Stock Market VIX Spike Prediction Revisited

Stock-Markets / Stock Market 2017 Jun 30, 2017 - 01:09 PM GMTBy: Chris_Vermeulen

Nearly 2 weeks ago, we issued a research/analysis report indicating our analysts had seen a VIX pattern that forecasted a VIX spike on June 29th of this month to coincide with a potential explosive move in the markets. Today (June 29th) the vix spiked over 45% exactly as we has predicted, so we thought we would revisit this analysis and update our valued followers.

Nearly 2 weeks ago, we issued a research/analysis report indicating our analysts had seen a VIX pattern that forecasted a VIX spike on June 29th of this month to coincide with a potential explosive move in the markets. Today (June 29th) the vix spiked over 45% exactly as we has predicted, so we thought we would revisit this analysis and update our valued followers.

Recently, as many of you already know by being ATP members, the US and global markets have rotated on a number of news items and concerns. First, the IMF revised US economic expectations to address slower than expected economic activity. Next, NASDAQ technology stocks have recently been very volatile in relative terms and have driven some very big moves. Additionally, just last weekend two banks in Italy have been closed as a result of failed ability to raise capital levels to support activities/risk. Lastly, the BITCOIN drama seems to be continuing with this recent ransom-ware outbreak originating from within Ukraine. All this uncertainty and risk is a bit concerning for the markets in terms of volatility.

Today, the US markets recovered well, but we are still watching these price levels closely for further signs of weakness. Our interest in terms of revising our VIX spike projection is as it relates to the metals markets, so lets get started.

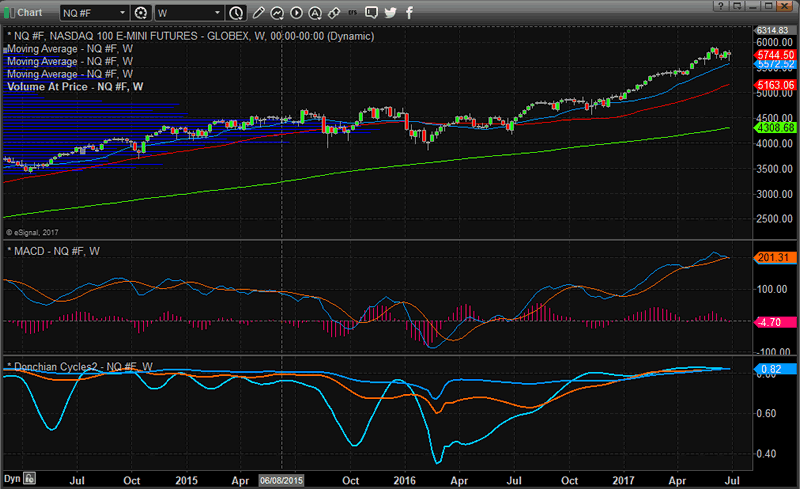

The recent rotation in the US majors is setting up a consolidation period that may be similar to past price moves. This weekly NQ chart illustrates the previous 4 years of price action and clearly shows levels of consolidation prior to upward price expansion. Notice the two most recent examples, October through December 2016 and April through July 2016. Volatility throughout these periods spiked as the markets rotated magnitudes away from Standard Deviation ranges – yet, the markets resumed the upward price moves after a period of time. We believe this is a function of capital searching for price validation.

Also, notice the cycle indicators near the bottom of the chart. This recent rotation is not really evident in the cycle rotation analysis. Although the cycle indicator is showing us extended upward cycle expansion, we believe this rally still has room to run.

