Gold, Bitcoin and the Blockchain Replaces the Banks – Realists Guide To The Future

Commodities / Gold and Silver 2017 Dec 28, 2017 - 11:56 AM GMTBy: GoldCore

– Futurist guide to 2028 shows a world of uncertainty and disruption

– Futurist guide to 2028 shows a world of uncertainty and disruption

– One scenario suggests cybersecurity attacks will result in bitcoin and blockchain’s dominance of financial systems

– Cybersecurity threat will still loom large and wreak havoc. Gold, silver and other real assets will benefit.

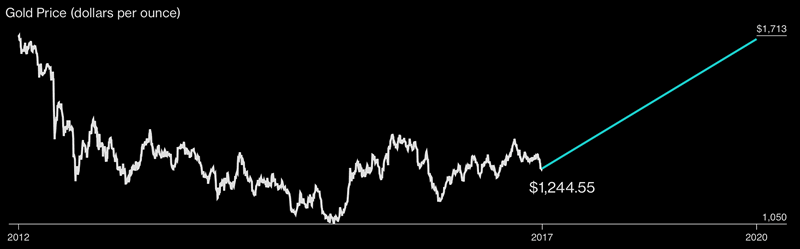

– Adoption of cryptocurrencies and blockchain will send gold price soaring

– Use of cryptocurrencies to take advantage of world systems will see investors turn to safe havens such as gold bullion and coins

The media is filled with predictions for 2018. Will Trump survive another year? How will Brexit negotiations play out? Can bitcoin recover from its recent fall? What fake news will create the next disruption to the apparent status quo?

No one knows the answers to any of theses questions. If the past year to eighteen months has taught us anything it is that the polls and predictions are almost a waste of time. Arguably it is better to look further into the future and at a range of scenarios so one can consider the opportunities and threats that may lie ahead.

Bloomberg has done just this, with their ‘Pessimists Guide to 2018‘. In it the authors consider eight scenarios. Each scenario could very easily begin to take place in 2018, but the full impact will play out over the following decade.

The scenarios put forth are:

Scenario 1

Trump wins second term

Scenario 2

Fake news kills Facebook

Scenario 3

Bitcoin replaces the banks

Scenario 4

North Korea launches an attack

Scenario 5

Corbyn makes socialism great again

Scenario 6

Generational Warfare Destroys Europe

Scenario 7

China begins a trade war

Scenario 8

Electric Cars end the oil era

Below we bring you the Scenario 3: Bitcoin replaces the banks

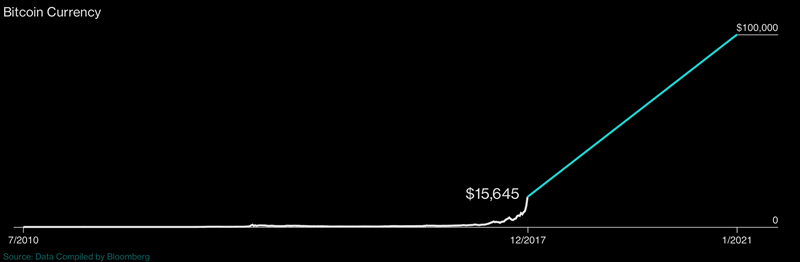

Each scenario is deserving of attention in its own right but it is the third one which we believe is the most pertinent and arguably realistic. This is the assumption that bitcoin will replace the banks and gold will benefit. Arguably gold would benefit as a result of many of the scenarios put forward. But, given the interest in bitcoin this year it is an important reminder that both bitcoin’s growth and weaknesses will see gold and other real assets shine.

2018

A U.S. regional lender announces that its systems have been taken down in a cyberattack and all its deposits have vanished. Regulators around the world reassure account holders that their deposits are safe. Bitcoin jumps to $40,000 as deep fears set in about the safety of the financial system. Gold surges too, but by less.

2021

China’s Alibaba adopts its own cryptocurrency for use inside its vast e-commerce network, establishing the mass-market viability of digital money. Following Venezuela’s lead, Greece and a few African countries adopt bitcoin, which hits $100,000.

2023

Rogue coders inside a regulatory-compliance software company inject a Trojan malware program called Worm Hole into scores of banks around the world. Undetected, it siphons data and cash from accounts in fractional increments.

2026

A 10-year-old schoolgirl in Pittsburgh discovers Worm Hole and exposes it on social media, triggering a run on the global banking system. Shares in Old Wall Street crash as major central banks embrace blockchain technology, bypassing the banks, and issue digital money directly to households.

