Currencies, and Some ‘Out There’ Thoughts on Inflation, Stocks, Gold and Miners

Stock-Markets / Financial Markets 2017 May 30, 2017 - 03:28 PM GMTBy: Gary_Tanashian

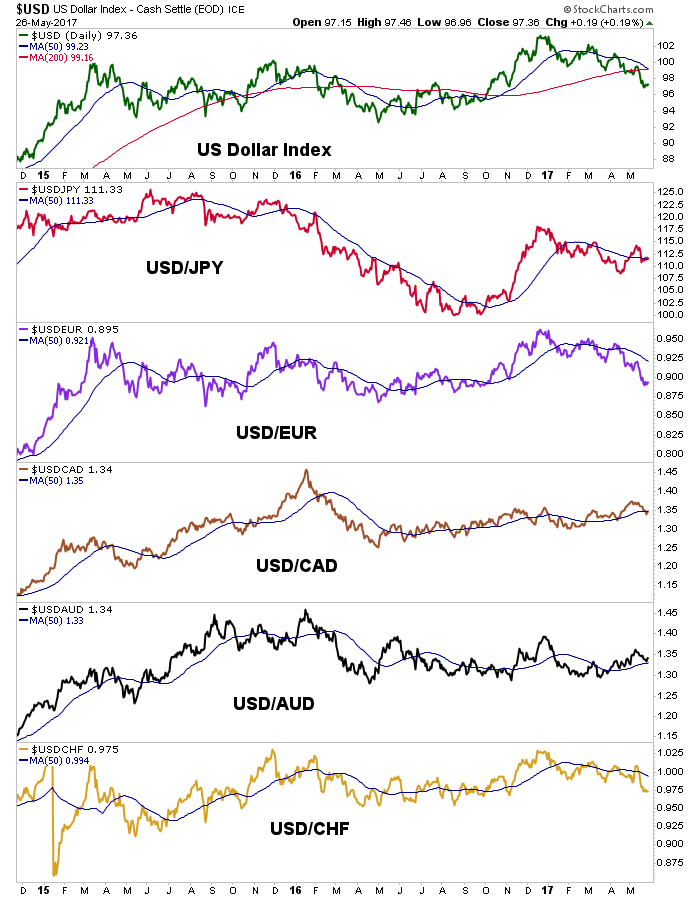

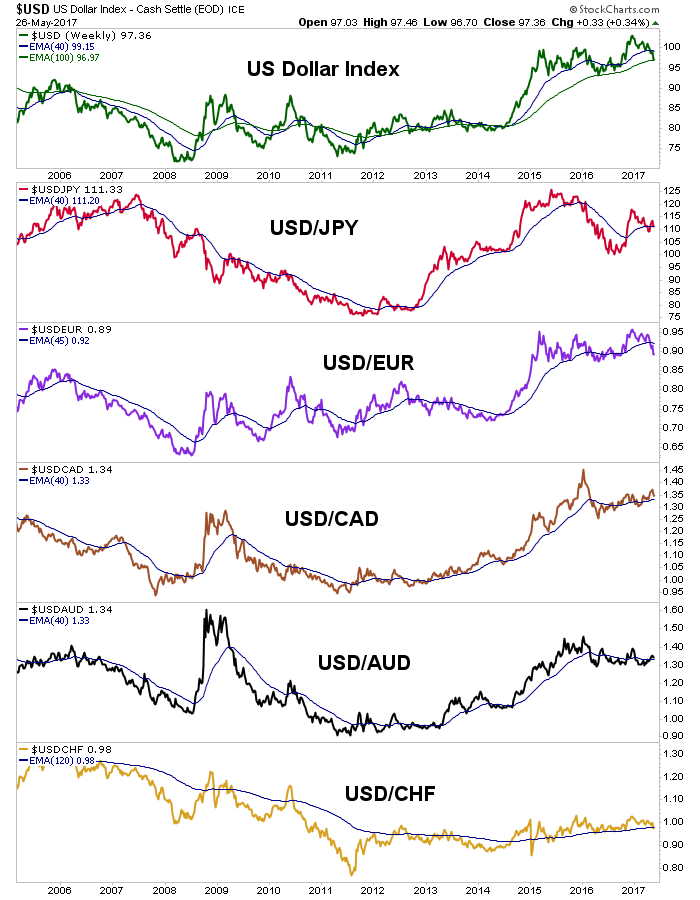

Uncle Buck’s index is weak and the SMA 50 is crossing below the SMA 200. Before long we will be reading about it in the media. Now let’s consider a theme we’ve promoted for years; when the media trumpet a “DEATH CROSS!” * it is time to brace for the opposite implication to the media’s bearish promotion. Our view has after all, included a decline to the mid-90s for the index. Meanwhile, USD/JPY is decent right at the SMA 50, USD/EUR and USD/CHF are at lateral support and USD is at least neutral vs. the Commodity currencies.

Uncle Buck’s index is weak and the SMA 50 is crossing below the SMA 200. Before long we will be reading about it in the media. Now let’s consider a theme we’ve promoted for years; when the media trumpet a “DEATH CROSS!” * it is time to brace for the opposite implication to the media’s bearish promotion. Our view has after all, included a decline to the mid-90s for the index. Meanwhile, USD/JPY is decent right at the SMA 50, USD/EUR and USD/CHF are at lateral support and USD is at least neutral vs. the Commodity currencies.

The weekly chart shows the USD index still at a higher low, neutral at worst vs. Yen, neutral/bullish vs. Canada and Australia dollars and not having broken down vs. Euro. I am not saying USD is in great technical shape but I am saying that we are approaching a time period (again, there’s that June thing… ) when a reversal of recent trends can come about.

