What Makes Millennials Disturbingly Different?

Politics / Demographics Apr 07, 2017 - 08:14 AM GMTBy: Gordon_T_Long

In Stealth Fashion Millennials Are Rapidly Transforming Society

In Stealth Fashion Millennials Are Rapidly Transforming Society

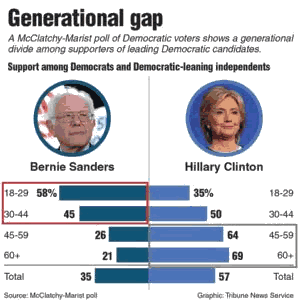

Something had mysteriously changed during the 2016 US Presidential primaries when an unlikely democratic candidate burst on the national scene with an unquestionable allure for the Millennial generation. How was it that a 'left wing' Bernie Sanders, who was of an age that he would be considered as a very old grandfather by this young generation, could draw such rousing support? What was it about this grey haired unknown senator from Vermont who so clearly represented the expectations, aspirations and frustrations of this new 'coming of age' generation?

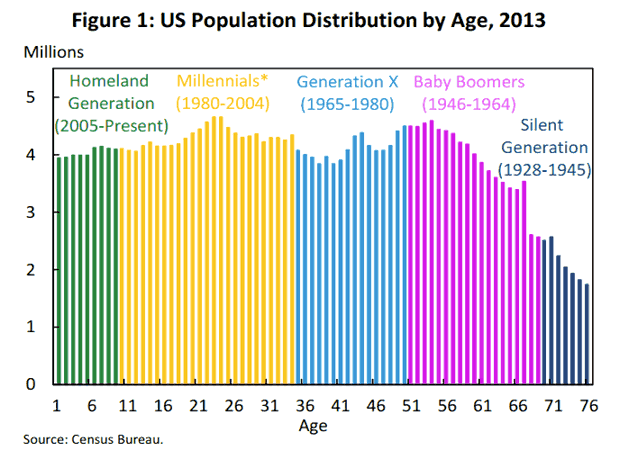

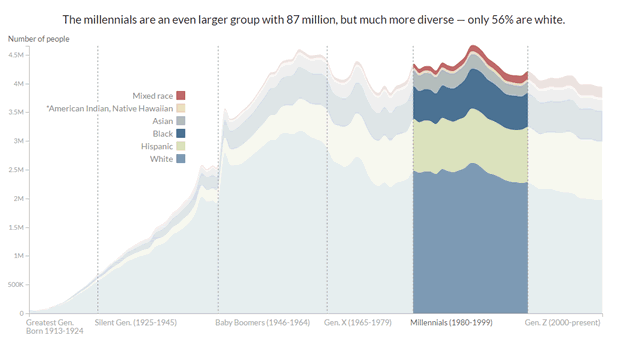

Millennials have silently emerged as a powerful and influential force because of their size and because of how contrasting their beliefs are from versus previous generations including only slightly older Gen-X.

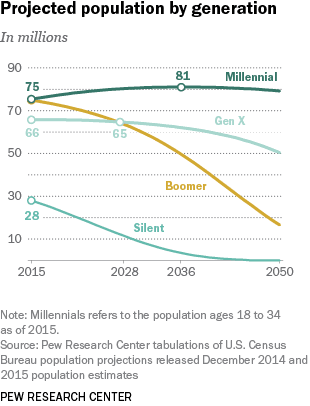

Millennials have surpassed Baby Boomers as the nation’s largest living generation, according to population estimates recently released by the U.S. Census Bureau. Millennials, defined as those ages 18-34 in 2015, now number 75.4 million, surpassing the 74.9 million Baby Boomers (ages 51-69) and Generation X (ages 35-50 in 2015) is projected to pass the Boomers in population by 2028.

