Bitcoin Blasts Through $1,400 Amid All Time Highs in Every Currency

Currencies / Bitcoin May 03, 2017 - 02:13 PM GMTBy: Jeff_Berwick

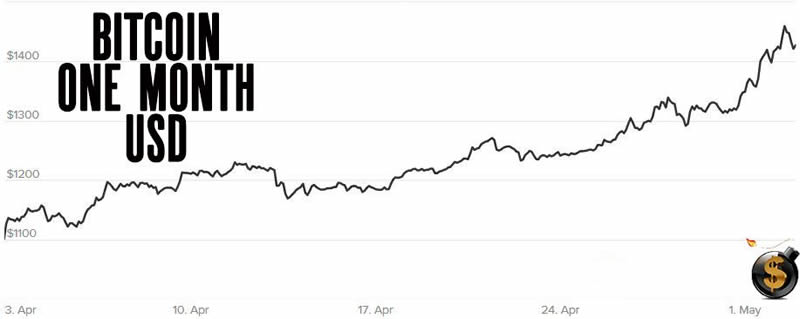

It was just a few days ago that we trumpeted that bitcoin had hit a new all-time high above $1,330 and it has since blasted through $1400.

It was just a few days ago that we trumpeted that bitcoin had hit a new all-time high above $1,330 and it has since blasted through $1400.

And, it hasn’t stopped there… at all.

Bitcoin has continued to smash through new highs nearly hourly since. And today it hit a high of $1,466.88.

We’ve been covering bitcoin at The Dollar Vigilante since it was $3 in 2011.

If you had bought then, as many TDV subscribers (subscribe here) did, you would have made fortunes.

$10,000 worth of bitcoin bought at $3 in 2011 would be worth nearly $5 million today. If you had found out about bitcoin in 2010 and purchased $10,000 worth it would be worth $148,000,000 today.

Not bad for anarcho-capitalist computer money!

It’s not even just for anarcho-capitalists anymore. Sean Spicer, Trump’s press secretary tweeted out a bitcoin address earlier this year…. Although he quickly deleted it right after.

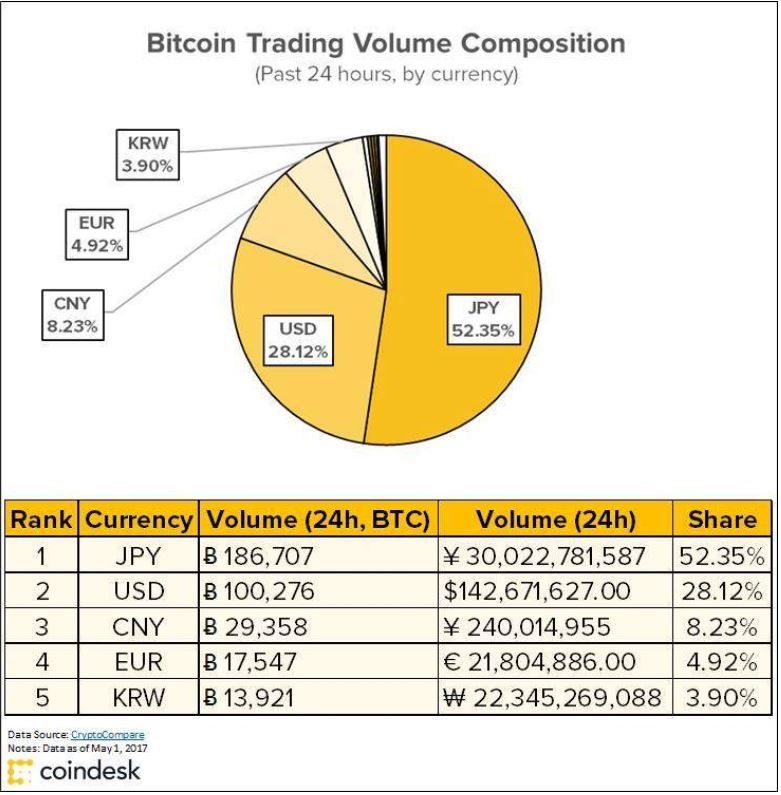

In any event, the great majority of bitcoin trading until recently has come from the US and China. But something major has changed recently.

There’s a new Sheriff in town. In the last 24 hours, more than 50% of trading has taken place in Japanese yen, according to the data service CryptoCompare.

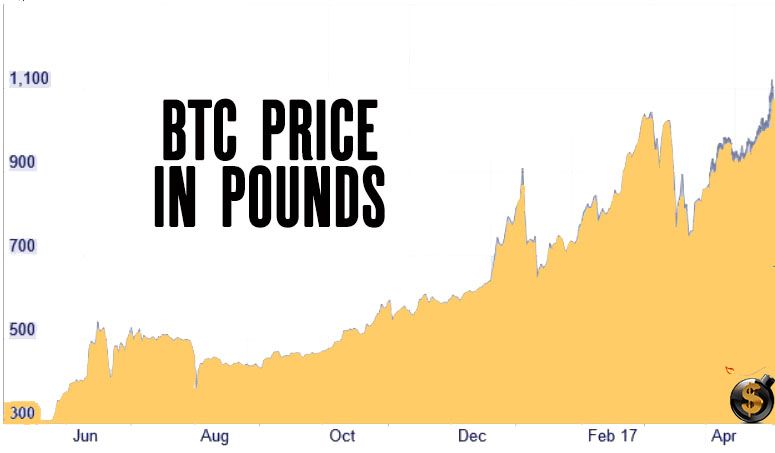

In terms of euros, which we admonished Europeans to buy bitcoin over the last few years, bitcoin has risen over 238% in the last year!

Bitcoin has risen by a total of over $2 billion in just the last few days.

On my show, Anarchast, I recently had on Simon Dixon of BankToTheFuture.com and we discussed how the modern day banking system is quickly becoming obsolete and how cryptocurrencies and fintech are dominating. You can watch the entire discussion here:

Simon has an incredibly interesting theory on how the only two things that will be left standing in the next few years are central banks and cryptocurrencies… with the private banking system being wiped out completely. Make sure to watch the interview to hear more.

Bitcoin has done so well for us and our subscribers, that we want to offer you a special discount to The Dollar Vigilante newsletter and access to our book Bitcoin Basics all for as little as $1 right now.

It’s a limited time offer and you can take advantage of it by clicking here.

We’ve made numerous people millionaires just from following our advice and we want to help you as well.

Cryptocurrencies are the wave of the future and they are just getting started. And no one on Earth covers them like The Dollar Vigilante.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2017 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.