Jerome Powell vs. Janet Yellen

Interest-Rates / US Federal Reserve Bank Dec 09, 2017 - 03:27 PM GMTBy: Arkadiusz_Sieron

As expected, Donald Trump nominated Jerome Powell as the next Federal Reserve Chair. He is often perceived as a merely Republican version of Yellen. But is that really the case? Let’s analyze in a more detailed way what impact on gold Powell’s term as the head of the U.S. central bank would mean for the gold market.

As expected, Donald Trump nominated Jerome Powell as the next Federal Reserve Chair. He is often perceived as a merely Republican version of Yellen. But is that really the case? Let’s analyze in a more detailed way what impact on gold Powell’s term as the head of the U.S. central bank would mean for the gold market.

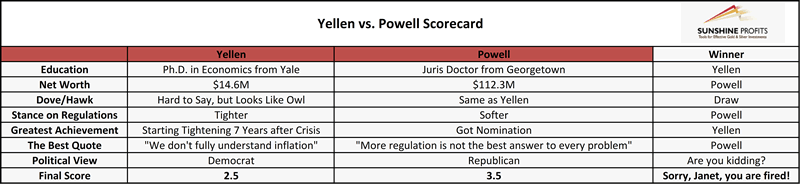

The choice of Powell was welcomed by financial markets, as he is believed to continue of Yellen’s cautious monetary policy. Indeed, he never dissented with her at the FOMC. Does it mean that he is just a “GOP’s answer to Janet Yellen”? Well, in a way, yes, as the Fed headed by Powell will likely stay on track to gradually raise interest rates and to unwind its balance sheet. However, the fact that Powell voted with Yellen does not mean that he is her male and Republican clone. The most important differences between them are presented in the table below.

Table 1: Yellen vs. Powell’s Scorecard

But let’s be serious: there are really a few important distinctions which investors should be aware of. First, Powell may be a bit more hawkish than Yellen. For example, he has been a skeptic of the third round of quantitative easing started in 2012. And Powell may be less focused on the stock market’s performance (or the so-called Greenspan’s put). In January’s speech in Chicago, he said:

“Overall, I do not see leveraged finance markets as posing undue financial stability risks. And if risk-taking does not threaten financial stability, it is not the Fed's job to stop people from losing (or making) money.”

Moreover, with the growing economy, tight labor market, and without financial stability risk on the radar, he can afford to be more hawkish. Hence, Powell’s leadership might be worse than Yellen’s for the gold market – not necessarily because of differences in Powell’s nature, but due to the distinct macroeconomic environment in which he would have to act.

Second, Powell differs is his view of financial regulations, being much more in line with Trump on this issue. He generally supports the Dodd-Frank reform, but believes that the Volcker Rule should be re-written to ease the regulatory burden on smaller banks. Indeed, Powell called some parts of Dodd-Frank “unnecessarily burdensome.” And in an October’s speech at the New York Fed, he said that “more regulation is not the best answer to every problem.”

The softer approach toward financial regulations should support the financial institutions, which should be negative for the yellow metal, which can be perceived as a hedge against financial turmoil or a safe-haven asset purchased when banks struggle.

Third, Powell will be the first chairman without a Ph.D. in economics since Paul Volcker. Surely, he has a long resume of experience in both the private sector and government, but it would be a precedent for an investment banker to lead the most powerful central bank in the world.

The impact of Powell’s different educational background on the gold market is difficult to assess. On the one hand, he lacks deep understanding of monetary policy and sophisticated academic reasoning. Hence, Powell may be less prepared to sail the Fed through the next crisis if it hits under his leadership (which could be positive for the yellow metal).

On the other hand, his corporate background may actually be an advantage compared to academic mumbo-jumbo of secular stagnation, potential GDP, Philips Curve, natural interest rates and so on. Both Greenspan and Bernanke held a Ph.D. in economics, but it did not prevent the world from the Great Recession (and it might actually have contributed to it, as the focus on the CPI, which resulted from the academic models, prevented Bernanke from noticing the housing bubble). Such a realistic and pragmatic approach could potentially be better for the economy, and therefore negative for the gold market.

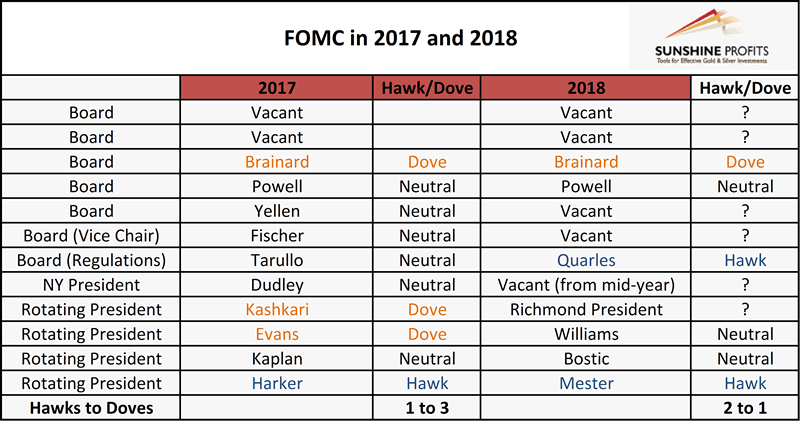

Anyway, the issue of Powell’s educational background may be not so important after all. He would not steer the U.S. central bank alone. Instead, the FOMC is a collegial body – and Powell will be likely to create compromise among its members. Here we come perhaps to the most important thing. By February, when Powell starts his term, Trump may fill other vacancies at the Fed as well. As a reminder, after Yellen’s resignation, there are four vacancies in the Board of Governors. This is why it is likely that the composition of the FOMC in 2018 will move slightly from the dovish to the hawkish side, especially if Taylor joins the Committee. We do not expect a revolution, but the hawkish camp will probably strengthen its position next year, which is clearly not good news for the gold market in the medium-term. The rotation among the Fed regional presidents confirms our view. Just look at the table below. There are many unknowns due to a few vacancies (there are four slots at the Board itself) but the FOMC would be more hawkish next year – that is for sure.

Table 2: Composition of FOMC in 2017 and 2018.

To sum up, Powell was picked up by Trump as the next Fed chair. He is expected to continue a gradual tightening policy. However, he may raise interest rates slightly faster than Yellen. Although the pace would not be extreme, a more hawkish policy would be a headwind for gold prices. And the next year’s FOMC composition is likely to shift slightly toward the land of the hawks. A lot will obviously depends on the future condition of the economy, but the more hawkish Board of Governors, when analyzed in isolation, seems to be a fundamentally bearish factor for the gold market.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.