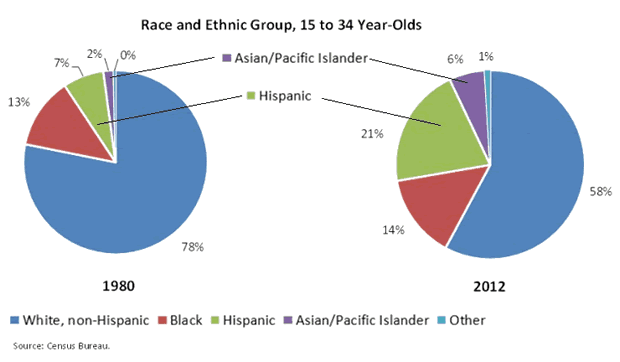

Very importantly, the Millennial generation continues to grow as young immigrants expand its ranks which presently account for over 15% of the total.

What Makes Millennials Different?

The Millennial generation grew up during an era of unprecedented changes and shocks which have profoundly influenced their views and choices:

- Millennials are older in household formations when they marry and have children compared to previous generations,

- Millennials have student debt loads that define and significantly frame this generations financial choices,

- Millennials are more educated than any previous generation as defined by percentage with undergraduate and post graduate educational attainments,

- There is a much more foreign born component of the millennial generation at 15%, than any generation going back to the early 1900's European immigration wave to the US,

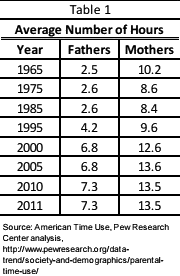

- Family is much more important as a result of changes in parenting since roles such as fatherhood have taken on more involvement, youth event participation and inward family cocooning. A 1997 Gallup survey found that 9 in 10 children (a population comprised entirely of Millennials that year) reported high levels of closeness with their parents and were personally happy with that relationship. Their tight relationship with their parents extends to work, where some companies report establishing relationships with parents of their Millennial employees. The Millennials’ close relationships with their parents might be related to the greater time they spent with their parents growing up. According to Pew (2014), hours spent parenting have increased for both fathers and mothers, tripling for fathers since 1985 and increasing by 60 percent for mothers. These increases have been particularly pronounced among college-educated parents, with college-educated mothers increasing their childcare time since the mid-1990s by over 9 hours per week, while less educated mothers increased their childcare time by only over 4 hours per week.

- Millennials are much more pronounced to move to Urban centers versus being interested in Suburban living,

- Millennial are the most technology-centric generation yet, as they came of age in the era of the internet / smart phones and fully embraced social media to change how they communicate and socialize,

- Millennials also came of age during developments that deeply shaped their sense and need for security.

- 911 and the emerging reality of terrorism in the US,

- Iraq and Afghanistan Wars where fellow students fought,

- School shootings across the nation and the security changes required,

- Corporate Downsizing, Right-Sizing and Out-Sourcing which effected their financial security of the family,

- The Millennial generation has a much larger sense of "entitlement" since they were often raised and educated with a sense of "you deserve" versus "you earned",

- Millennials believe student loans should be forgiven and is one of the reasons Bernie Sanders was so popular,

- Millennials are much more tolerant of others and cultural differences and react strongly to hate speech, threats and racism

- Millennials earn 20% less than Baby Boomers did at their age.

All of these differences are now being felt as the Millennial generation becomes an increasingly larger component of the US economy.

Three Major Economic Ramifications

My Macro Analytics Co-Host Charles Hugh-Smith believes these differences are being witnessed by the following three Economic ramifications:

1- URBAN versus SUBURBAN LIVING

THE SHIFT

- Millennials favor foot-traffic urban shopping/entertainment/dining districts,

- Millennials favor streets with high densities of venues, cafes, brew-pubs, etc. which are safe and close to mass transit,

- These urban districts are expanding in small cities, college towns, etc.

- The experience is as important as pricing: Millennials value convenience and a variety of experiences, not just convenience and price.

- Long commutes and suburban shopping malls are not convenient to Millennials

- Home ownership rates are falling due to the very high cost of urban-core housing,

- By choice or necessity Millennials rent rather than buy,

THE ECONOMIC RAMIFICATION

- Future Single Residential Housing Requirements may be less and housing prices exposed as Baby Boomers leave their homes for Assisted Living or Nursing Homes.

