probability that SPX may rally to the potential targets (2380.00 to 2384.00) outlined yesterday afternoon. The reason why is that the Cycle has completed only 29 hours thus far. It must complete 30.1 hours. That gives us a potential rally until 10:00 am. Otherwise yesterday’s afternoon action counts as a horizontal correction. These formations are rare and must be taken with a grain of salt. However, the ensuing decline may provide us with more opportunities to see this phenomenon.

ZeroHedge reports, “Asian markets dropped following disappointing China trade and Japan GDP data, while European stocks rebounded for the first time in five sessions led by miners and banks. US futures were little changed as the dollar strenghtened, pressuring oil further below $53; sterling slid for the eighth day out of nine, dropping under 1.215 before the chancellor of the exchequer delivers his spring budget. Treasuries are headed for their longest losing streak since 2012 ahead of a 10Y U.S. debt auction, and today's ADP private payrolls report.”

Speaking of payrolls, “Following January's surge in employment (biggest gain in 7 months), February's ADP print exploded higher to 298k (5 sigma above all expectations). This is the third biggest monthly employment gain of the expansion. It appears the 'Trump Effect' is the biggest driver as the ADP payroll surge was mostly due to a record surge in employment for goods-producing industries.

Private sector employment surged by 298,000 for the month, with goods producers adding 106,000. Construction jobs swelled by 66,000 and manufacturing added 32,000.

3rd best month of the recovery:”

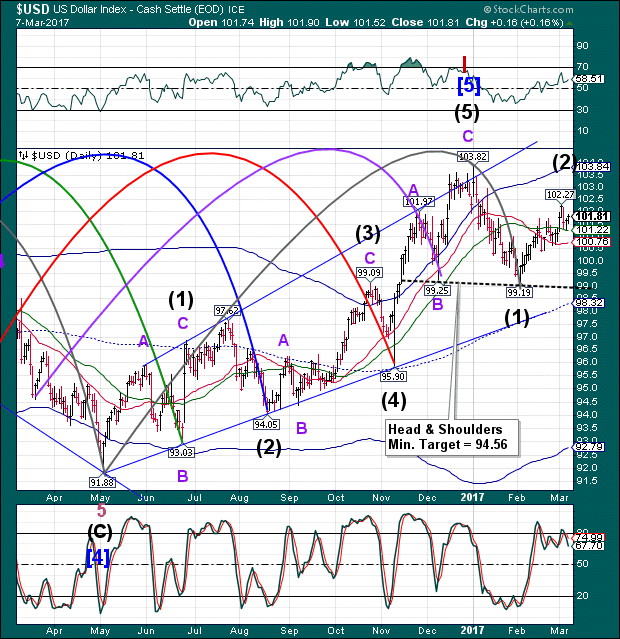

The USD rallied this morning to 102.15. It still needs to exceed the previous high of 102.27 to complete the retracement (a-b-c). We may see this by the end of the day.

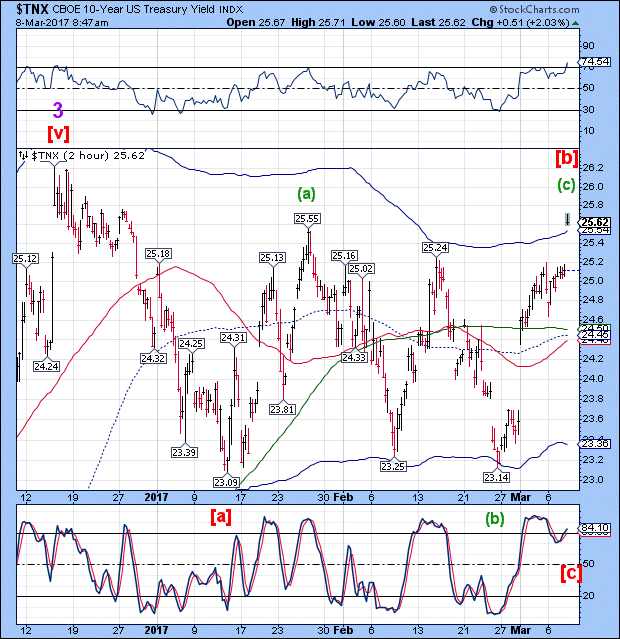

TNX spiked to its Wave [b] high this morning. The Cyclical period of strength appears to be ending and the next Master Cycle low is due on March 20.

If the correlation between TNX and SPX holds, it may extend the SPX decline to March 20, as well. What this also implies is that the decline in the USD and SPX may also influence the Fed’s decision to raise rates on March 20.

ZeroHedge reports, “Following the massive ADP employment beat (but productivity disappointment), March rate hike odds finally upticked to certainty. Fed Funds futures now imply a 100% chance that The Fed hikes next week.

Up from low 20s to 100% in a month...”

VIX futures are down at this time. The odds appear to be better-than-even that VIX may decline to the Cycle Bottom support at 10.48, making the formation a more complex Wave 2. The current structure still holds should the VIX decline stay above 10.55.

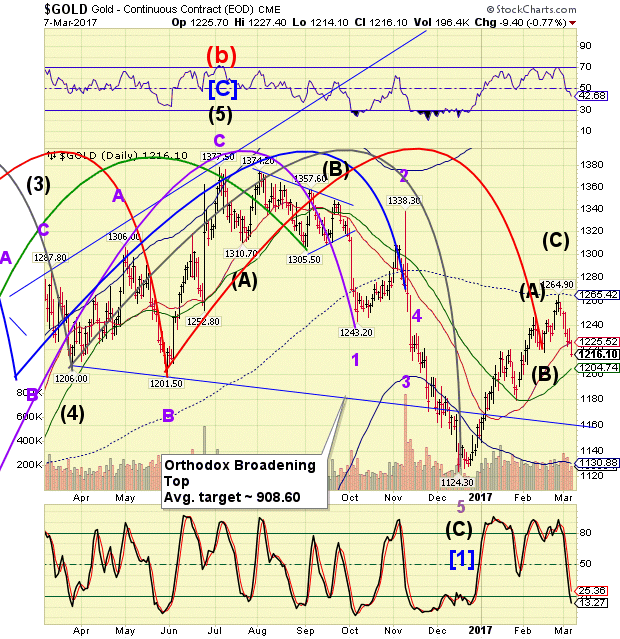

Gold futures declined to 1208.50 this morning. It is on an aggressive sell signal until the decline exceeds the 50-day Moving Average at 1204.74. The chance of a bounce above the 50-day is high, so uninvested cash should wait for the bounce for another short position.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.