UK Stagflation, Soaring Inflation CPI 2.3%, RPI 3.2%, Real 4.4%

Economics / Inflation Mar 21, 2017 - 06:20 PM GMTBy: Nadeem_Walayat

The implications of sterling's sharp drop in the wake of the Brexit vote were inflationary resulting in an an increase the price of imports and therefore has been exerting upwards pressure on shop prices as suppliers restock at the worse exchange rate that already depressed retailers such as the big supermarkets had delayed fully implementing that is likely to result in a crisis for the retail sector during 2017 that literally faces a perfect storm, that could even result in a Woolworth's moment...

The implications of sterling's sharp drop in the wake of the Brexit vote were inflationary resulting in an an increase the price of imports and therefore has been exerting upwards pressure on shop prices as suppliers restock at the worse exchange rate that already depressed retailers such as the big supermarkets had delayed fully implementing that is likely to result in a crisis for the retail sector during 2017 that literally faces a perfect storm, that could even result in a Woolworth's moment...

The latest inflation data saw prices soaring during February 2017, jumping on the governments preferred economic propaganda measure of CPI from 1.8% to 2.3% (0.6% pre-brexit), a 0.5% jump in one month that annualises to a 6% momentum rate. Whilst the more widely recognised RPI inflation rate busted above 3% from 2.6% to 3.2% (1.4% pre-brexit) and real demand adjusted inflation broke above 4% to 4.4% (1.9% pre-brexit). Whilst factory gate price inflation also rose to 3.7%, signally higher future official inflation.

Whilst my long standing forecast expectations since shortly after the Brexit vote were for a far rapid rise in the rate of UK inflation towards a peak of CPI 2.8% and RPI 4% before declining towards the end of 2017:

- 04 Jul 2016 - BrExit Implications for UK Stock Market, Sterling GBP, House Prices and UK Politics...

- 04 Jul 2016 - BrExit Implications for UK Economy, Interest Rates, Bonds, Markets, Debt & Deficit, Inflation...

However what's worse is that Britain's inflation trend goes beyond the Brexit sterling plunge, instead is becoming subject to a global inflation surge as a consequences of 8 years of central bank zero interest rates and rampant money printing as the US CPI inflation graph illustrates.

US CPI jumped sharply higher to 2.5% up from 1.7% the month before. Similarly Germany the bastion of price stability is also witnessing the early signs of an surge in inflation, rising to its highest level for 3 years to 1.7%, with the economic basket cases such as Spain not far behind on 1.4%, that collectively have sent euro-zone inflation soaring to 1.8% from 1.1% the month before, which is a far cry from the deflation expectations of economies that have remained in economic stagnation, even depression for the past 6 years.

The big question mark is the surge in global inflation temporary or are we about to finally see runaway inflation as a consequence of the world central banks collectively having conjured some $20 trillion out of thin air and printed about $100 trillion in additional debt (government bonds) to save the bankrupt banking crime syndicate. Rampant money printing that asset prices such as housing and stocks have already greatly leveraged themselves to in the mother of all bull markets, far beyond anything any one could have imagined back at the start of the bull run in 2009.

Well we are clearly starting to see some seepage out of the banking / asset price system towards feeding the wage price spiral (including in work benefits), the consequences of which will be for the further loss of purchasing power of savings / bond investments and earnings. Whilst continuing to inflate the price of assets that cannot be easily printed such as housing.

Which implies to expect a far higher and sustained spike in UK inflation during 2017 as the temporary Brexit Tsunami inflation wave becomes absorbed into a global rising inflation climate, the real world consequences will be one of a 10% hike in UK food prices during 2017 that will have a severe impact on consumers who are already facing energy price hikes of as much as 14% from the likes of NPower with city councils across England warning of hikes of 5% to 10% in council tax to cover the shortfalls in central government funding, all of which is leading towards a perfect storm for the retail sector that looks set to trigger thousands of job losses and store closures.

In terms of inflation expect UK CPI to spike above 3% and then remaining in the 2-3% range well into 2018.

STAGFLATION

Current wage growth is estimated at 2.1% down from 2.3% for January so now official inflation at 2.3% exceeds worker earnings implying that workers on average are now basically just standing still. However in reality actual inflation is far higher with RPI at 3.2% and real demand adjusted inflation at 4.4% implying that the UK economy has entered a period of stagflation, one of the real terms erosion of the purchasing power of earnings, i.e. falling demand which increases the risks of a recession as the economy enters a depressed stagnant state where workers are not able to maintain consumption of goods and services resulting in economic depression with inflation i.e. stagflation.

