Really Bad Ideas - The Fed Should Have And Defend An Inflation Target

Economics / Inflation Oct 16, 2017 - 12:15 PM GMTBy: John_Rubino

Central banks in general and the Fed in particular are struggling to understand a world in which they’ve thrown everything they have at the economy without generating “beneficial” inflation. Their confusion can be traced back to some profoundly false assumptions.

Central banks in general and the Fed in particular are struggling to understand a world in which they’ve thrown everything they have at the economy without generating “beneficial” inflation. Their confusion can be traced back to some profoundly false assumptions.

Some Thoughts And Assertions

An inflation target implies that modest inflation is actually a good thing. This is simply wrong. Inflation is a “stealth tax” through which governments confiscate a bit of savers’ wealth each year without admitting it. If explained honestly such a trick would be a political loser always and everywhere.

Nor do rising prices increase growth or reduce debt. Just the opposite. Knowing that a currency is going to depreciate because the government has promised to make it so, rational citizens borrow as much money as possible since they’ll be paying future interest in ever-cheaper currency. This leads to what mainstream economists define as “growth” but is actually just 1) pulling future consumption into the present at the cost of lower consumption in the future and 2) malinvestment, as businesses, seduced by artificially-low interest rates, start projects that wouldn’t pass muster if the cost of money was realistic (that is, determined by market forces). So the quality of the capital stock declines over time and productivity falls.

The result: A system where the amount of debt soars, the amount of bad debt rises as a share of total debt, productivity growth slows and the inflation needed to generate future “growth” rises steadily. Governments are then forced to push interest rates ever-lower and eventually negative, which drains savers’ capital even more aggressively and tricks businesses into even more extreme malinvestment. Sound familiar?

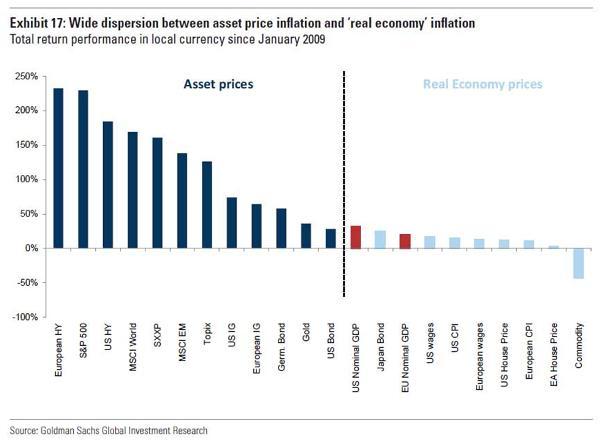

An inflation target implies that economists can actually measure the phenomenon. This is also false. Right now, governments create an official inflation number by arbitrarily including some things and excluding others – like stocks, bonds, and house prices. The latter “assets” are for some reason assumed not matter to “the cost of living” when in fact they matter greatly. And many of them are soaring. As the following chart illustrates, stocks and junk bonds are up over 200% since 2009.

If you’re trying to save and invest, soaring financial asset prices make that process vastly more expensive, which is one definition of inflation. If you’re trying to find a decent home for your family, soaring home prices either make this impossible or squeeze out the other crucial things like health care, high quality food and good schools. Which is also a form of inflation.

Here’s a former central banker (funny how the former ones always seem to make more sense) on this subject:

Inflation isn’t low, it’s just hiding in the stock market: ex-head of Bank of Israel

(Fidelity) – Inflation is not really low, nor is its cause a mystery, Jacob Frenkel, the former head of the Bank of Israel said Friday.The culprit is the global central banks, said Frenkel, who is now the chairman of JPMorgan Chase International.

Keeping rates excessively low just gives people incentive to invest in the stock market, and nowhere else, he said. “Then all the inflation is reflected in the market, something that is not included in consumer price gauges.”

Frenkel said the low rates are also weakening the insurance companies and the pension systems that transmit monetary policy to the economy. So if you weaken the system, the effectiveness of policy is diminished.

“So don’t be surprised if you are missing” a 2% inflation target, he said.

Fed officials are debating whether they should raise rates again in December because inflation is so low.

Frenkel said the markets would welcome higher rates. The Fed “should just do it,” he said.

But the biggest problem with an inflation target is that it’s a potentially disastrous admission of defeat. Lowering the value of your currency is, in effect, telling the world that you can’t manage your own finances without secretly stealing from those who trust you. Like most breaches of trust, this eventually leads former friends to abandon the relationship.

In finance, this manifests as an unwillingness to hold the offending money. Citizens in an inflationary economy quickly convert their paychecks into real things before prices rise further. Trading partners accumulate as little of the depreciating currency as possible, and swap the excess for better stores of value like sound currencies and gold.

Once this mindset takes hold, it’s game over for the inflating country. The Austrian School of economics calls the end of this process a “crack-up boom,” and historically it’s been the ultimate fate of badly managed currencies.

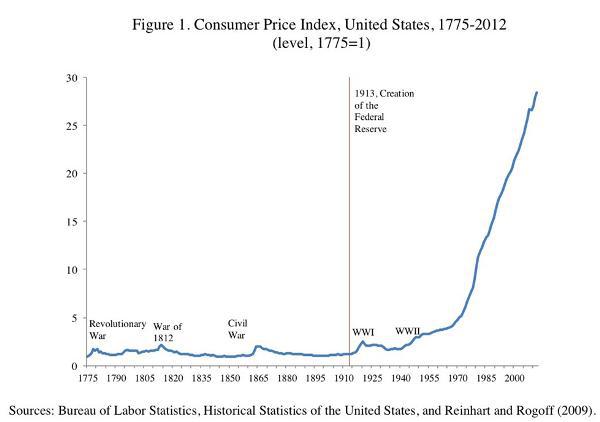

As for what should replace an inflation target managed by omniscient central bankers, the classical gold standard offers an example. For over a century prior to World War I, governments didn’t bother trying to manipulate prices. They simply defined their currencies as various weights of gold, a form of money whose supply rises by about 1.5% a year. This limited supply kept prices in line – inflation was, on average, negative throughout this time – without hampering growth.

One other positive side effect: People in those days weren’t forced to listen to clueless central bankers’ pointless debates.

By John Rubino

Copyright 2017 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.