These Headlines Say Gold is Building a Base for Something Big

Commodities / Gold and Silver 2017 Nov 15, 2017 - 10:44 AM GMTBy: GoldSilver

It may be frustrating to watch the gold price remain dormant as stock markets continue to push higher. But while cryptos and Trump grab a lot of the headlines, you might be surprised to know there are significant forces behind the scenes that signal the gold market is not only strong but suggest something big is coming.

It may be frustrating to watch the gold price remain dormant as stock markets continue to push higher. But while cryptos and Trump grab a lot of the headlines, you might be surprised to know there are significant forces behind the scenes that signal the gold market is not only strong but suggest something big is coming.

Check out these reports from the last 30 days and see what conclusion you’d draw…

Global Physical Demand

Demand for coins and bars in North America may be low, but that’s not the whole market. Check out what occurred around the world last quarter…

Chinese coin and bar demand hit the second highest volume on record. In the third quarter, demand for physical metal rose an incredible 57% over the same period last year.

Gold bar and coin purchases in Turkey are almost three times higher than last year.

Bar and coin demand in Europe rose 36% vs. 2016. German demand surged 45%.

South Korea demand jumped 42%. It’s admittedly a small market, but this shows once again that investors turn to gold when geopolitical tensions rise.

It’s clear that demand for physical metal is surging in many areas around the globe.

Central Bank Demand

Global central banks added 111 tonnes to their gold reserves last quarter, 25% more than the same period in 2016…

The Central Bank of Russia bought 63 tonnes, pushing their gold reserves to 1,778.9 tonnes. I like this quote from Russian newspaper Kommersant: “If US sanctions are expanded to block Russia’s assets invested in US Treasuries, gold will be a magic wand." The trend is expected to continue, says Alexander Losev of Sputnik Asset Management: “The regulator will continue to amass gold in its reserves, decreasing the share of US Treasuries.”

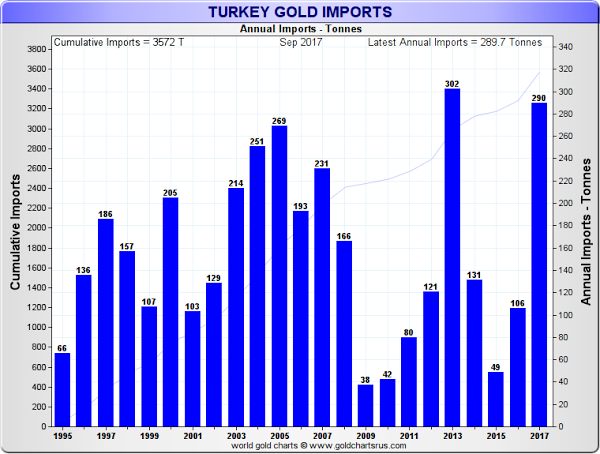

The Central Bank of Turkey has gone bonkers for gold, its reserves now more than 50 tonnes higher than April 2016. Here’s what Turkey’s gold imports look like so far, from our friend Nick Laird of goldchartsrus.com:

You can see that a new record will almost certainly be set by the end of the year.

Other central banks increased their gold reserves last quarter, too…

- Kazakhstan purchased 10.3 tonnes last quarter, and has increased its gold reserves every month for the last five years.

- Qatar bought 3.1 tonnes

- Kyrgyz Republic added 1.3 tonnes

- Indonesia bought 1.2 tonnes

- Mongolia added 0.4 tonnes

While these increases are small in the big picture, it demonstrates that central bankers in emerging markets continue to see the need to add gold to their reserves.

Why are so many central bankers buying so much gold? They clearly see the need to denominate their reserves in physical metal.

Technology Demand Grows

Technology demand for gold rose 2% over the same period of 2016, reports the World Gold Council in its Q3 report:

- Gold used in wireless applications grew 8% over last year.

- Demand for 3D sensors, used in facial recognition, were higher than projected.

- Applications in gaming, vehicles, and healthcare are projected to see growing demand.

Government Expansions and Institutional Interest

Kuwait Plans to Build a $112.5 Billion 'Gold City.' The Ministry of Commerce and Industry asked Kuwait Municipality to allocate a plot to build a special “gold and jewelry city” over a 100,000 square meter area, which would make it the largest of its kind in the region.

The new “Gold Connect” exchange links the gold markets of Hong Kong and Shenzhen, and on the first day over nine hundred kilos of gold traded, worth 300 billion yuan, or $38.45 billion in US dollars. That’s not exactly chump change.