Therefore expect UK GDP to decline from its current rate of +2.2%, that a year from now could be at GDP of sub +1%

INTEREST RATES

Normally one would expect the Bank of England to respond to soaring inflation by hiking interest rates. Unfortunately we have not been living in normal times since 2008. Therefore it is highly probable the Bank of England will do nothing instead decide to ride out the inflation spike hoping that it turns out to be temporary, especially if the economy starts to stall.

Retail Sector Crisis - Shrinkflation and Fake Prices

The Supermarket giants that dominate Britain's retail sector have both delayed passing on most of the consequences of the sharp fall in sterling to consumer in the form of price hikes and by playing a game of hide the inflation with consumers, which is why the inflation indices have so far not quite spiked as sharply higher as I originally expected.

Once such example of the game all major producers / super markets are playing is one of shrinking package contents. A 10% to 15% cut in pack contents achieves far more inflation than from sterling's drop which on average would equate to about 5% of the price of goods in the shops.

For a real world example of shrinkflation have a look at this photo of a super market shelf selling walkers crisps multi-packs for 99p, do you notice anything strange ?

Here's a closer look, now do you see ?

Yes that's right, crisps multi packs that had been sold in packs of 6 are now suddenly being sold in packs of 5 at the SAME price! An effective stealth inflation price hike of 17% on the item without impacting the inflation indices! In fact for ultimate consumer confusion the 5 and 6 packs are even being mixed together to better fool consumers into buying.

However, arrogance born of size has led the super markets to go one step further, perhaps one step too far as the recent BBC investigation into TESCO's FAKE Shelf prices revealed! Shelf prices that FAIL to convert at the checkout tills by virtue of Tesco having left expired offers on the shelf's, effectively fooling customers into buying products at literally DOUBLE the expected price. I covered Tesco's fake shelf prices in the following recent video, though again all of the major super markets play the same game to some extent, it's just that Tesco got carried away and triggered a BBC investigation:

The delays in price hikes and the games the super market giants are playing that customers are eventually seeing through will continue to convert into rising food price inflation during 2017, perhaps by as much as 10% which will have a severe impact on consumers and the already depressed retail sector.

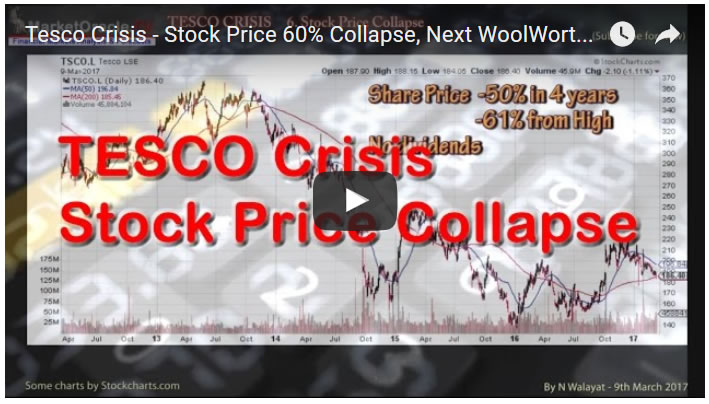

Tesco Crisis - Stock Price 60% Collapse, Next WoolWorth's?

As an example of the pain the retail sector is suffering, Tesco by far ranks as Britain's number 1 retailer in terms of sales of over £54 billion for the last accounting year, more than twice its nearest rival Sainsbury. The Tesco stock price says it all of just how badly run Britain's super market giant has been for many years, which goes beyond the usual dynamics of a badly run businesses that over expanded during the good years. For you know when a companies in deep trouble when the Serious Fraud Office has been investigating it for several years. And whilst the fraud is estimated at £326 million, however when it's all done and dusted the verdict could be accompanies by an even bigger shock to Tesco's finances, a mega-fine of upwards of £500 million.

At £1.87 the Tesco share price is trading at LESS than 50% of its 2013 high. That's a 50% LOSS of stock market value over the past 4 years, valuing the super market giant today at just £15bn. I am sure many inexperienced investors looking at the 50% collapse in the Tesco share price might be imagining how cheap Tesco is right now, find out what the prospects are for Tesco's stock price in my latest video.

More on the crisis the retail sector faces during 2017.

Ensure you are subscribed to my youtube channel for new videos as Britain counts down to BrExit.

By Nadeem Walayat

Copyright © 2005-2017 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.