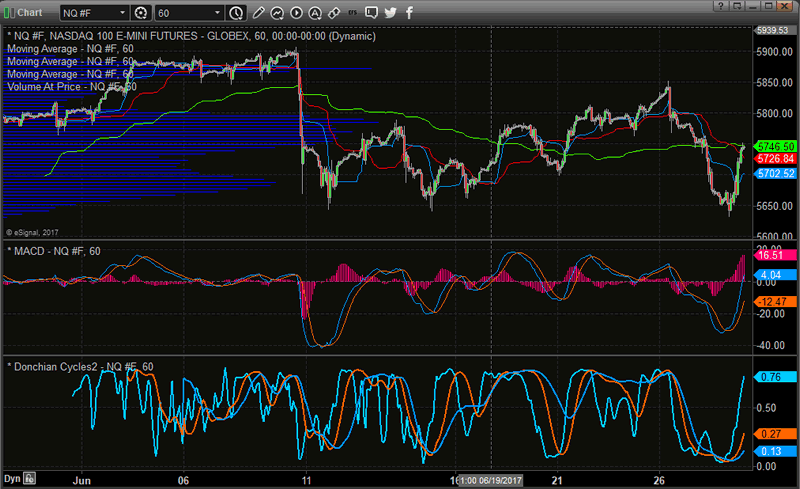

This 60 minute NQ chart more clearly illustrates the recent “washout low” price rotation and defines support near 5650. We can see the price move after the US Fed increased rates (near June 11th) as well as the rotation in price thereafter. We can also see the near perfect “Triple Bottom” formation that coincides with major cycle rotations.

Our analysis suggests this type of price rotation and congestion may continue for another few weeks as we were expecting this weeks VIX Spike and we took advantage of it with our automated vix trading system today which hit a new high watermark for the portfolio today, and more VIX spikes may follow yet. Because of this expectation, we also believe the metals markets will attempt to find lower lows over the next few days/weeks as volatility increases and the VIX rallies above $14~15.

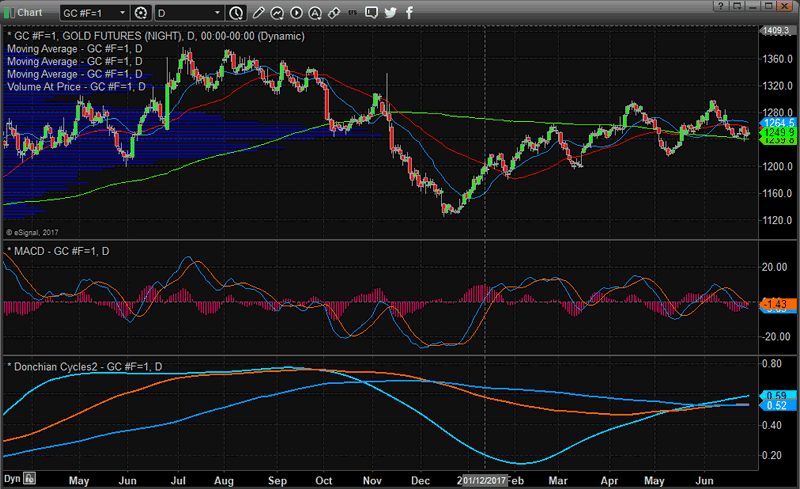

Our analysis of the metals markets indicates we may be setting up for an explosive upside price move – but not before we retest some recent lows. Based on this analysis, we believe the Gold may fall to near $1200 as the US majors resume some attempt at recent highs before the VIX spike explodes – resulting in the beginning of a massive move in the metals and likely many global markets.

The VIX is setting up for what we believe will be a spike higher that may break recent highs (well above $16). Our VIX analysis tells us that between now and July 7th, we should see the beginning of a VIX spike that could be 2x or 3x larger than the most recent price spikes. As this relates to the US majors, metals and global markets, this could be a massive disruption/trend. We believe our analysis of the VIX price cycles are accurate and we have positioned our ActiveTradingPartners.com members appropriately to take advantage of these moves.

We will likely revisit this analysis near the middle of July to follow-up with our research and to better inform our members with regards to future price action and opportunities. If you find this type of analysis helpful and insightful, then visit ActiveTradingPartners.com to learn more about our research team and opportunities. Our most recent trades illustrate our dedication to delivering success to our members and providing the best research we are capable of. Join ATP today to take full advantage of our success.

Chris Vermeulen

www.TheGoldAndOilGuy.com – Daily Market Forecast Video & ETFs

www.ActiveTradingPartners.com – Stock & 3x ETFs

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.