4 Reasons European Stocks Will Make a Big Comeback This Year

Stock-Markets / European Stock Markets Aug 22, 2017 - 05:24 PM GMTBy: John_Mauldin

BY STEPHEN MCBRIDE : Just a year ago, Europe looked like the last place where you’d want to put your money.

BY STEPHEN MCBRIDE : Just a year ago, Europe looked like the last place where you’d want to put your money.

The UK had voted to leave the EU, top German and Italian banks were in shambles, and populists reigned on the Continent.

The issues that plagued Europe didn’t fade away, but the turmoil subsided.

While everyone was applauding the uptick in US growth after the election, Europe recorded higher growth in 2016. This reversal of fortunes has now begun to show up in the markets.

Since the beginning of 2017, the the main ETF for the European market (Vanguard FTSE Europe ETF (VGK)) is up twice as much as the SPDR S&P 500 ETF (SPY).

After six years of underperformance, European equities look very positive compared to their US counterparts.

Here are four big reasons why.

-

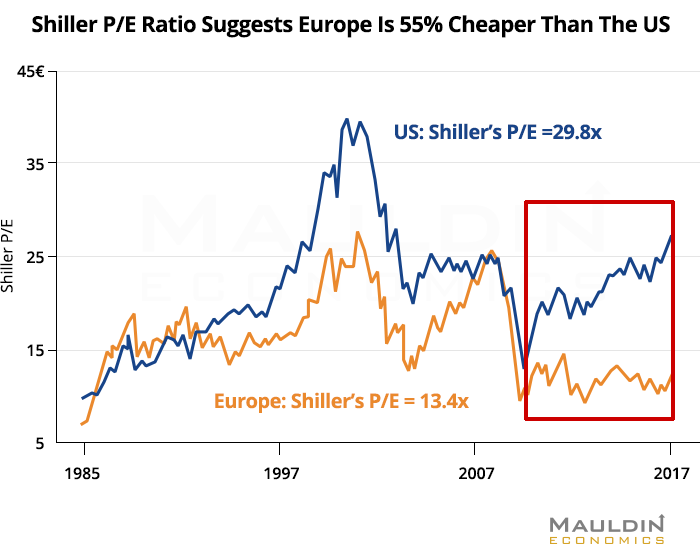

The Valuation Gap

The cyclically adjusted price-to-earnings ratio, aka the Shiller P/E suggests European stocks are now trading at a 55% discount compared to US equities.

Source: Mauldin Economics

European equities today aren’t far above their 2011 crisis lows. Also, their value in relation to US stocks is the cheapest in decades.

In a recent outlook, Credit Suisse said Europe was its “most preferred region,” citing attractive valuations as a major reason.

Besides, European stocks also offer higher dividends than US equities. The average dividend yield in Europe is 2.5%... 0.6% higher than the S&P 500 average.

-

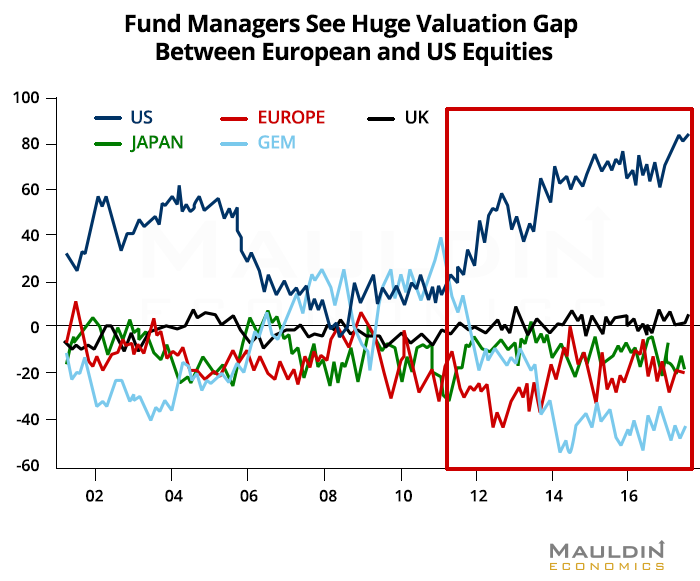

Follow the Big Money

In the latest edition of the BoAML Global Fund Managers Survey, a record 81% of asset managers said that US equities were overvalued. In contrast, 23% believed European stocks were undervalued.

This spread is the largest ever recorded.

Source: Mauldin Economics

The respondents include 200 of the world’s top asset managers who oversee over $500 billion.

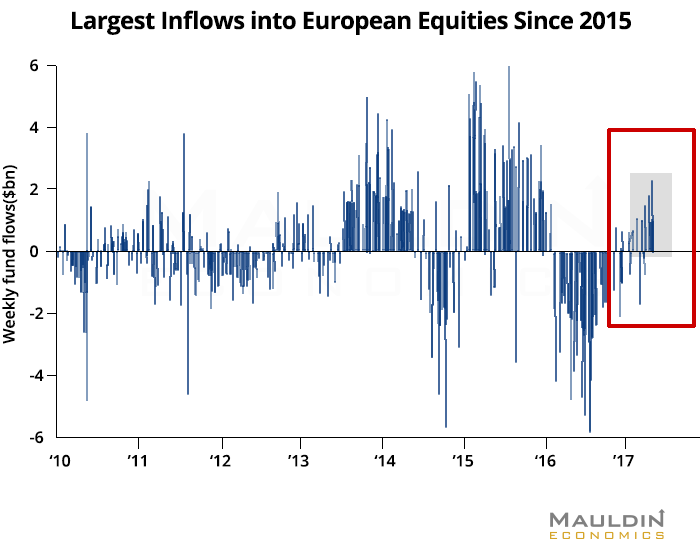

Their bullish sentiment toward Europe could be one of the reasons we have recently seen the largest inflows into the region since 2015.

