BOOM! Bitcoin Price Blasts To New All Time High!

Commodities / Bitcoin Apr 28, 2017 - 02:29 PM GMTBy: Jeff_Berwick

Having followed bitcoin since it was $3 in 2011 we have had many, many “all time high” celebrations.

Having followed bitcoin since it was $3 in 2011 we have had many, many “all time high” celebrations.

Breaking $10 was a small celebration. Breaking $100 had us cheering and buying a round of drinks at the bar. And, when it broke $1,000, TDV subscribers were heard around the world buying sports cars and yachts.

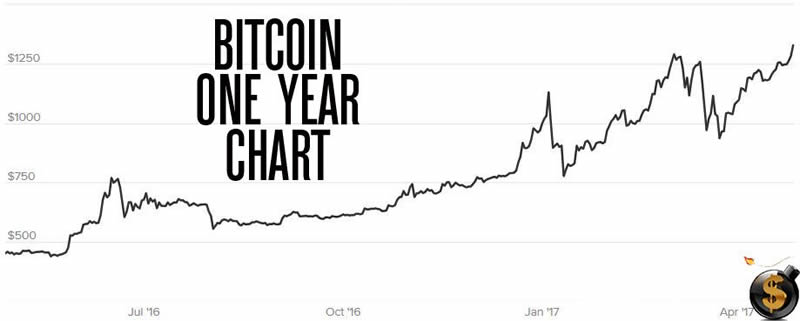

But with bitcoin breaking above $1,325.00 to hit an all time high of $1,331.31 on CoinDesk’s Bitcoin Price Index (BPI), this is a memorable one.

After COIN’s rejection by the corrupt central planning agency, bitcoin’s price subsequently dipped around 25%

If you recall, the SEC found that the proposed fund was “too susceptible to fraud, due to the unregulated nature of Bitcoin.”

It is of course because of its unregulated nature that bitcoin is so sought after - people like to keep their money out of the reach of thieving government hands and prying eyes. Not to mention, there is no better regulation than the blockchain itself which is perfect, transparent and incorruptible… nearly the exact opposite of the SEC.

A few weeks after the Winklevoss rejection there was some hype that the SEC was going to approve a different bitcoin ETF proposal by SolidX - set to list on the NYSE Arca Exchange - as a result, bitcoin surpassed the price of gold in US dollars. This too was rejected and caused bitcoin’s price to fall thereafter.

However, the currency has since recovered those losses in this upswing which can be attributed in part to the recent SEC revelation stating that it will be “reviewing” the petition submitted by the Bats BZX Exchange challenging the ETF rejection decision.

The SEC stated that between now and May 15th they will allow their review to be commented upon.

Another component of BTC’s price increase could be a result of increasing bank pressures on major exchanges.

The Bitfinex Exchange, in particular, has been under pressure as it has been unable to process outbound wire transfers from the banks it works with in Taiwan.

Since Bitfinex has close ties to other exchanges, many think its difficulties may represent a systemic exchange risk. Also, China’s central bank is still barring bitcoin and litecoin withdrawals from major Chinese exchanges which has tied up capital and is, therefore, limiting the supply of coins available for trading and probably driving the price higher.

With governments bankrupt and sticky-fingered it’s no wonder that bitcoin isn’t the only cryptocurrency making new highs.

Ethereum has also broken out above $60 breaking a new record. We featured it to TDV subscribers just over a year ago near $2.

And we featured Dash near $17 two months ago, and it currently trades near $80.

In the last few months, it appears that many financial advisors similar to TDV, but WAY behind the curve, have started featuring bitcoin to their subscribers. This also is likely driving the price of bitcoin higher as they finally get on the bandwagon TDV and our subscribers have been on since 2011.

And, more bullish for bitcoin, it is rising in price while bitcoin remains mired in a scaling debate that has pushed a lot of investors to the sidelines.

It’s still not too late to get into bitcoin and other cryptocurrencies… but you will want to get the best analysis and information in the space in order to know when to take some profits or buy more. And, we’ve been doing that since 2011 (sign up here).

To find out more about bitcoin and the massive potential it has, click here.

For anarcho-capitalists, bitcoin is as good as it gets. It’s a deflationary, non-fiat currency uncontrollable by central banks. Plus, it is also a banking system in and of itself. As Barack Drone Bomber said last year, “Bitcoin is like having a Swiss bank account in your pocket.”

Of course, he meant that like it was a bad thing that needs to be destroyed. The great part is that he, nor Trump, nor any other sociopath, can destroy bitcoin and that is why it is actually better than a Swiss bank account!

And, on top of being the best currency and infinitely better than the current banking system, it is also a transaction system, like Visa or Mastercard, without most of the fees.

And if all that isn’t good enough, bitcoin holds the potential to disrupt and destroy central banks and government completely.

Is it any wonder we love it? Next stop, $10,000!

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2017 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.