Buffett Sees Stock Market Crash Coming? His Cash Speaks Louder Than Words

Stock-Markets / Stock Market Crash Aug 21, 2017 - 04:19 PM GMTBy: GoldCore

The Sage of Omaha’s adage is “it’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

The Sage of Omaha’s adage is “it’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

Editor: Mark O’Byrne

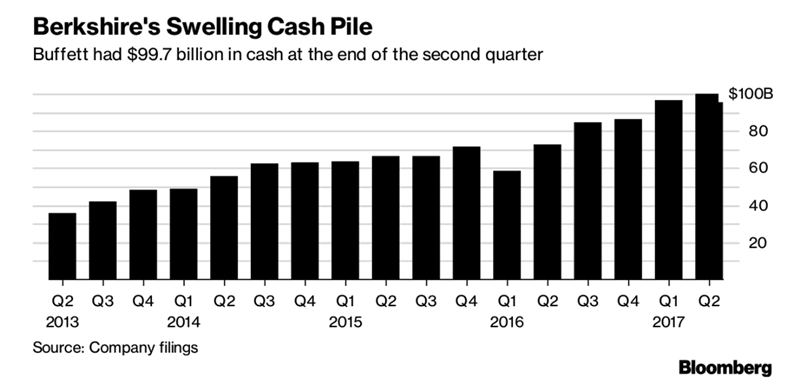

But for Warren Buffett the current environment doesn’t appear to be offering up any wonderful companies at fair valuations. The situation is so bad that the cash stockpile of Berkshire Hathaway has more than doubled in the last four years, from under $40 billion to $100bn.

The infamous investor is famed for his investment approach of pouncing on companies when they run in to problems and are seemingly undervalued. At the moment though, there aren’t many out there.

The large stockpile is a likely indicator of not only how Buffett negatively views the current market environment but also how he sees the near future and what opportunities it will bring.

Buffett hates cash, he wants to spend it

Buffett has previously stated how much he hates cash, telling investors at the Berkshire AGM that it was a poor way to keep their money.

During the Omaha-based meeting Buffett expressed his frustration with a cash pile that is approaching $100 billion, “We shouldn’t use your money that way for long periods…The question is, ‘Are we going to be able to deploy it?’”

It may well be the case that Buffett is prepared to pay a dividend, stating that dividends could be paid “reasonably soon, even while I am around.” But this is unlikely.

Buffett is known for his dislike of paying dividends. Since he took over Berkshire over half a century ago the company has paid a single $0.10 dividend in 1967. Instead, shareholders have been rewarded with value through investments that have increased the company’s earning power.

Given the company’s track record of generating more than twice the S&P 500’s annualized returns over the past half-century, it’s more likely that Buffet is looking for an attractive acquisition or investment opportunity rather than pay dividends.

Making investments is all very easy when there are good value ones to be picked up but right now there are none.

Buffett can see this and his lack of investment suggests he sees opportunities on the horizon. These can only come about in the event of a market crash or a sharp market correction.

Bargains are tough to find

The last major acquisition by Berkshire Hathaway was the $32 billion purchase of Precision Castparts. For Berkshire Hathaway’s Vice Chairman Charlie Munger this wasn’t the kind of deal that they were used to stating, “this is no screaming bargain like the old days.”

Munger was referring to the growing issue that it is difficult for the company to find bargains worthy of investment, in the current environment.

Warren Buffett has previously shown patience when it comes to looking for the right deals. Right now he likely views the market as overvalued with a greater chance of an imminent downturn as opposed to continued growth in valuations.

This isn’t an isolated view. Other investors of note have expressed concern that the market is currently over-valued.

Lord Rothschild, Chairman of RIT Capital Partners, wrote in the latest report about his concerns regarding current equity valuations:

‘Share prices have in many cases risen to unprecedented levels at a time when economic growth is by no means assured. The S&P is selling at 25 times trailing 12 months’ earnings, compared to a long-term average of 15, while the adjusted Shiller price earnings ratio, which averages profits over 10 years, is approximately 30 times.’

This situation, states Rothschild, is unsustainable.

“The period of monetary accommodation may well be coming to an end. Geopolitical problems remain widespread and are proving increasingly difficult to resolve.”

Other investors have also issued warnings that frothy valuations are a sign of a worsening financial environment.

