4 Maps That Show Why Europe Is Destined for Extinction

Politics / European Union Apr 06, 2017 - 06:22 PM GMTBy: John_Mauldin

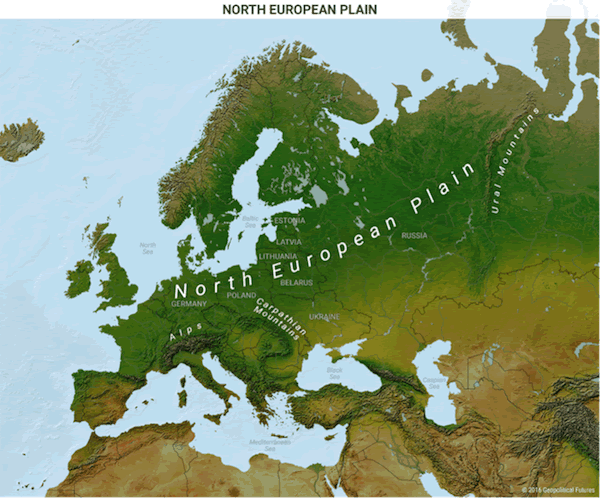

BY GEORGE FRIEDMAN: The European Peninsula runs from Portugal and Britain in the west, to St. Petersburg in the east, and the city of Rostov-on-Don in the southeast. It goes from the Mediterranean and Black seas to the North Sea and Baltic Sea.

BY GEORGE FRIEDMAN: The European Peninsula runs from Portugal and Britain in the west, to St. Petersburg in the east, and the city of Rostov-on-Don in the southeast. It goes from the Mediterranean and Black seas to the North Sea and Baltic Sea.

Access to rivers, the Mediterranean, and the North Atlantic has let the European Peninsula build trade routes and flourish economically.

However, as we’ve discussed before, the continent has always been quite diverse and splintered from a geopolitical perspective. Its borders are the result of hundreds of years of wars, treaties, and forced settlements.

Here are four maps that shows how much Europe is fragmented on all levels and why the European Union is destined for extinction. (Download my FREE e-book, The World Explained in Maps, to get more insight into the forces shaping our physical and financial worlds.)

Geography Has Little to Do with Borders or Safety

Let’s first take a look at Germany.

Germany lies south of the Baltic and North seas and north of the Alps. The country is in the center of the continent, on the flat North European Plain.

Germany has no significant natural boundaries. The country’s location, its veins of rivers, and access to seaports have let it access both European and world markets. Still, Germany’s geography also makes it vulnerable to armies, like from France in the west and Russia in the east.

As a result, Germany has often tried to rule the North European Plain through war and friendship.

Southern Europe has fewer navigable rivers good for trade paths. The Alps cut the Italian peninsula off from the rest of Europe. Mountains also form a wall between Spain and France.

Yet, they do not make the state safe. From Hannibal to Napoleon, armies marched through many Alpine passes into Italy. The Italian peninsula’s miles of coast also make it a target to invaders.

Modern Italy, Spain, and Portugal are far from world naval powers. Their geography stops expansion north.

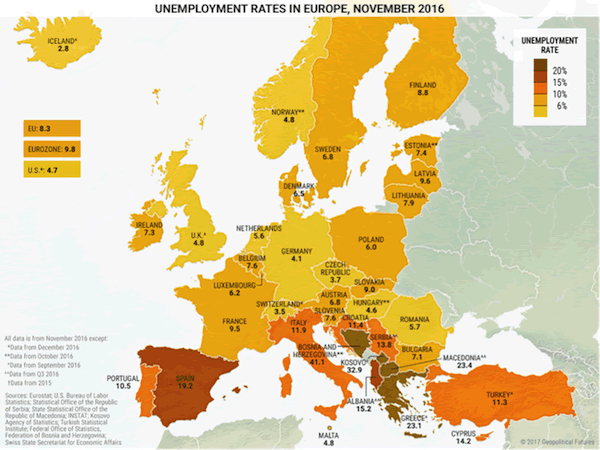

The EU is a Financial Catastrophe for Southern Europe

Southern Europe today is highly reliant on northern Europe.

Southern European economies have gained less from membership in the common market than the north. They do not gain from the EU’s control of monetary policy.

They are trapped in a monetary union with export giant Germany. These countries cannot devalue their currencies to protect their economies and promote social stability in times of financial stress.