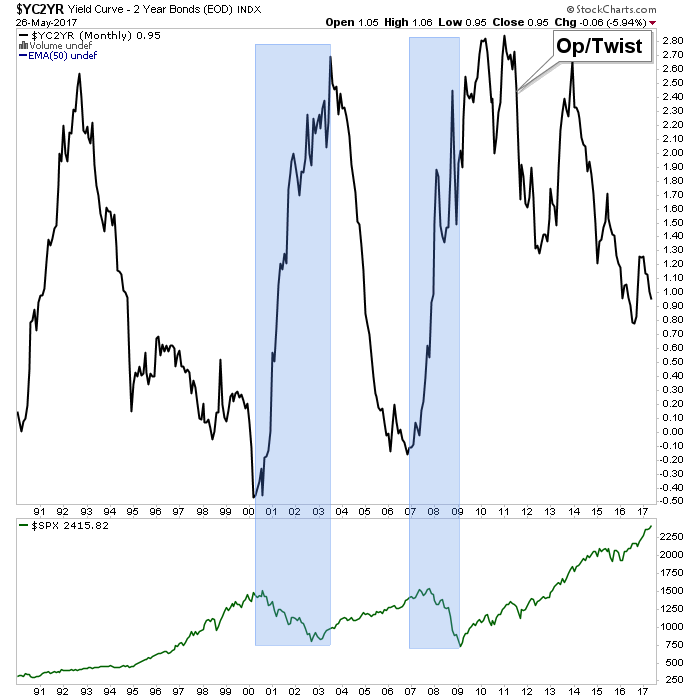

So what would be the implications of a US dollar that fools the majority by bottoming out and rallying? We have noted that the current inflation operation has rooted first and foremost in US stocks on this cycle. Gold? You need not apply. Commodities? Ha ha ha… US stocks have been preeminent as the funny munny has flowed there along the path of least resistance ever since Operation Twist turned the macro into a pretzel and screwed up traditional inflation signals. Per the Fed’s own admission, this operation was specifically designed to raise short-term interest rates and contain long-term interest rates.

The result that was kicked into gear was a yield curve that keeps benefiting stock market bulls with a chronic decline – and an associated Goldilocks** backdrop – still in progress.

The problem is that on the current macro we have a completely new presidential administration (let’s keep the snide commentary aside for now) and a diametrically opposed political party in power to the one that applauded the “hero” Ben Bernanke and his non-stop, balls out monetary fire hose. The monetary has been replaced by the fiscal.

The Fed is now free to tighten its policy (supporting the dollar), and we do of course now have a favorable backdrop for long-term interest rates to rise again in the coming months, per the analysis in the ‘Bonds’ segment. Because it has been the beneficiary of a stealth inflation (a Goldilocks pretense, but the money was printed and it did go into asset inflation; it’s just that when it goes to stocks the majority do not call it inflation), the stock market may be the item that is most vulnerable to a rising dollar, not gold.

So much work in the report above indicates that June may be pivotal across several markets. The seasonal trend for stocks, the CoT data for gold and silver, the CoT and public optimism data for the 10yr Treasury Note and even Uncle Buck’s technical status noted above, as it declines to the mid-90s on the verge of a DEATH CROSS no less, which could signal the herds to believe in the “death of the dollar!” as the old promotion goes. A note here, the US dollar CoT and public sentiment data are not yet extreme to an over bearish level, but perhaps this too may be registered by late June.

Now think about our view that gold does not depend on inflation in order to be bullish and gold miners do not benefit fundamentally, from inflation. They benefit when gold out performs stock markets and commodities against an economically weak backdrop.

I can see two scenarios…

-

- Fiscal policy is ‘successful’ in stimulating inflation. Long-term yields rise in response, the yield curve rises, stocks are no longer stealthily inflated but may be vulnerable as other more traditional ‘inflation’ markets gain the relative bid.

- Fiscal policy is not successful and the USD and Gold ride together again as the 2 Horsemen of the Apocalypse. We are shifting to a ‘fiscal or bust’ situation. There is no going back to Obama era monetary bailouts. Gold would outperform most assets and in a drainage of liquidity, the yield curve would rise as well as players seek safety in short-term bonds relative to the long end.

So the above thought experiment is interesting, to me at least. This report has had several data points from different asset classes that seem to point to a change of some kind on the macro coming this summer, and possibly by late June.

The yield curve however, is the item about which the changes could be most profound if they come about. The two scenarios noted above deal with things that could make the curve rise. The first is fiscally-driven inflation and the second is draining market liquidity in the event that fiscal policy either does not work or does not work in a timely manner.

But let’s also consider that bearish forecasters have put forth rational work in the past that seemed to ensure that the stock market was all done. So let’s consider that the yield curve is currently declining and the stock market is currently rising. So that’s the current reality and all we are doing now is simply being prepared for potential changes.

* With the SMA 200 rising, the validity of any ‘DEATH CROSS’ muck raking in the media would be even more suspect.

** Goldilocks of course being an inflation/deflation backdrop that is not too hot (inflation) and not too cold (deflation) but rather, just right… ‘ah, perfect!’ think the bulls.

Subscribe to NFTRH Premium for your 40-55 page weekly report, interim updates and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com. Also, you can follow via Twitter ;@BiiwiiNFTRH, StockTwits, RSS or sign up to receive posts directly by email (right sidebar).

By Gary Tanashian

© 2017 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.