Bitcoin & Bitcoin Cash Smash Through $5,000!

Currencies / Bitcoin Aug 21, 2017 - 11:13 AM GMTBy: Jeff_Berwick

Now, I realize I can’t do this forever. I can’t continue for years to combine the value of both Bitcoin and Bitcoin Cash and quote it as a “total value” of bitcoin.

Now, I realize I can’t do this forever. I can’t continue for years to combine the value of both Bitcoin and Bitcoin Cash and quote it as a “total value” of bitcoin.

But, considering that it was just 19 days ago that every person in the world who owned bitcoin, if they stored it correctly, also became a new owner of an equal amount of Bitcoin Cash… it is still a very reasonable thing to take note of the two currencies combined price as being the value that the grand majority of bitcoin holders currently hold… or “HODL”, to talk more like the cool kids.

I’d say that this is a perfectly viable thing to mention for at least another month or two… then it’s probably best to completely delineate the two as totally separate entities for the most part.

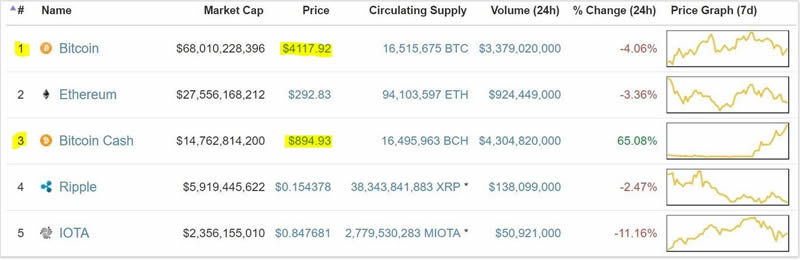

In any case, since I’ve now officially decided that it is fine for me to do so… I will now make mention that the combined price of Bitcoin and Bitcoin Cash surpassed $5,000 this afternoon!

This is no small feat!

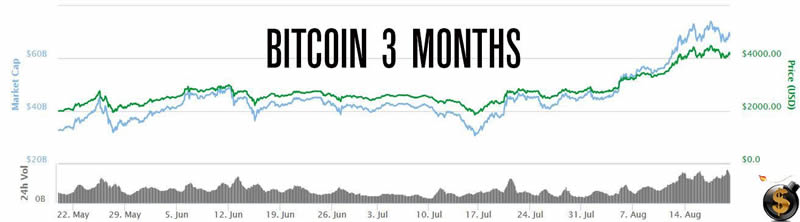

On July 17th, just over one month ago, bitcoin hit a low of $1875.

At a combined price of $5,000 today, that means people who held bitcoin on July 17th and haven’t since sold their bitcoin or Bitcoin Cash have had a gain of 167%!

Not bad considering the Health Ranger warned, “Bitcoin collapse now under way… has already plunged nearly 40% from its high.”

He warned that the August 1st fork was a “bitcoin civil war” and that the bitcoin Ponzi scheme was unraveling.

Soon after we wrote, “Don’t Fear The Fork: The Future of Bitcoin” where I told people to ensure they held their bitcoin properly, so they received Bitcoin Cash and to just HODL and not worry about the fork.

That’s probably why you should get your vitamin advice from health websites and your financial advice from financial websites.

It’s a crazy way of doing things I know…

Now things get interesting, however.

The rising price of Bitcoin Cash is creating the incentive for miners to dedicate computing power to mining it over “bitcoin classic.”

Currently, miners are making about 2% more to mine Bitcoin Cash over bitcoin.

But, it gets more interesting as Block 479,808 (set for this weekend) will likely trigger a difficulty adjustment in Bitcoin Cash mining 50% lower than it is currently is. And if the prices of bitcoin and Bitcoin Cash stay the same, this means miners will make almost double on Bitcoin Cash than they would on bitcoin.

Keep in mind though that miners make far greater fees on bitcoin (at 1.5 bitcoin per block or around $6,000 USD currently) than they do on Bitcoin Cash (usually under $50 per block).

So, it gets really technical and free market economics will decide in the end whether miners prefer to mine bitcoin or Bitcoin Cash in the coming days, weeks and months.

Needless to say, this is quite complicated to sort through and analyze… so you definitely won’t want to be getting your information on bitcoin from vitamin websites. Make sure to subscribe to The Dollar Vigilante newsletter HERE for the most informative source on cryptocurrencies which we have been following and recommending since bitcoin was $3 in 2011.

And I’d also like to announce that the dates for Anarchapulco have now been officially set for February 15-18th, 2018. The official trailer for the conference has just been released. You can see it here:

On February 18th the entire day will be devoted to cryptocurrencies and blockchain technology, called Cryptopulco. Some of the big names that are already confirmed are Roger Ver, Trace Mayer, Dan Larimer (creator of Steem & EOS) and many others.

And on February 19th we’ll be holding our third annual TDV Internationalization & Investment Summit with a sizable focus on cryptocurrencies in addition to precious metals, gold stocks and internationalization of your ass and assets.

And if you register before September 1st you can get a discount off of Anarchapulco & The Dollar Vigilante Summit.

You can check it all out and register at www.anarchapulco.com. If you plan to go, you may wish to register as soon as possible as given the massive gains earned by our massively growing audience, the event will likely sell out quite quickly.

I’ll look forward to seeing many of you in Acapulco, Mexico this coming February!

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2017 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.