- Boomer wealth is largely tied up in costly homes--who will buy these houses as Boomers sell to downsize/retire?

2- AUTO & LIGHT TRUCK SALES

THE SHIFT

- Millennials favor Uber and Car-sharing over auto ownership.

- Urban living and avoiding longer commutes reduces the need for auto ownership.

THE ECONOMIC RAMIFICATION

- This has implications for auto/truck sales and gasoline consumption.

- Can 18M / year of auto sales be maintained?

http://www.zerohedge.com/news/2017-03-04/us-motorist-unwell-miles-driven-suffer-biggest-slowdown-over-2-years3- RETAIL SHOPPING & RETAIL COMMERCIAL REAL ESTATE

THE SHIFT

- Millennials favor the convenience of online shopping,

- Millennials do not find value in big suburban malls

- Millennials often work a lot of hours and don't want to waste time commuting/driving to suburban shopping.

- Hard to beat the easy return policy of Zappos and Amazon or the value of free delivery via Amazon prime,

THE ECONOMIC RAMIFICATION

- The future of the Mall is likely limited as well as many "brick & mortar" retailers.

- America is the most highly over-stored nation in the world. Excess retailing space is a massive future problem

- Amazon has reached critical mass and as Millennials continue to dominate, online procurement and delivery will continue to accelerate.

Three Major Social Ramifications

Though it is too certain to know for certain, indications are that there are a number of social ramifications that can be expected as a result of the advent of the Millennial Generation.

1- PHYSICAL & FINANCIAL SECURITY

THE SHIFT

- Millennials place a higher value on physical and financial security as a result of the era they grew up in,

THE SOCIAL RAMIFICATION

- Millennials will be willing political to sacrifice personal freedoms if it is perceived that it will allow government agencies to better ensure this,

- Security-Surveillance methodologies and technologies will become an increasing larger way of American life.

- Millennials are likely to be "savers" in a much larger way than the last two generations.

2- GOVERNMENT ENTITLEMENTS

THE SHIFT

- Millennials overwhelmingly believe student loans are unjust and should be a government entitlement program,

- Existing student loans should be forgiven and paid by the government.

THE SOCIAL RAMIFICATION

- Candidates that run on a platform of student loan forgiveness will be elected.

- Candidates that run on platforms of Social Security and Medicare means testing will have wide Millennial support,

- Generally, Millennials will be more 'left leaning' as demonstrated by Bernie Sanders.

3- LESS MATERIALISTIC

THE SHIFT

- Millennials having grown up with most of their needs being met are less inclined to seek satisfaction from materialism and pursue wealth accumulation.

- Millennials are more inclined to be motivated by notoriety & seek political influence. This stems from their roots in social media,

- This is a trend that has been seen in other countries when opportunities for wealth creation become more restrictive.

THE SOCIAL RAMIFICATION

- Millennials will place in jeopardy the US economy maintain being a 70% Consumption economy

The biggest long term ramification may be the last. The era of the US economy sustaining itself via consumption may die as the Millennials become the economy! Their motivations and expectations are completely different than any prior generation and the changes will be profound.

Charles Hugh Smith concludes that there may be a consequence which is a even bigger question.

He asks: "Can our financial system and debt-burdened economy enable the sort of life the Millennials seek, or have we run out of room to transition to a lower consumption lifestyle and still service the growing mountain of debt?"

His conclusion: "It seems to me that the Millennials will have to navigate a system re-set that few of them seem to anticipate!"

What Is Often Dubbed "The Snowflake" Generation

Signup for notification of the next MATASII Macro Insights

Gordon T. Long

Publisher - LONGWave

Signup for notification of the next MACRO INSIGHTS

Request your FREE TWO MONTH TRIAL subscription of the Market Analytics and Technical Analysis (MATA) Report. No Obligations. No Credit Card.

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that you are encouraged to confirm the facts on your own before making important investment commitments. © Copyright 2013 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or suggestions you receive from him.

Copyright © 2010-2017 Gordon T. Long

Gordon T Long Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.