US Drowning in Debt, Surpasses $20 Trillion As Bankruptcy and Hyperinflation Loom Closer

Interest-Rates / US Debt Sep 14, 2017 - 10:44 AM GMTBy: Jeff_Berwick

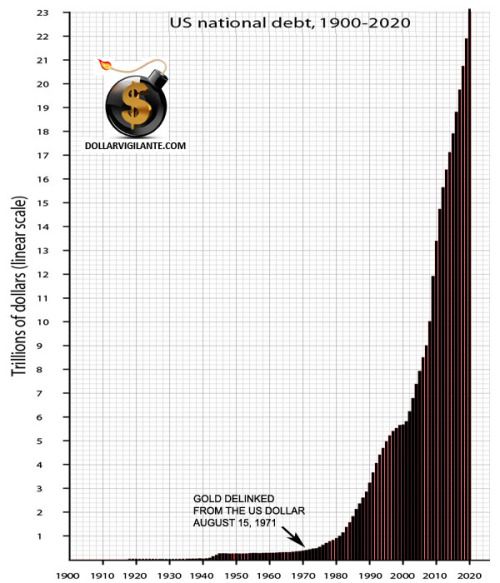

The US government finally surpassed the long anticipated $20 trillion national debt mark on Friday the 8th.

The US government finally surpassed the long anticipated $20 trillion national debt mark on Friday the 8th.

Oh, I don’t say “finally” because they had so restricted their expenditures that it was taking longer than expected. That’s far from the case!

In fact, under globalist, Donald “Big Government” Trump, the federal government had its largest deficit month in history in June topping $400 billion for the first time.

The only reason it took this long to hit the big $20 trillion was due to a multitude of accounting tricks in order to put off acknowledging the expenditures until now in order to meet the debt ceiling… which I actually call the debt target, because they hit it every time.

But, what else would you expect from a government who routinely loses trillions of dollars. Like that time Donald Rumsfeld announced the Pentagram (they call it the Pentagon) was missing $2.3 trillion on September 10th, 2001.

The next day, the accounting department at the Pentagon blew up and no one asked about it again.

Even the US government’s own auditors haven’t been able to audit their books properly for more than 20 years because it was deemed too vast to account for. Yes, too vast! Here’s a pro tip… if you have the largest government in the world, with the highest level of extortion (taxation), highest levels of debt and the most people in concentration camps… you aren’t the “land of the free.”

But now that the US government has admitted to $20 trillion in debt, what does this mean?

Well, first, that isn’t even close to the total debt and liabilities of the US government. When you take into account money already spent on Socialist InSecurity and Medicare, the total amount of debt and liabilities amounts to somewhere between $100 and $220 trillion.

And yes, there is about $100 trillion give or take that is hard to account for!

But, even if the lowest estimate of $100 trillion is used, that is still over $300,000 for every man, woman, and child in the US! Even a baby unlucky enough to be born today in the USSA is saddled with more than a quarter of a million dollars worth of debt.

Many Trump supporters say the exact same thing every President’s supporters say once he is in office… It isn’t his fault… It was the last guy.

To some extent that is true… But, there is absolutely nothing being done to reign in the spending of the US government by Trump. In fact, as I pointed out, it has only increased under his tyrannical regime. Exactly as I said it would.

This is the never-ending game of politics, to keep making things worse and worse and to keep people hoping for a change that never comes as the boot stamps down on their face, forever.

There will NEVER be change until people stop paying their extortion fees (called taxes) and stop obeying the illegitimate authority of government.

Government is nothing but a criminal organization. The only difference between it and the mafia is size.

And the only reason some people haven’t figured this out yet is because they are “taught” as children in the government indoctrination camps, doing their daily Pledge of Obedience and worshipping the flag from the age of five.

The only other way this tyrannical organization can be stopped is if/when it goes completely bankrupt and its fiat scrip, the US dollar, becomes worthless because of hyperinflation.

Because, after all, with $20 trillion in debt, if interest rates were allowed to rise to even 10%, that would mean $2 trillion per year in interest payments… which is almost the entire tax/extortion/theft based revenue of the murderous US government.

At that point the dollar will hyperinflate in order to keep the game going for just a few more months. And then, total collapse.

It’s actually been planned for decades and we are nearing the end game right now. In fact, it may begin this month. Stay tuned to this blog (make sure to subscribe to our free email list on our home page to get them emailed directly to you as most social media continues to block our content) as I’ll soon be releasing some information that indicates the total collapse could begin as soon as this month.

If you’d like to find out more information on not only surviving, but prospering during this collapse, make sure to check out Max Wright’s free webinar here. He goes over why the crash is coming and how you can protect yourself from it and even make massive profits through it.

The webinar is free and has some excellent information in it. It is only offered to a limited number of people and for a limited time, but you can get access to it HERE if you act immediately.

I suggest you do because if you still have not prepared for the coming collapse, then you are really leaving things until the last second. I expect things to begin to go off the rails as soon as this month.

Stay tuned here for more information in the coming days.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2017 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.