Will there be Another New Stock Market High?

Stock-Markets / Stock Market 2017 May 31, 2017 - 02:26 PM GMT Good Morning!

Good Morning!

This morning’s SPX futures are higher, suggesting at least a challenge of the 2418.71 high if not a new high. The decline from Thursday’s high does not appear impulsive, so the chances are better than even for another attempted high. Right now the best estimate for a new high would be the Cycle Top at 2421.48…just in time for the quarter-end.

ZeroHedge reports, “t has been another quiet session for global equity markets, with S&P futures flat, as are European and Asian stocks, which is perhaps odd, as there was quite a bit of newsflow and, in the case of China, outright fireworks.

The main event in DM was the violent move in sterling, which as we first reported on Tuesday afternoon, tumbled for the first time this week after a YouGov poll showed Theresa May’s Conservative Party may fall short of a majority. The currency’s weakness boosted British equities, and the FTSE 100 Index rose even as miners and energy companies weighed on the broader European gauge after another night of sliding commodities in China.”

VIX futures are down this morning as it appears to be testing the 61.8% retracement level at 10.10. I am comfortable with the Wave structure as illustrated in the chart, although the VIX short-term ETFs may go lower.

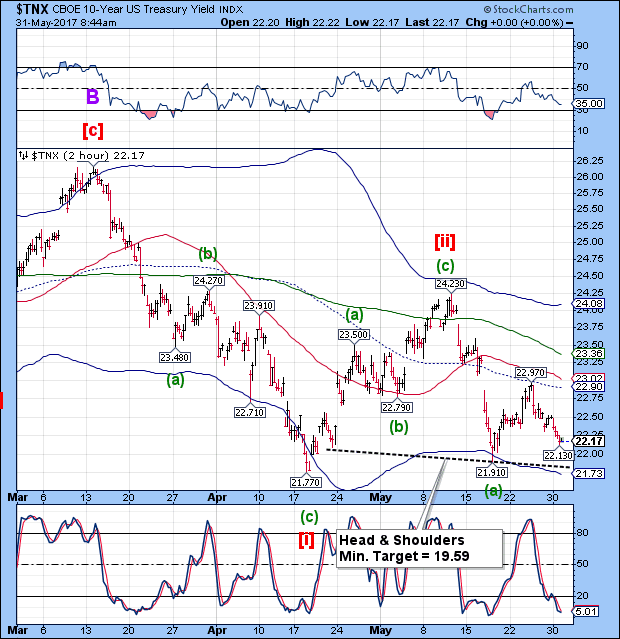

TNX is flat this morning and may go higher to finish a probable Wave (b). It could go as high as the 50-day Moving Average at 23.36, but that is not certain, yet.

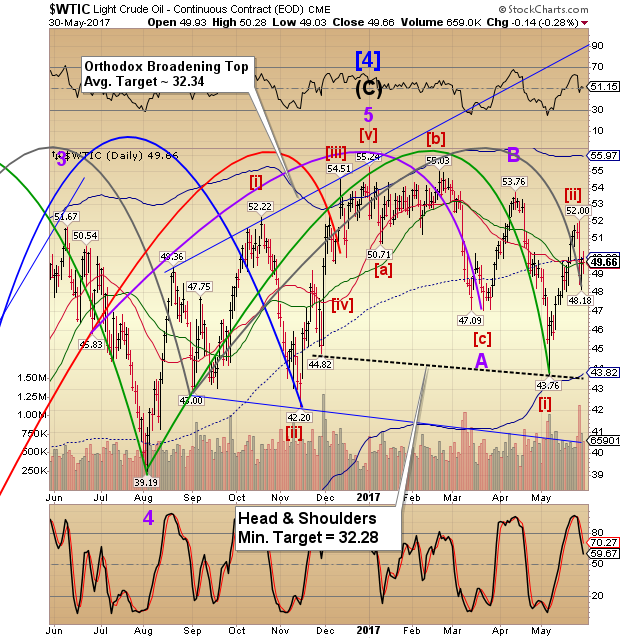

Crude Oil futures appear to be declining impulsively, so I wouldn’t be surprised to see new lows soon. The Cycles Model suggest that this decline may be a very large one, since the next Master Cycle low is not due until the end of July.