Source: Mauldin Economics

In March, JPMorgan stated it was overweight Europe due to solid economic momentum and fading political risk. It also projected Euro stocks would outperform their US cousins by 16% over the next decade.

Given their recent outperformance, we are likely to see more inflows into European markets—especially with economic fundamentals now improving. (Download our free report to learn more about the new asset class raising in popularity that helps Investors earn 7% yields while lowering their risk)

-

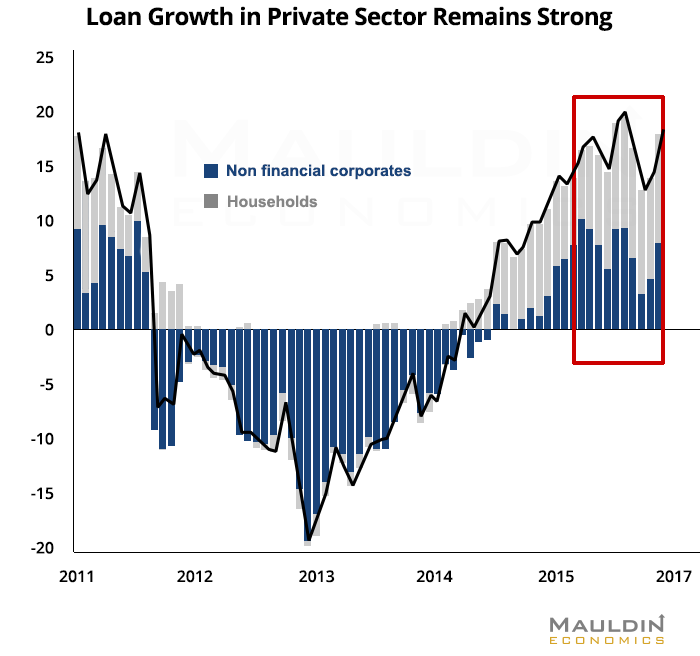

Credit Demand and Manufacturing Are Rising

Europe had higher GDP growth than the US in 2016. With two leading growth indicators now trending upward, the momentum is likely to continue.

The first indicator is a rising demand for credit.

Source: Mauldin Economics

Given that banks fund 75% of loans in Europe, compared to just 25% in the US, this trend is very bullish for European financials.

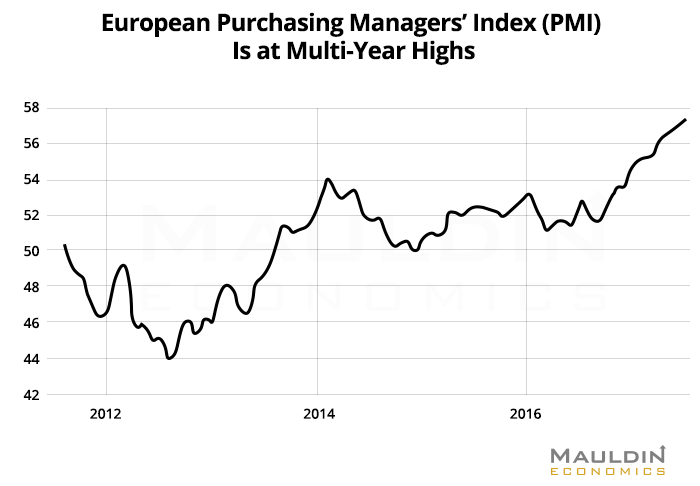

The second indicator is manufacturing.

The manufacturing sector has been growing steadily over the last 12 months. In June, the European Purchasing Managers Index, a key economic indicator, hit its highest level since 2011.

Source: Mauldin Economics

These indicators paint a positive outlook for European equities devalued by years of stagnation.

-

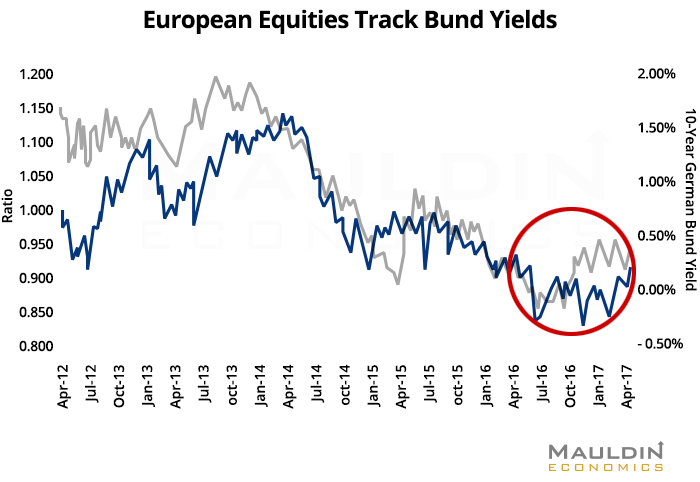

Bund Yields Are Rising

Since April, the German 10-year Bund yield has soared by 200%.

This is another positive sign for European equities. Credit Suisse found that for over a decade, European equities have tended to outperform US markets when Bund yields are rising.

Source: Mauldin Economics

I could go on, but it’s clear that years of stagnation pushed European equities down to bargain levels. Couple it with improving economic fundamentals, and we have a strong case for Europe’s big comeback this year.

Free Report: The New Asset Class Helping Investors Earn 7% Yields in a 2.5% World

While the Fed may be raising interest rates, the reality is we still live in a low-yield world. This report will show you how to start earning market-beating yields in as little as 30 days... and simultaneously reduce your portfolio’s risk exposure.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.