UK General Election 2017 Spread and Exchange Betting Market Opportunities

ElectionOracle / Spread Betting Jun 06, 2017 - 05:13 AM GMTBy: Nadeem_Walayat

With the opinion polls all over the as illustrated by the pollster based Conservative Party seats forecasts wide range from 305 to 385. Where it would be great if one could bet against the pollsters! i.e. ring up YouGov and go LONG on their forecast of Conservative 305 seats and SHORT of their Labour 267 seats. Of course they would never do that, as they clearly don't put their money where their mouths are, instead without consequence continue to pump out headline grabbing seats forecasts as demanded by the mainstream media to sell copy.

With the opinion polls all over the as illustrated by the pollster based Conservative Party seats forecasts wide range from 305 to 385. Where it would be great if one could bet against the pollsters! i.e. ring up YouGov and go LONG on their forecast of Conservative 305 seats and SHORT of their Labour 267 seats. Of course they would never do that, as they clearly don't put their money where their mouths are, instead without consequence continue to pump out headline grabbing seats forecasts as demanded by the mainstream media to sell copy.

Whilst I recently concluded in my UK election forecast conclusion on the basis of the sum of my analysis of the past 6 weeks which aims to repeat the accuracy of Trump 2016, EU Referendum 2016 and GE2015.

So on the basis of my forecast conclusion and with 3 full days to go until the polls close the search is on for spread and exchange betting market opportunities.

FIRSTLY, understand that trading markets, betting, gambling are HIGH RISK activities. And a forecast is NOT written in stone, it is what I deem to be the most probable. And most gamblers tend to lose in the long run with losses can exceeding deposits. So if you don't have the stomach to take a loss then DO NOT TRADE OR BET!

My primary UK election forecast expectation is for the Tories to win the election on 358 seats, a 66 seat majority.

Spread Betting Market

My preferred vehicles for betting on elections are the betting markets such as the spread betters and exchange markets.

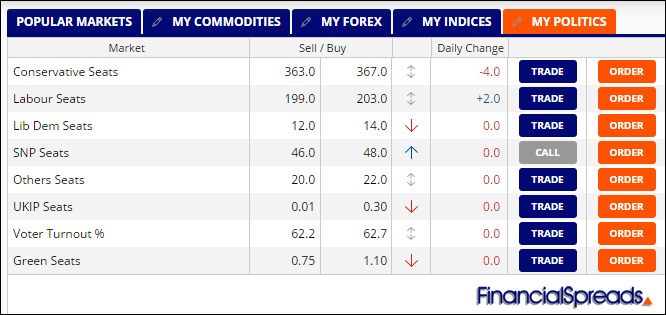

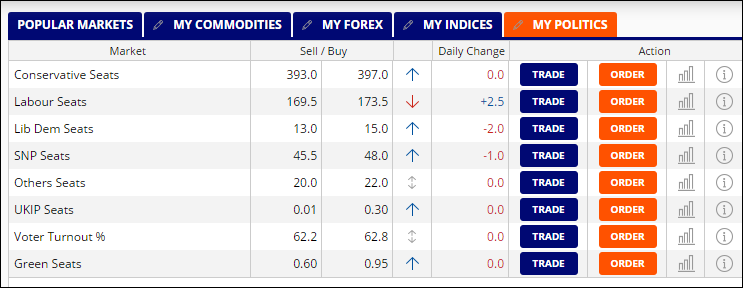

The current prices being quoted by the spread better Financial Spreads are :

(losses can exceed deposits)

Therefore the Tories are currently trading at 365 against my forecast of 358, which at the moment does not present much of an spread betting opportunity. However market volatility is very high i.e. here are the spread betting prices from just a couple of weeks ago :

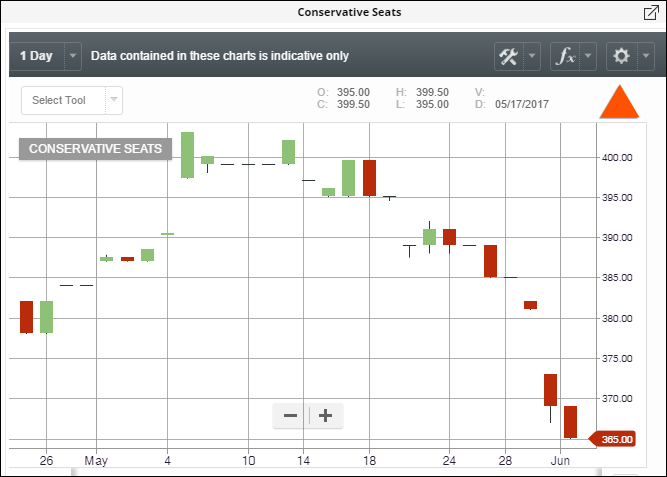

And the following graph further illustrates Conservative seats market volatility :

Therefore I expect volatility in the wake of for instance YouGov's crazy polls to deliver market opportunities both in the countdown and in the immediate aftermath of the UK General election result, just as occurred during the US Presidential Election and the EU Referendum.

So it could be worth keeping a close eye on the spread betters for significant deviations from my forecast. One of the best strategies is to use stop and limit orders, i.e. for a trade to be executed when a market price hits a particular level which saves one having to constantly monitor a market. Again do remember that betting is high risk and losses can exceed deposits.

BetFair Exchange Market

Betfair is another favourite of mine as it presents a myriad of betting options. So having scoured the Betfair market then these are the bets that have caught my attention -

Size of Conservative Majority

The forecast majority is 66 therefore an high reward profit potential exists given the price of 6.4 for 50-74 seats. However given the tightness of the ranges then there would be a need for smaller hedging bets on either side of the expected range i.e. 25 to 49 and 75 to 99 seats.

For example

£100 on 50 to 74 should be hedged with £20 on 50-74 and £20 on 75 to 99

Total Conservatives Seats

The opportunity here is a lot tougher as the forecast of 358 is towards the bottom of the range on offer. So this market favours an error in the forecast being to the upside rather than to the down side, for instance not towards what house prices are forecasting (342). Also the profit potential is poor at just £95 per £100 bet. Whilst a bet on the forecast being out by 10 seats would favour the 300 to 349 seats bet price of 3.75. So similarly two bets to cover the range 300 to 400 is probably the better trade here so as to hedge the forecast being wrong on the downside.

Conservatives Under 370.5 seats

Again the odds are nothing to shout about but the distance of 371 to 358 gives a 13 seat margin of error for a price of 1.79. So maybe a smaller hedge bet to cover being wrong on the downside.

And once more whilst today's prices may not be great, however polling induced market volatility could present a series of opportunities over the coming days, so these final days and hours until the results are known is the time period to keep a close eye on the betting markets.

And I will likely once more publish a list of my 'winning' election positions after the election just as I had for the US Presidential election.

And remember not to get carried away! Don't bet more than you can afford to lose because it is a gamble!

Ensure you are subscribed to my always free newsletter for my latest analysis and to our youtube channel for videos in the BrExit War series.

By Nadeem Walayat

Copyright © 2005-2017 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.