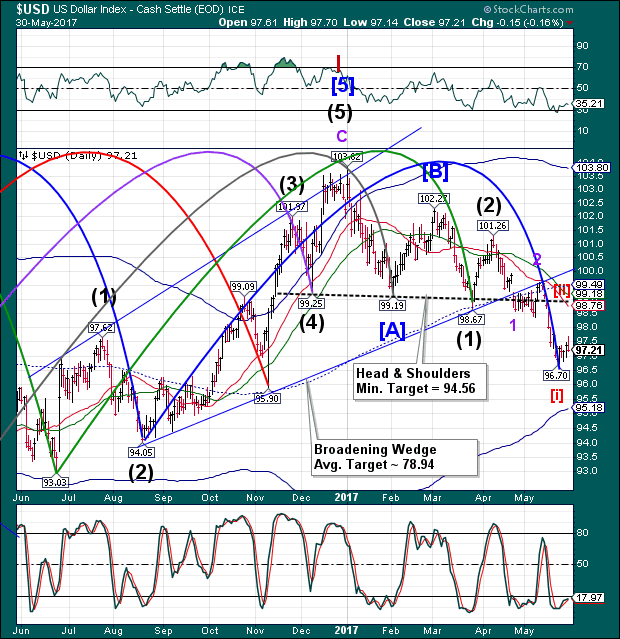

USD futures have come down to a morning low of 97.00. Although lower, there is the probability that the USD may stay in correction mode through the weekend. It, too has a long decline ahead of it with a potential Master Cycle low at the end of July.

ZeroHedge reports, “The US dollar will almost certainly remain the world's most important reserve currency for the foreseeable future but the lack of a ready substitute does not mean the dollar's current position is entirely assured, says Fitch Ratings in its latest Global Perspectives commentary.

No other currency offers the same set of advantages to money managers, including central banks, or is as deeply embedded in the global financial system. Crucially, the dollar is underpinned by the fact that the US Treasury market is the world's largest and most liquid for risk-free assets, and the Federal Reserve operates independently of government with respect to the market, and in implementing policy more broadly.”

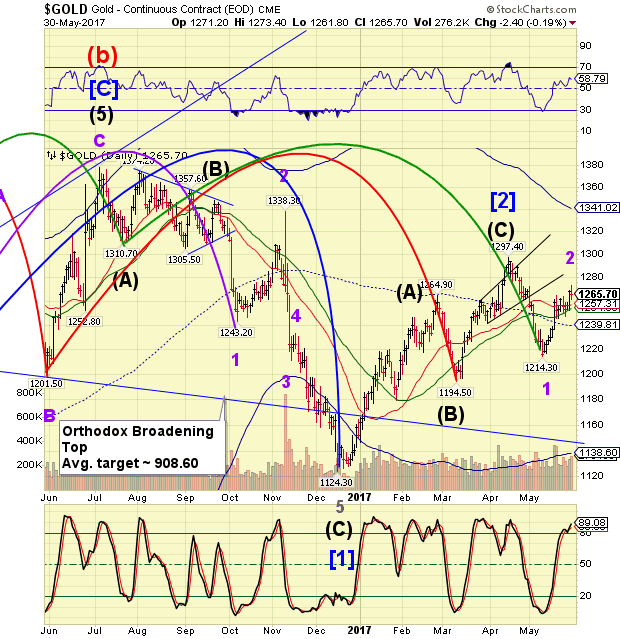

Gold appears to be lingering near its retracement high at 1273.40 and a 71% retracement thus far. It appears that a period of strength may run out by this weekend, so there is a possibility of another probe to 1280.00, near the Broadening Wedge trendline.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.