The region’s economies have suffered over the years. Like we wrote about last year, Southern Europe is now having significant banking woes that may destabilize Europe’s financial system.

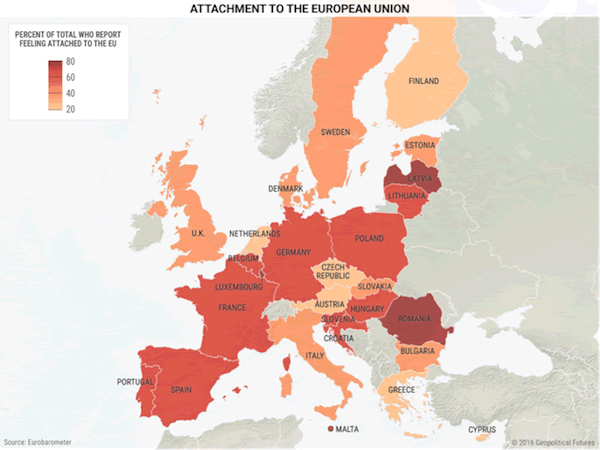

The EU is less popular in the region since the 2008 global crisis. Anti-establishment and Euroskeptic parties are gaining ground.

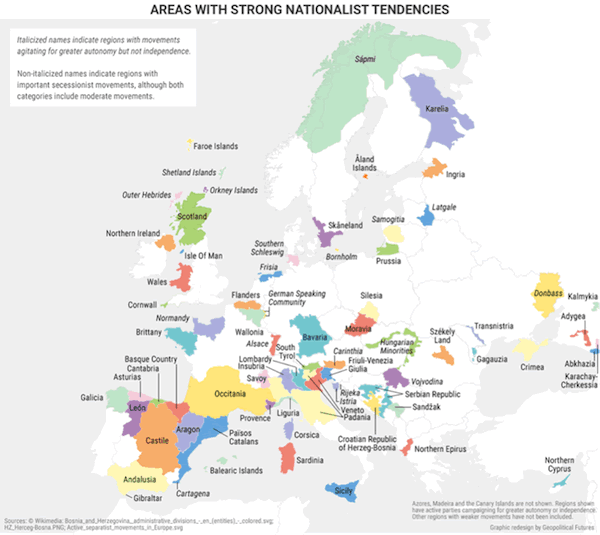

The Goals of the EU Founders and Other Nations Differ

Northern Europe—France, the UK, and the Nordic states—differs from the south in economic realities and geopolitical goals.

France is unique, wedged between the North Sea and the Mediterranean, and between Atlantic powers, European land powers, and southern European states. French strategy must keep an eye on Europe, the Atlantic, and the Mediterranean.

France aims to be Germany’s partner in leading the EU, but it lacks economic clout. It also differs from the east states on core economic and military issues.

British voters have asked to leave the EU. But geography and economics mean that the UK will likely keep close ties with Europe. As an island, Britain has a natural defensive wall. But rulers over the years were aware that invading armies could cross the Channel.

So, Britain’s chief strategic goal has been to lessen any potential security threats from the other side. Also, to stop the rise of a power able to rule the continent. Britain, once an empire, also needs broad trade networks.

Today, Britain has a dual strategy. It has a strong bilateral tie with the US while also staying a player in Europe. This is to hold some power and balance any potential hegemons.

In the east are Europe’s borderlands. This is a historically contested region. It lies from the Baltic states in the north to Bulgaria in the south. These lands are in two groups: Central and Eastern European states that have joined NATO and the EU, and old Soviet states (Belarus, Ukraine, and Moldova) as well as most of the Balkan states (some of which are in NATO and the EU).

These states are mainly involved with defining each of their ties with the peninsula. The EU’s breaking up has deepened divisions in the EU and NATO. West and east members of the blocs have different aims, which resulted in growing nationalist movements across the continent.

Divisions in the EU Are Reaching a Critical Point

Europe’s geography has made quite a diverse continent. As the EU weakens, regional and local needs are coming to the forefront. Divisions are getting deeper.

Grab George Friedman's Exclusive eBook, The World Explained in Maps

The World Explained in Maps reveals the panorama of geopolitical landscapes influencing today's governments and global financial systems. Don't miss this chance to prepare for the year ahead with the straight facts about every major country’s and region's current geopolitical climate. You won't find political rhetoric or media hype here.

The World Explained in Maps is an essential guide for every investor as 2017 takes shape. Get your copy now—free!

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.