Howard Marks of Oaktree Capital recently warned investors of a ‘too bullish territory’ and wrote that investors are ‘engaging in willing risk-taking, funding risky deals and creating risky market conditions.’

Those risky market conditions will form an environment which Buffett thrives in when it comes to making investment decisions.

As Jim Rickards explained when covering Berkshire’s latest revelation regarding cash holdings for Strategic Intelligence:

“What this tells us is that Buffett believes stock market valuations are rich (otherwise he’d be using the cash to buy companies), and that he wants a deep pool of liquidity so he can play the white knight in a coming panic.”

Buffett, along with other notable investors, foresees a sharp correction or a stock market crash. He will not be rushed into a buying a company which is currently overvalued because he knows there will be plenty of opportunities once the bubble bursts.

Threat to security

The problem Buffett has in the meantime is keeping his cash safe.

In recent years Buffett has become increasingly vocal about his concerns regarding cyber-terrorism.

Earlier this year he told shareholders, “I’m very pessimistic on weapons of mass destruction generally although I don’t think that nuclear probably is quite as likely as either primarily biological and maybe cyber…I don’t know that much about cyber, but I do think that’s the number one problem with mankind”

The problem with the ‘cash’ that Buffett is holding is that is literally numbers on a screen. It can be wiped out within a matter of seconds thanks to a cyber attack. The same goes for shares in a company.

Even if a cyber attack is unlikely, cash holdings pose further counterparty risks – namely ongoing devaluation thanks to currency creation and the threat of negative interest rates.

For every day that $100 billion sits on a screen waiting to be ‘deployed’ into a good value stock, the greater the rate of devaluation and exposure to banking risks.

No one, not even the Oracle of Omaha, can possibly predict the next downturn and certainly not the next cyberattack.

We would suggest that perhaps Warren Buffett deploys some of that excess cash into his father’s favourite form of money and his old foe: gold bullion.

Conclusion: Listen to your parents and buy gold

Warren Buffett’s own father, the Honourable Howard Buffett, wrote in 1948:

‘The owner of such gold redeemable currency has economic independence. He can move around either within or without his country because his money holdings have accepted value anywhere.’

Buffett Sr. believed in the importance of holding gold as it was ‘independent of the ruling politicians’ and gave money ‘a large degree of stability’

Warren Buffett and his followers would be wise to listen to these words.

When one considers the degree of market risk today and the over valuation in stock and bond markets, it is time to rebalance portfolios.

Never have deposits been so vulnerable to negative rates and counterparty risks in the form of bail-ins.

The world has changed since Buffett’s ill judged comments on gold. In an era of negative rates, bail-ins and global currency debasement, an allocation to physical gold suddenly doesn’t seem so daft after all.

Indeed, never has holding gold bullion in allocated and segregated storage in the safest vaults in the world been more important.

Buffett deserves the title ‘Sage of Omaha’ and is to be respected but his failure to appreciate gold’s importance as a diversification in a portfolio and his repeated negativity towards gold, in contrast to his father Howard Buffett, will not be judged kindly in financial history.

Gold Prices (LBMA AM)

21 Aug: USD 1,287.60, GBP 999.82 & EUR 1,096.52 per ounce

18 Aug: USD 1,295.25, GBP 1,004.34 & EUR 1,102.65 per ounce

17 Aug: USD 1,285.90, GBP 998.12 & EUR 1,096.74 per ounce

16 Aug: USD 1,270.15, GBP 985.13 & EUR 1,082.29 per ounce

15 Aug: USD 1,274.60, GBP 986.92 & EUR 1,084.05 per ounce

14 Aug: USD 1,281.10, GBP 987.34 & EUR 1,085.48 per ounce

11 Aug: USD 1,288.30, GBP 993.67 & EUR 1,096.47 per ounce

Silver Prices (LBMA)

21 Aug: USD 17.02, GBP 13.20 & EUR 14.48 per ounce

18 Aug: USD 17.15, GBP 13.30 & EUR 14.60 per ounce

17 Aug: USD 17.02, GBP 13.23 & EUR 14.55 per ounce

16 Aug: USD 16.68, GBP 12.96 & EUR 14.25 per ounce

15 Aug: USD 16.89, GBP 13.12 & EUR 14.38 per ounce

14 Aug: USD 16.97, GBP 13.09 & EUR 14.39 per ounce

11 Aug: USD 17.09, GBP 13.18 & EUR 14.53 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.