When You Think It Can’t Get Worse, The Markets Become Even More Absurd

Stock-Markets / Stock Market 2017 Jul 27, 2017 - 05:21 PM GMTBy: John_Mauldin

BY JARED DILLIAN : The market is up 2% since I called the top a month ago.

BY JARED DILLIAN : The market is up 2% since I called the top a month ago.

Financial newsletters are now stuffed with bubble porn—their favorite subject is complaining about how overpriced everything is. As a financial writer, it’s tough to stay fresh when that’s all there is to talk about.

Let’s continue, nonetheless.

How Long Can This Continue?

Let me tell you a quick anecdote.

Remember a few weeks ago when Amazon said it was going to buy Whole Foods? Of course you do. From a strategic standpoint, Amazon getting into physical grocery stores is a huge deal. It even started a discussion on antitrust law in Congress.

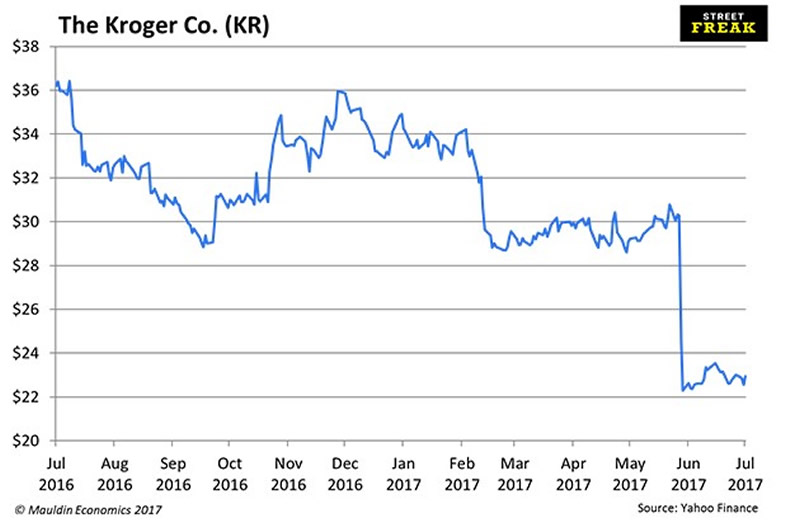

All the supermarket stocks got caned the day it was announced, because Amazon getting into the grocery business is bad for everyone. Kroger got hit hard.

Interestingly, Kroger tapped the bond market not too long after that with a $1 billion deal, of 5s, 10s, and 30s, across maturities. People were willing to buy Kroger paper just a week or two after finding out that Amazon was going to put them out of business!

Amazing.

The bonds, priced at 180 bp over 30-yr Treasuries, then rallied. They now trade at 175 over.

Keep in mind that Kroger is a low-investment grade credit to begin with, and now people believe that Amazon is going to put it out of business.

Here is a stock chart of KR for reference:

If you are buying Kroger 30-year paper, you have to be pretty sure that Kroger is going to be around in 30 years. Will they? Probably, in some incarnation. But are you getting compensated for the risk at 4.65%?

This isn’t the dumbest bond out there. It’s actually not even close to the dumbest bond out there. But it’s a pretty good example of bond investor ebullience.

I don’t spend a lot of time shopping for individual bonds, but when I do, I cannot bring myself to get excited about marginal credits in low single-digit yields. I’ve seen quite a few cycles in credit, and this feels like all the other tops. Except even toppier.

Meanwhile, Markets Go Up

We could sit here and complain about credit, the short vol trade, etc., but you get nowhere.

Meanwhile, the NDX is up nine days straight, the S&P tech sector just made new all-time highs, and that broken chart I sent around a few weeks ago has become un-broken.

There are some bulls out there who do a sack dance every time the market makes new highs, and call people idiots for not buying Amazon. I get it. Amazon goes up every day.

You can be that bull, or you can buy an index fund. But then you buy the expensive stocks along with the cheap ones.

What’s left?

It’s a Matter of Your Style

As an investor, you have to decide: Am I a value investor? Am I a growth investor?

Momentum? Macro? Distressed?

The point is, you pick a style and you stick to it. For most people, it is when you have style drift that you get into trouble.

Take distressed investors, for instance. You could go years without seeing any opportunities. When you get outside your comfort zone and start looking at stuff that is not distressed, that is when the trouble starts.

Chances are you did not pick your investing style. It is a feature of your personality, and it has always been with you.

My investing career started in a bubble, and I was skeptical of the bubble from the very beginning. That skepticism has served me well, for the most part. I have missed out on some opportunities, but I have avoided some big crashes.

Assuming I am talking to mostly value folks here, let me ask the question: How long are you going to have to wait? Possibly a while. We could be having this conversation a year from now, with the S&P 500 at 2900, my “top” call left in the dust.

Sitting around and watching this every day is just agonizing. But every day things get a little sillier, and dreams get a little bigger. So far, Pitbull has weighed in on bitcoin and Canadian housing, and both are circling the drain.

Please, someone get him on Fast Money and ask him what he thinks of stocks.

Get Thought-Provoking Contrarian Insights from Jared Dillian

Meet Jared Dillian, former Wall Street trader, fearless contrarian, and maybe the most original investment analyst and writer today. His weekly newsletter, The 10th Man, will not just make you a better investor—it’s also truly addictive. Get it free in your inbox every Thursday.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.