2028

Many commercial lenders break apart. The global financial system gives way to a fragmented patchwork of digital currencies and payment systems dominated by such players as Alipay and Amazon.com. Bitcoin hits $1 million.

In light of this scenario’s end, Bloomberg offers Nightberg’s advice for the investor:

Vanished bank deposits would likely drive a major disbelief in all things digital, even bitcoin. Owning real physical assets, such as gold, luxury real estate for high net worth individuals, artwork, and safety vault producers in general as individuals seek to store more of their wealth within their private residences. The cyber-insurance sector would benefit as the world would scramble to find a solution to decimated trust in the financial sector. Nightberg macro research.

Bloomberg’s analysis and Nightberg’s conclusion bring up a fear which is not just for the future but is a very real one today: cybersecurity attacks. the scenario begins because of a cybersecurity attack and it this issue is still not resolved ten years into the future.

Cyber attacks are not something which can be overcome by cybersecurity. Like any form of attack there will be new approaches and strategies. The year of 2017 has been a very serious wake-up call as to how cyber power can flip the status quo on its head. Consider the apparent meddling by Russia in Western politics or North Korea’s (occasionally successful) attempts to steal bitcoin.

The invisible threat is very much on our doorstep.

This Christmas weekend HMS St Albans was forced to shadow a Russian warship in the North Sea. According to reports the warship was showing interest in ‘areas of national interest’. What is there apart from oil? The UK’s communication cables.

Air Chief Marshal Sir Stuart Peach, the chief of the UK’s defence staff, has recently expressed concerns over the security of the cables. Should they be cut (or service disrupted) then the damage would “immediately and potentially catastrophically” hit the economy.

Prepare for uncertainty, not the rise of bitcoin

This weekend’s posturing by the Russians or Bloomberg’s scenario planning should serve as a timely reminder as to what can and will survive such times. Physical gold cannot be made to disappear at the touch of a few buttons or by the cutting of cables. Should there be a global cyberattack on the financial system, the primary wealth would no longer be primarily digital (bitcoin, cash, stocks and bonds etc).

Gold and silver allocated and segregated bullion is important because of both its tangible nature and its role as a safe haven in times of geopolitical upset. Bitcoin, or any other cryptocurrency, cannot be considered safe when cyberattacks are a daily reality. They are also new and still untrusted by the majority of the system.

When seeking to diversify your portfolio in order to protect from uncertain scenarios you should consider the risks posed to digital gold providers who do not allow clients to interact and trade on the phone and are solely reliant for pricing and liquidity from online portals and online trading platforms.

Those who have outright legal ownership of physical gold and silver coins and bars outside the banking system will be far better prepared for cybersecurity attacks and uncertain times.

You can read more on the other seven scenarios here. Whilst reading them it is worth reminding oneself of how easily the world can change and how uncertain we are as to whether they may or may not happen.

Gold Prices (LBMA AM)

27 Dec: USD 1,285.40, GBP 958.78 & EUR 1,081.54 per ounce

22 Dec: USD 1,268.05, GBP 947.74 & EUR 1,069.85 per ounce

21 Dec: USD 1,265.85, GBP 945.97 & EUR 1,065.09 per ounce

20 Dec: USD 1,265.95, GBP 944.27 & EUR 1,068.21 per ounce

19 Dec: USD 1,263.10, GBP 944.93 & EUR 1,070.10 per ounce

18 Dec: USD 1,258.65, GBP 943.11 & EUR 1,067.71 per ounce

15 Dec: USD 1,257.25, GBP 937.41 & EUR 1,065.52 per ounce

Silver Prices (LBMA)

27 Dec: USD 16.50, GBP 12.30 & EUR 13.87 per ounce

22 Dec: USD 16.18, GBP 12.08 & EUR 13.65 per ounce

21 Dec: USD 16.15, GBP 12.08 & EUR 13.61 per ounce

20 Dec: USD 16.19, GBP 12.09 & EUR 13.67 per ounce

19 Dec: USD 16.16, GBP 12.08 & EUR 13.68 per ounce

18 Dec: USD 16.09, GBP 12.04 & EUR 13.64 per ounce

15 Dec: USD 15.99, GBP 11.93 & EUR 13.55 per ounce

Important Guides

For your perusal, below are our most popular guides in 2017:

Essential Guide To Storing Gold In Switzerland

Essential Guide To Storing Gold In Singapore

Essential Guide to Tax Free Gold Sovereigns (UK)

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.