BOOM! Bitcoin Rockets To New All-Time High As Cryptocurrencies Surge Higher!

Currencies / Bitcoin Aug 07, 2017 - 08:30 AM GMTBy: Jeff_Berwick

All eyes were on bitcoin on August 1st, as it underwent the biggest change it had undergone since its inception in 2009.

All eyes were on bitcoin on August 1st, as it underwent the biggest change it had undergone since its inception in 2009.

After years of debate, the issue of scalability resulted in a fracturing of bitcoin onto two separate paths, now called Bitcoin and Bitcoin Cash.

The usual cast of characters came out to warn that this was the death of bitcoin. And, as it always seems to do, bitcoin pushed on unscathed.

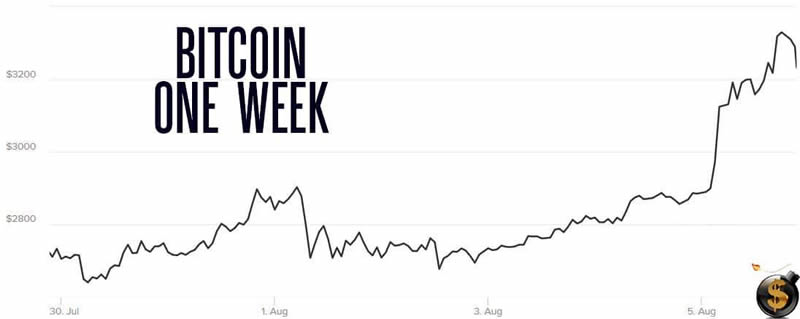

In fact, it was more than just unscathed. Just days after the fork it skyrocketed to new all-time highs.

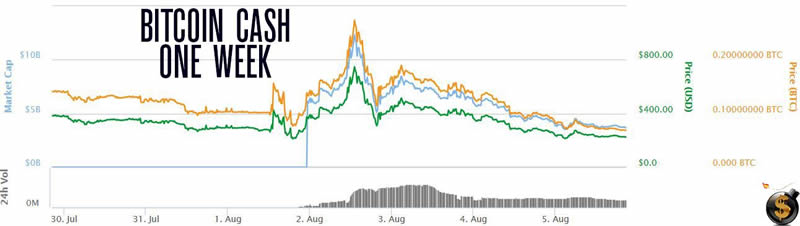

And, that’s not including Bitcoin Cash which everyone who was holding bitcoin on August 1st also now has.

Bitcoin Cash has sold off the last few days and currently sits just over $200.

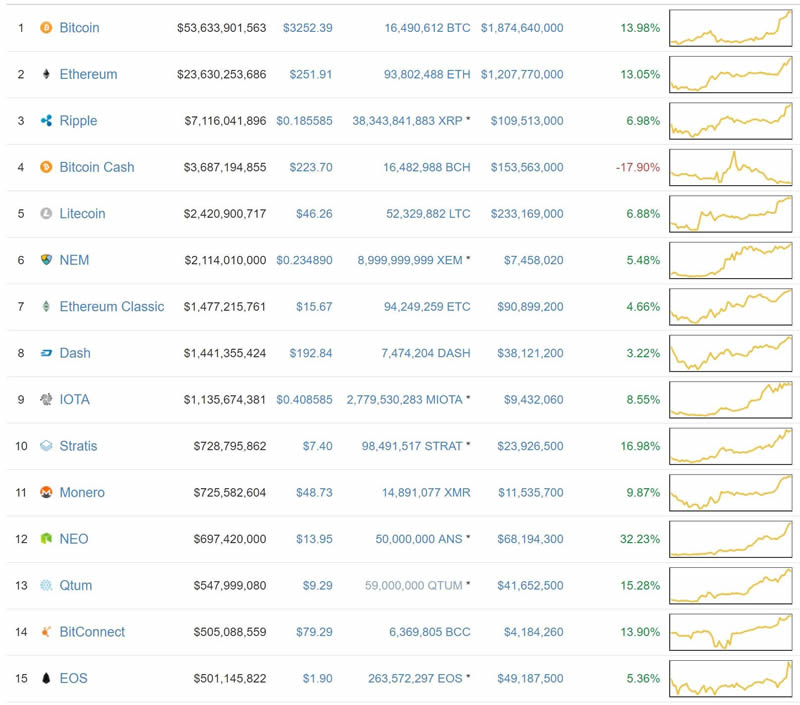

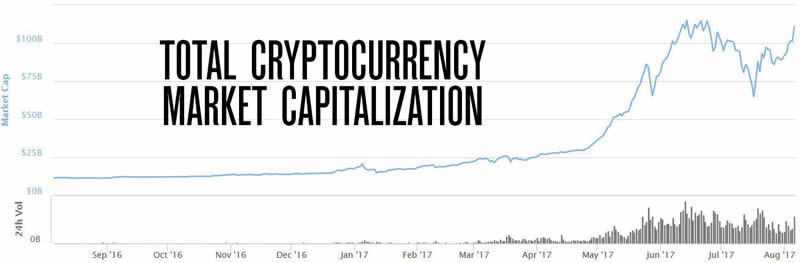

The entire cryptocurrency space skyrocketed today, with the exception of Bitcoin Cash.

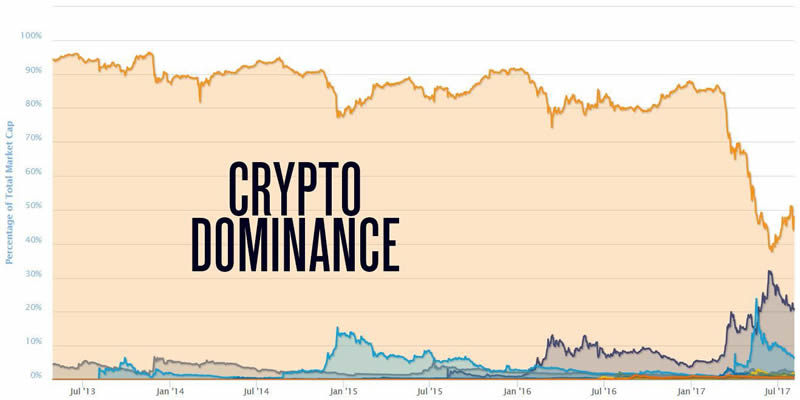

Bitcoin fell from 86% dominance in the crypto space to start the year to a low of 38% in June. But it has now begun to regain some of what it lost and rose about 50% just prior to the fork.

Believe it or not, this whole scaling issue still isn’t over and is expected to continue on at least until November.

In order to ensure you get all the best and most up-to-date information on what is happening in the space, subscribe to The Dollar Vigilante newsletter (subscribe HERE) where we have been covering bitcoin and cryptocurrencies since bitcoin was $3 in 2011.

Our next issue is coming out soon and I’ll reveal some shocking information about bitcoin that could potentially make or lose many people fortunes if they are unaware of it.

And when you sign up, you also get immediate access to our book Bitcoin Basics to give you all the basics you need to know to get started in the cryptocurrency space. And you get free access to the e-book, The Book Of Satoshi, which I call the “autobiography of bitcoin”, directly from the keyboard of Satoshi Nakomoto himself.

Make sure to subscribe HERE to get access to all of it.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2017 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.