Janet Yellen Just Said The Most Ridiculous Thing We’ve Heard All Year!

Interest-Rates / US Interest Rates Jul 02, 2017 - 07:40 AM GMTBy: Jeff_Berwick

Of all people, the last person you should ever ask about what is going to happen in the economy is a central banker or a Keynesian economist.

Of all people, the last person you should ever ask about what is going to happen in the economy is a central banker or a Keynesian economist.

They are, after all, communists trying to centrally plan the economy. Commies are always clueless about economics.

And, their track record of predicting the economic future is almost perfect in that they almost always say “this time things are different” just moments before another crash happens.

In September of 1929, Keynesian Yale Economist, Irving Fisher, said, “Stocks have reached a permanently high plateau.”

Less than two months later, the most devastating stock market crash in US history occurred along with a 12-year depression.

More recently, Ben Bernanke, in 2007, said, “Our assessment is that there's not much indication at this point that subprime mortgage issues have spread into the broader mortgage market, which still seems to be healthy.”

And he went on to say, “The global economy continues to be strong, supported by solid economic growth abroad. U.S. exports should expand further in coming quarters. Overall, the U.S. economy seems likely to expand at a moderate pace over the second half of 2007, with growth then strengthening a bit in 2008 to a rate close to the economy's underlying trend.”

Then within weeks, the biggest housing crash in US history occurred along with the biggest stock market collapse of all time.

And, now, Janet Yellen has come out with a shockingly moronic statement, saying, “Would I say there will never, ever be another financial crisis? You know probably that would be going too far, but I do think we're much safer and I hope that it will not be in our lifetimes and I don't believe it will be.”

Well, it is either moronic, or she is outright telling us that the US will soon be entering into hyperinflation.

Let’s analyze what she said.

First, she was speaking without a teleprompter, so it’s possible she was off her meds today and was just rambling and making stuff up at random… because a lot of what she said in that interview was really meaningless. But, Greenspan was a master of that, so maybe she is learning Greenspeak.

But, her statement that she doesn’t think there will be another financial crisis in our lifetimes needs to be considered.

At first, I thought she meant, in “her” lifetime. And, being 70 years old my first thought was maybe, hopefully, she has cancer and was going to die soon.

But, she didn’t say “her” lifetime, she said in “our” lifetimes. What’s that even supposed to mean? Children alive today should expect to live at least 70 years. Or longer. Did Janet Yellen really say that she doesn’t believe we’ll have a financial crisis in the next 70 years??

There was one less than a decade ago in 2008. And, almost every metric is far worse now.

US government debt has doubled since then to $20 trillion. The stock market is at all-time highs having nearly tripled since the lows in 2009.

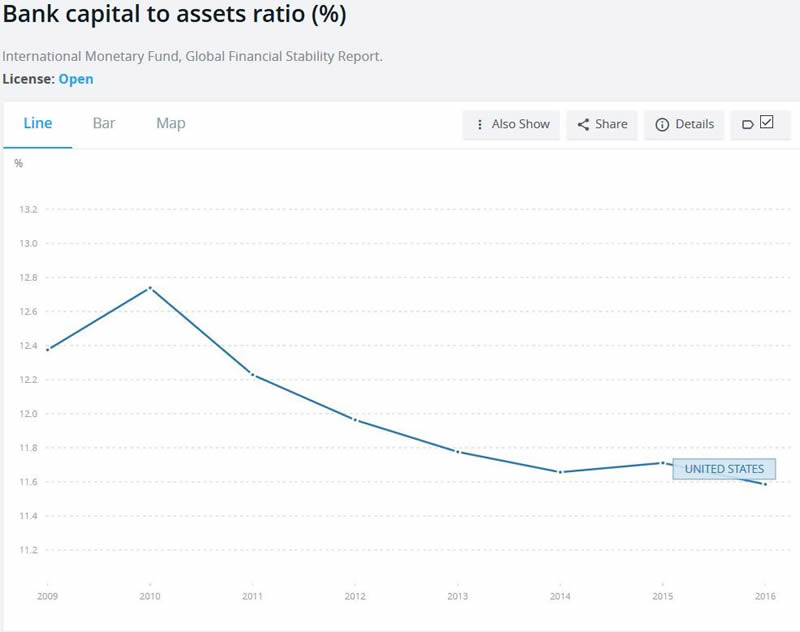

Well, if Janet is claiming the banks are so solid now, their capital to assets ratio must have gotten much better since 2008, right?

Hmm, it’s gotten worse. And don’t forget we are nearing the end of the nearly 40-year long bond bull market.

So worldwide government debt has skyrocketed, stocks are at all-time highs, the bond bubble is close to popping and banks are leveraged more than they were during the last crisis in 2008/2009.

And this data makes Ol’ Yellen quite comfortable in predicting that we’ve got 70 years of smooth sailing ahead?

Wow.

So, really, there are four possible reasons she said that.

#1 is she accidentally took an extra handful of Prozac that morning and she just kinda went a bit loopy.

#2 is that her and all her communist economists got together and tried to make a prediction… and just like almost every other central bank and Keynesian economics prediction in the past… it is almost exactly wrong at almost the exact time when things fall apart.

#3 is that her handlers told her to say it because they love giving the public the exact wrong info at the exact right time and think it is funny that a lot of people will be trapped in the stock market and banks just as they pull the plug on the entire financial system.

Or, #4, is that the Federal Reserve has already planned to go into hyperinflation in the event of any crises which would technically save the banking system from a “crisis” but leave all bank account holders with worthless dollars.

Now that I look back on all four options, I actually think all four could be correct.

If that is the case, Yellen saying there won’t be a crisis for at least 70 years should be all the warning you need to begin to prepare for a crisis to happen imminently.

Cryptocurrencies have been skyrocketing, and some people are suggesting that it is because a lot of the smart money is preparing for a complete financial and banking collapse to begin soon.

This could be the case as I have met many Wall Streeters who’ve told me that this is what they are doing.

It could also be the case that the cryptos are the recipient of some of the inflation the Federal Reserve and other central banks have been pumping into the economy.

But, whatever the case, cryptocurrencies are certainly one way to protect yourself from a banking crisis. So, if you don’t know enough about cryptocurrencies yet, please check out my free four-video webinar HERE.

And, as well, I want to give away our book, Getting Your Gold Out Of Dodge, for free to you today to make sure you have some of the basics to prepare for the coming collapse. You can get it free, for a limited time only, HERE. It normally sells for $44.95, but we want to help as many as possible to survive the coming financial crisis.

Because if Yellen says there won’t be a financial crisis for at least 70 years, then that is all the evidence you need to know that we are just weeks or months away from the next big crisis which could leave your bank collapsed or the dollars in your account nearly worthless.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2017 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.