Hedge funds and money managers cut their long positions the past couple months, but their net positions are still higher than the start of the year.

According to Zero Hedge, Ray Dalio went on a gold buying spree last quarter: he increased his GLD holdings by a whopping 575% and became the 8th largest holder.

New Gold Supply Is About to Start a Long-Term Decline

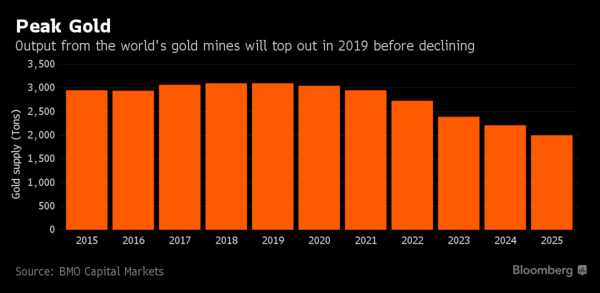

As we’ve been reporting, new gold supply is destined to decline. Here’s BMO Capital Market’s prediction:

If they’re right, new gold supply will fall by almost one-third by 2025. There’s no way that doesn’t have an enormous impact on the market and prices. Read our original article to see how you could be impacted.

“The low-hanging fruit has likely already been picked” says Frank Holmes of US Global Investors. Explorers have to dig deeper… they have to venture further into more extreme environments to find economically viable deposits… regulations are tougher… production costs are higher… and no new method has been invented to extract gold from hard-to-reach areas.

Pierre Lassonde, chairman of Franco-Nevada, says gold mining production will decline significantly. “If you look back to the 70s, 80s and 90s, in every of those decades the industry found at least one 50+ million ounce gold deposit, at least ten 30+ million ounce deposits and countless 5 to 10 million ounce deposits. But if you look at the last 15 years, we found no 50 million ounce deposit, no 30 million ounce deposit and only very few 15 million ounce deposits. So where are those great big deposits we found in the past? How are they going to be replaced? We don’t know. We do not have those ore bodies in sight.”

Silver, Baby

Self-driving cars, solar power, and healthcare uses will demand more silver over the coming years, said analysts at the recent Silver Institute conference…

“Silver’s role in the auto industry will continue to grow due to safety upgrades in both human-powered and driverless autos, rear cameras, night vision, rear-object detection, and lane departure,” reports Steve Gehring, VP of safety and connected automation at trade group Global Automakers.

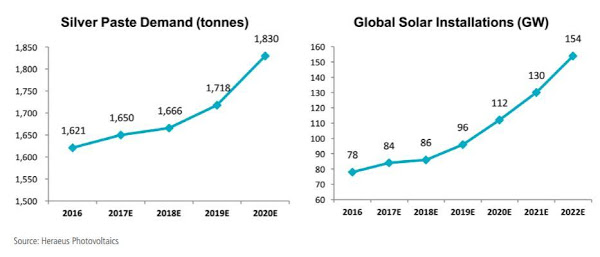

“Silver’s use in solar panels will increase at least through 2020,” says Larry Wang of Heraeus Photovoltaics. This despite panel manufacturers actively working on ways to reduce silver loadings per cell.

Silver paste is used in solar panels, and this chart shows the dramatic increase expected in demand over the next few years.

China has imported significantly more silver the past several months. According to customs authorities, August silver imports soared 68% over last year.

New Silver Supply Is Falling, Too

The Silver Institute’s World Silver Survey 2017 publication reported some sobering developments for future supply of this precious metal…

- Total silver supply fell by 32.6 million ounces in 2016.

- Global silver mine production in 2016 recorded its first decline since 2002.

- Silver supply from scrap is falling and hit its lowest level since 1996.

Gold Says, “The Future is Mine”

Add all this up and it’s hard to ignore that something seems to be gelling in the gold and silver markets. Future headlines will someday soon have a different tone, which will richly reward those who have stayed the course. Don’t be fooled by flat gold and silver prices—many investors around the world continue to add to their holdings, and new supply for both metals is about to start a long-term downtrend

In the meantime, I continue to use the current soft environment to add physical metals to my portfolio. Check out the brand new Canadian Maple Leaf, both gold and silver, what are widely considered to be the most secure sovereign coins in the world.

Source:https://goldsilver.com/blog/these-headlines-say-gold-is-building-a-base-for-something-big/

By Jeff Clark

© 2017 Copyright GoldSilver - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.